Where Can I Get Employee’s Daily Record of Tips and Report to Employer?

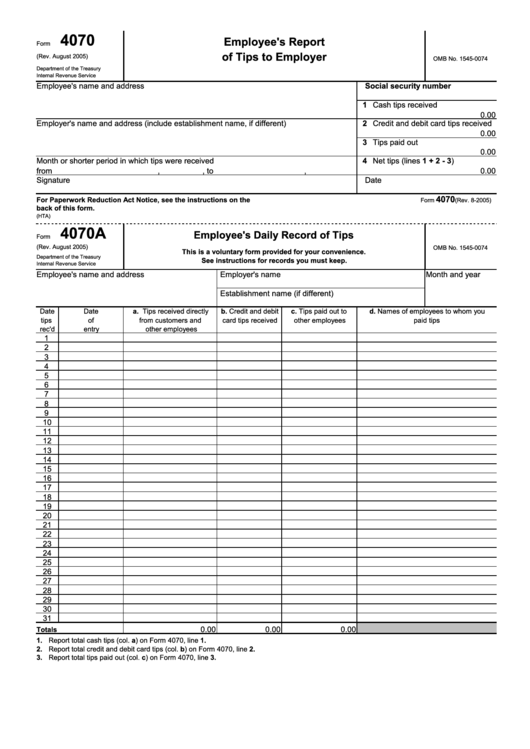

The most recent editions of Form 4070 and 4070-A are published in the IRS Publication 1244. This publication contains:

- Form 4070-A, Employee’s Daily Record of Tips. This is a voluntary form providing a convenient format for keeping a daily record of tip income.

- Form 4070, Employee’s Report of Tips to Employer. Employees use this form to report received tips to their employer. These include cash tips, tips received from other employees, and debit and credit card tips.

The latest fillable versions of both forms can be downloaded below.

Who Must File Form 4070?

Those who work as tipped employees must report both their regular earnings and their tips from each shift as income. Individuals obligated to report tips include waiters and waitresses, casino poker dealers, valets, busboys, or any another commonly tipped workers.

What Are Tips? Are Tips Taxable?

A tip is a voluntary payment that you receive from a customer. It could be in the form of cash, check or card payment, or be a non-monetary gift like a movie ticket, bus pass etc.

Businesses that allow customers to tip are forbidden from stipulating the amount or the frequency with which customers tip by law. If a business mandates tipping, this money can instead be considered a service charge by the IRS and should not be reported as a tip.

When to Report Tips by Form 4070? What Tips Are Taxable?

As an employee, it is important to know how and when to report your tips to your employer and to the IRS.

If your employer requires a mandatory gratuity on orders or charges extra for takeout purchases, for example, it is not under any obligation to report this extra money as tips. Even if the employer distributes the service charges or gratuity among the employees, you do not have to report the money as a tip, but rather as part of your regular income.

If your tips are less than $20 for the money, you are not obligated to report the money to your employer. It is only when you make more than $20 that you have to report the initial $20 plus anything extra to the IRS and to the company for which you work.

If you do make more than $20 in tips, you are required to fill out the IRS Form 4070 and submit it to your boss. Report tips by the 10th day of the month following the month you receive them on. If the 10th day lands on a Saturday, Sunday or any legal holiday, report tips by the next day that is not a Saturday, Sunday or legal holiday.

Why Do You Need to Report Your Tips Each Month?

Reporting tip income allows your employer to withhold money for Medicare, FICA, Social Security and State taxes.

Tipped employees mostly end each shift with an amount of cash. It may be very tempting to under-report your tips because you want to keep as much money as you can without having to give your employer their fair share.

However, it is critical for you to report the full amount truthfully. Failing to report the tips in full could lead to serious consequences that may include having your future earnings levied to pay off the amount that you owe the IRS. Likewise, the IRS could seize up to half of your Social Security benefits and still require that you pay the delinquent amount in full.

The amount of money that you report also plays into how much Social Security benefits you and your loved ones can legally receive after retirement or in case of death. Reporting the full monthly amount allows you to collect more of your Social Security benefits once you become eligible to receive them.

How to Report Tips Using Form 4070?

Your employer should have copies of the IRS Form 4070 on hand for you to fill out by the 10th day of each month.

Fill in the following lines on the form:

- Your name and address;

- Employer's name and address (list the employer’s establishment name, if different);

- Month or shorter period in which tips were received.

On the right side fill in:

- Your Social security number;

- The amount of cash tips received;

- Any credit and debit card tips received;

- Tips paid out;

- The overall sum of all received tips.

- Complete the form with your signature and date of filing.

If your employer doesn't have the IRS Form 4070 on hand, you must put these details down in writing so that you can be credited with legally and accurately reporting your tips. This handwritten report must include the following:

- Your full legal name;

- Your legal address;

- Your employer's name and address;

- Your Social Security Number;

- The overall amount of your month's tips;

- The month for when the tips were collected;

- Your signature and the date of submission.

After writing down this information, the report should be handed in to your employer, your company's HR manager or accountant.

Form 4070 Templates