- Financial

- Irs Forms

- 1065 Forms And Schedules

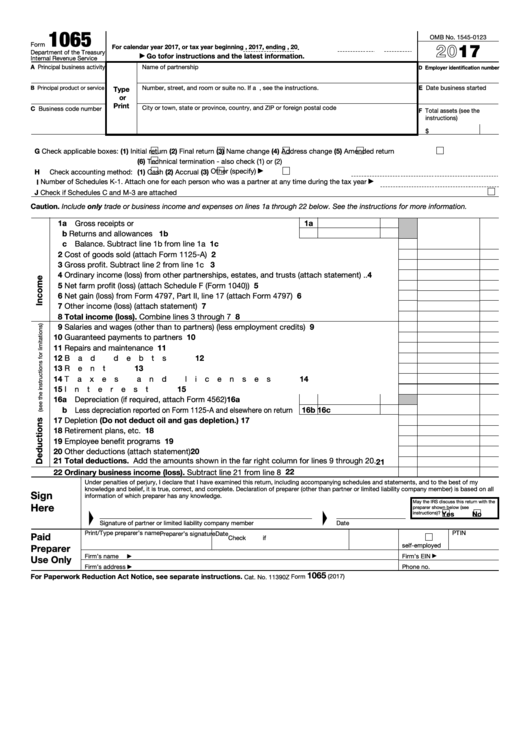

- Form 1065

Form 1065

What is form 1065?

Form 1065, U.S. Return of Partnership Income, is a tax form for reporting profits, deductions, credits, and losses of a business partnership.

Partnerships do not pay any tax on their profits, but their partners do. The partnership uses Form 1065 to list the necessary and pass any profits or losses through to its partners using Schedule K-1. Schedule K-1, on the other hand, is an obligatory document prepared for each partner.

The full form can be downloaded below in fillable PDF-format.

What Is Form 1065 Used for?

Form 1065 is a vital tool in reporting partnership income, deductions, and credits. The form itself consists of five pages.

Page 1 includes basic information about the partnership – its name, address, EIN, type of business activity, accounting method and the number of attached copies of Schedule K-1.

The income section on the first page lists income items from the partnership’s trade or business. Ordinary business profits or loss is the difference between the partnership’s total income and total deductions. This net amount, along with some other items, is allocated to partners.

The bottom of the page has room for the date and signature, as well as any information about the services of a paid preparer, if there was one.

Pages 2 and 3 contain Schedule B of the form. This schedule includes a list of yes or no questions about the partnership and is used to provide information about the Tax Matters Partner – a third-party, selected by the partnership to sign the return and correspond with the IRS on all related matters.

Page 4 contains Schedule K. This schedule lists the partners’ distributive share of items. Schedule K-1 includes parts for:

- income (loss);

- deductions;

- self-employment;

- credits;

- foreign transactions;

- alternative minimum tax items;

- any other information.

Page 5 consists of a number of different schedules

- Schedule K that divides the income and loss among the partners;

- Schedule L - the balance sheet;

- Schedule M-1 - a reconciliation of income or loss;

- Schedule M-2 - an analysis of the partners’ capital accounts.

How to File Form 1065

Form 1065 requires significant information from the corporation preparing the report. Businesses must gather the information submitted in the following forms and reports before filing:

- Form 4562, Depreciation and Amortization;

- Form 1125-A, Cost of Goods Sold;

- Form 4797, Sales of Business Property;

- Copies of any form 1099 issued by the partnership;

- Form 8893, Election of Partnership Level Tax Treatment;

- Form 8918, Material Advisor Disclosure Statement;

- Report of Foreign Bank and Financial Accounts (FBAR);

- Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts;

- Form 1040, (farming partnerships only).

Form 1065 Due Date

The official due date for Form 1065 falls on March 15 of the current year for previous year's tax returns, with the extended date being September 15.

Form 1065 Templates