- Financial

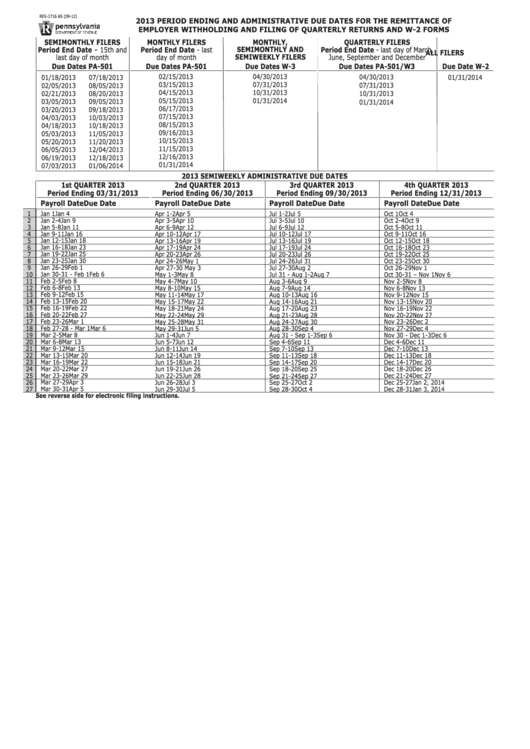

- United States Tax Forms

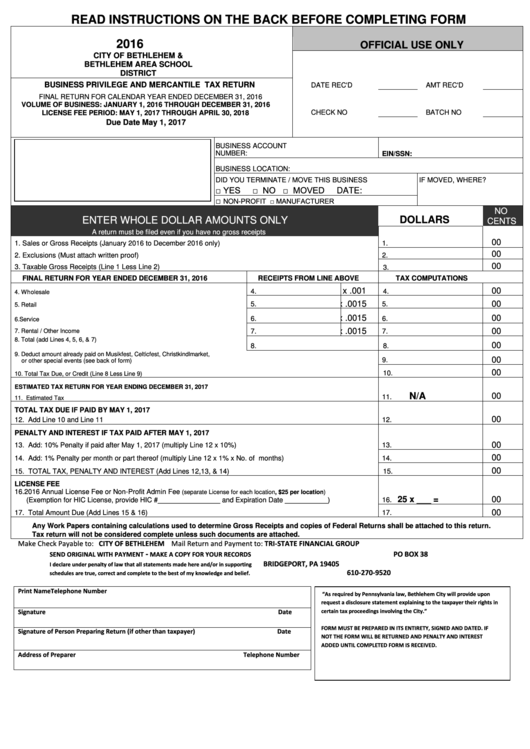

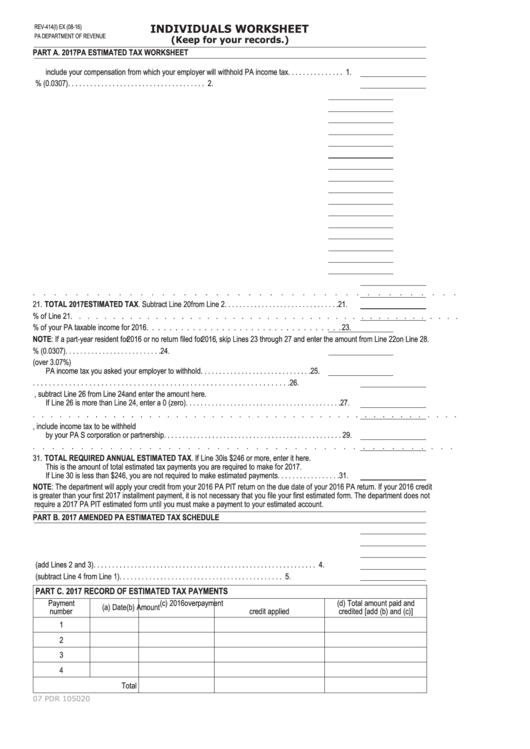

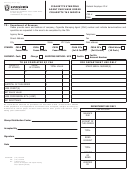

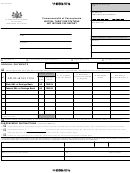

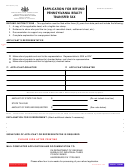

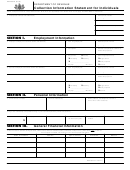

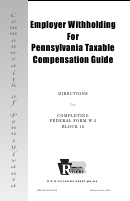

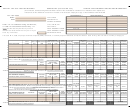

- Pennsylvania Tax Forms

Pennsylvania Tax Forms

Total 2281 templates

Pennsylvania Tax Forms And Templates

Pennsylvania Tax Forms Categories

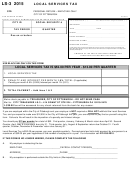

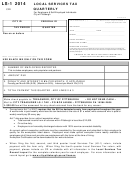

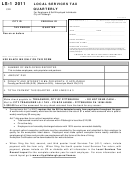

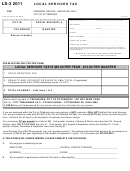

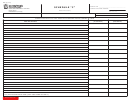

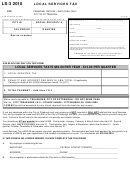

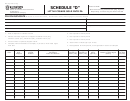

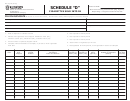

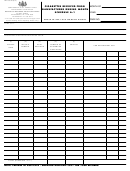

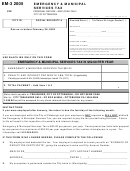

York Adams Tax Bureau Forms

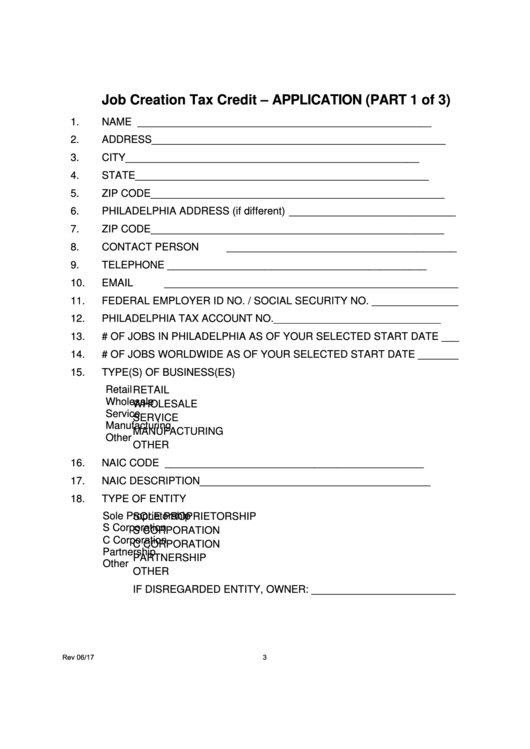

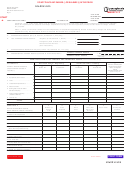

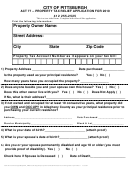

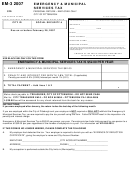

City Of Pittsburgh, Pa Department Of Finance Forms

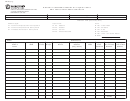

Pennsylvania Capital Tax Collection Bureau Forms