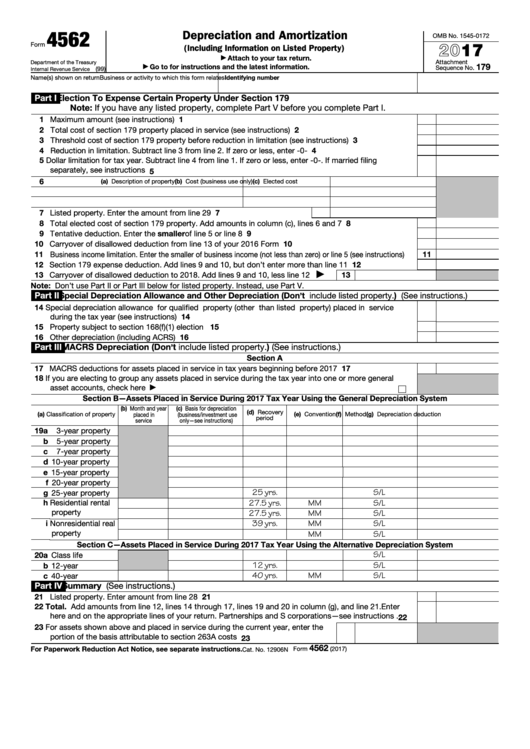

What Is Form 4562?

IRS Form 4562 or the Depreciation and Amortization form allows businesses to claim a deduction for both amortization and depreciation, declare any section 179 expense and provide information on listed property.

Form 4562 can be used annually to deduct the costs of any business-related property including company vehicles, furniture, and technical equipment. Deductions can also be claimed for assets like patents and intellectual property. What can't be deducted is the value of any land or property that had been purchased and used for personal reasons.

The latest fillable version of Form 4562 can be downloaded below.

What Is Tax Depreciation?

Depreciation is the gradual reduction in the value of property or real estate. Amortization is the process of spreading the cost of intangible assets like patents and trademarks over the duration of its active existence.

Form 4562 is used for yearly deductions of certain portions of the value of your property.

The estimated recovery period of the property is the time it’ll take your property to depreciate and stop becoming of use to your business. This is also the time it will take to recover the full cost of your investment into the property. A property’s recovery period defines the amount of deductions and the time period in which you'll be able to make these deductions.

How to Fill Out Form 4562

There are six sections in Form 4562. The following list is a step-by-step overview of the six parts filed under common circumstances.

Part I allows the individual to claim a Section 179 deduction for any tangible property like computer software or cell phones their business uses and certain types of realty used strictly for business purposes.

The maximum amounts of this deduction are:

- $510,000 for machinery and equipment;

- $250,000 for qualified leasehold, retail and restaurant improvements.

The limitation that restricts the Section 179 deduction to the extent of your business profits for the year must be applied regardless of the deduction amount. These limitations are personal net earnings from self-employment for sole proprietors or net profit for other business entities. File this information on line 11.

The official instruction leaflet for Form 4562 includes a worksheet you can use to fill out the first part of the form. Keep in mind that the amount you can deduct depends on the amount of taxable business income. Some parts of the deduction can be carried into the following year and claimed with next year's taxes.

In Part II is used for claiming special depreciation allowance also known as bonus depreciation. This deduction can only be claimed for the first year in which the property is used for your business. It’s a 50% allowance that’s available to any qualifying businesses.

You may refuse these additional deductions by notifying the IRS in writing when you mail in or otherwise submit Form 4562.

To qualify for the special depreciation allowance, businesses must own some property that can recycle materials or computer software. This allowance may not be claimed for listed properties or assets that are required to be depreciated under the ADS.

Part III is used to depreciate most tangible properties that have been in use since 1986 for your business under the Modified Accelerated Cost Recovery System (MACRS). This does not include depreciation for listed property, which is entered in Part V of this form.

Part IV of Form 4562 is used to add up certain numbers you’ve used in Parts I, II and III, as well as listed property in Part V.

Part V is for claiming write-offs for listed property. This includes computers, pickup trucks, cars weighing 6,000 pounds or less, peripheral or video recording equipment and any other property that falls under the "listed property" criteria.

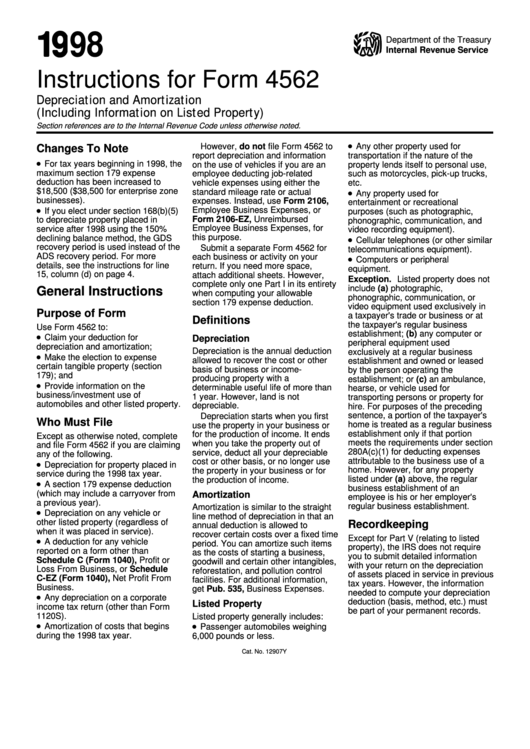

Form 4562 Instructions

File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election. Keep all copies of filed 4562 Forms when claiming depreciation to track your prior deductions and claim the correct amount in future years.

Figuring out how to depreciate assets can be difficult. If you need assistance completing the form, check out the most recent IRS-issued revision of Form 4562 instructions.

Form 4562 Templates