What Is a 401k Plan?

A 401(k) is a type of retirement plan offered through the workplace and is the most popular employer-sponsored retirement plan in the United States. This is a qualified retirement plan regulated by the laws stipulated in the Employee Retirement Income Security Act of 1974 and the tax code.

- Along with providing a great way to invest for retirement, the 401(k) plan offers several other advantages:

- Elective salary deferrals are excluded from the employee’s taxable income;

- Employers can contribute to employees’ 401(k) accounts;

- All distributions and earnings except for qualified distributions of designated Roth accounts are includible in taxable income at retirement.

In other words, a 401(k) plan allows an employee to choose between taking their whole payment in cash or deferring a percentage of it to their retirement savings account under the plan.

The amount deferred is usually not taxable to the employee until it is withdrawn or distributed from the plan. A Roth 401(k) plan, however, allows the employee to make contributions on an after-tax basis. These amounts withdrawn are tax-free.

State-specific PDF-versions of the form can be downloaded below.

How to Complete the 401k Enrollment Form

Here are some basic instructions for filling in the enrollment form to begin investing in your future retirement.

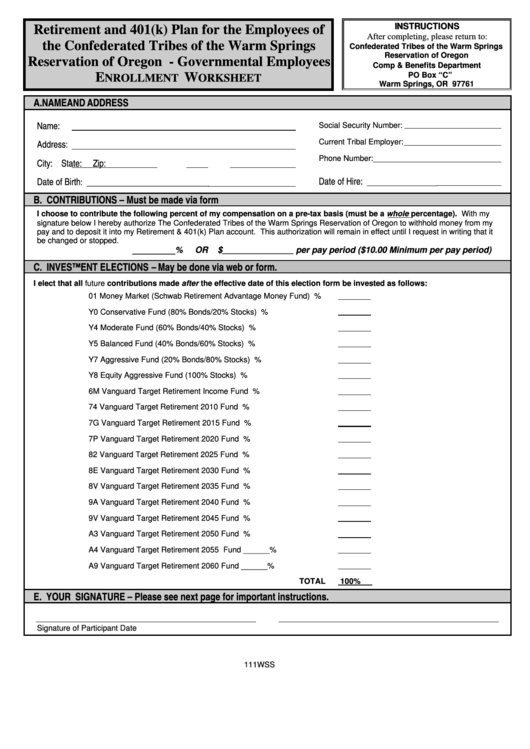

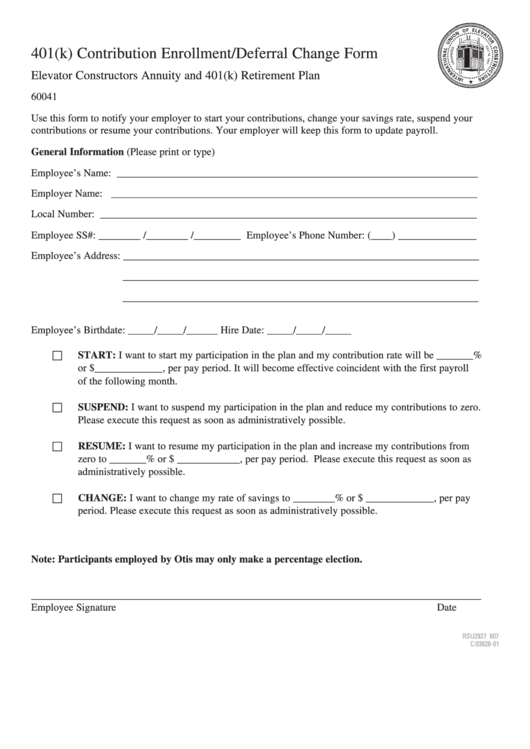

- Download the standard enrollment form for your state or organization.

- Fill in the personal information section of the enrollment form.

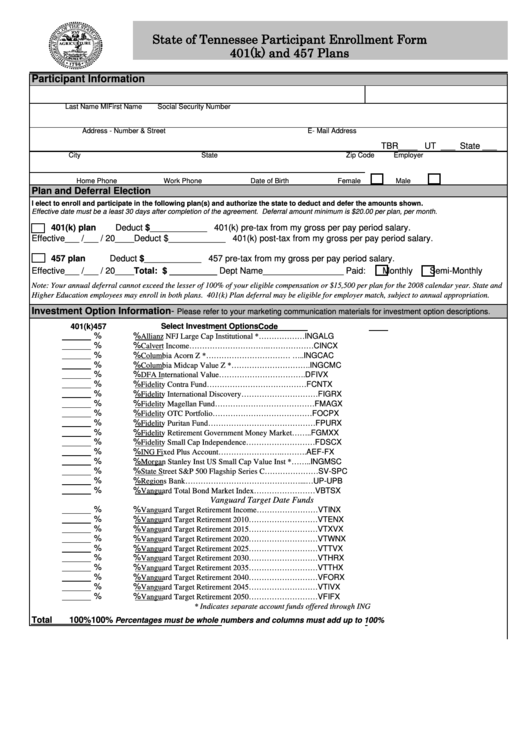

- Choose a type of plan and sign the appropriate box to authorize your employer to deposit parts of your salary into your retirement savings account. The plan types box is usually located at the top of the page.

- Choose whether you would like to contribute to an after-tax Roth option.

- Figure out the dollar amount you would like your employer to contribute to your account for each determined period.

- Divide your investments between the available retirement funds: enter the percentage you’d like to contribute for each option you select. Percentages must be whole numbers and columns must add up to 100%.

- Re-read the agreement and sign your form.

Keep in mind that 401(k) election forms differ from company to company and from state to state. Contact your employer for additional information about workplace retirement plans available to you.

401k Enrollment Form Templates

State Of Tennessee Participant Enrollment Form 401(k) And 457 Plans