- Financial

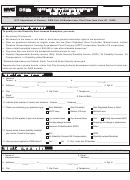

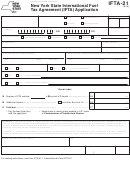

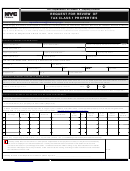

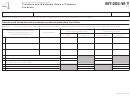

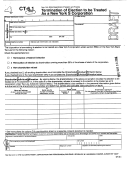

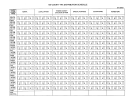

- United States Tax Forms

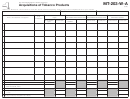

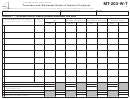

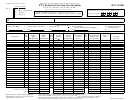

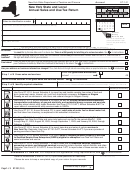

- New York State Tax Forms

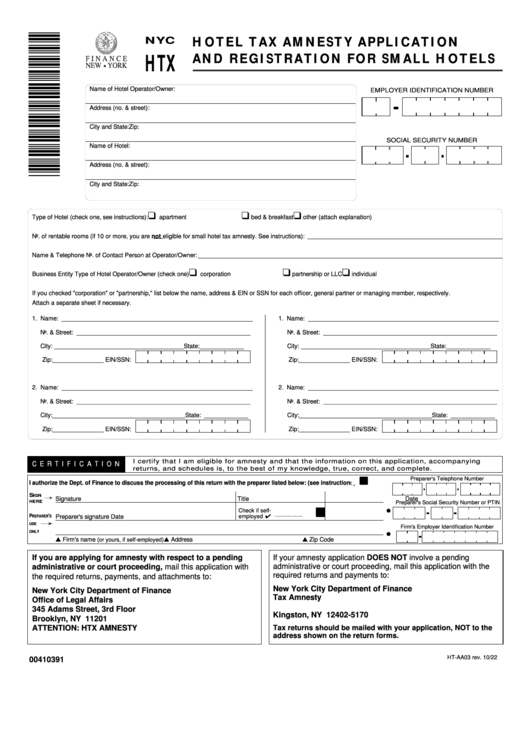

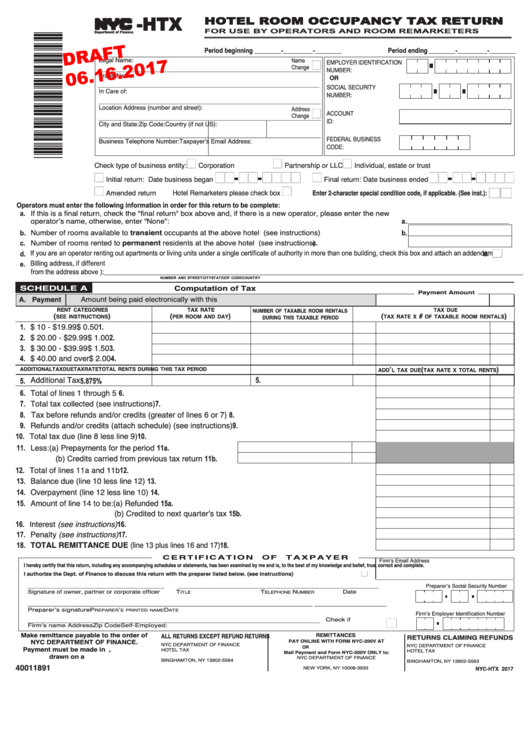

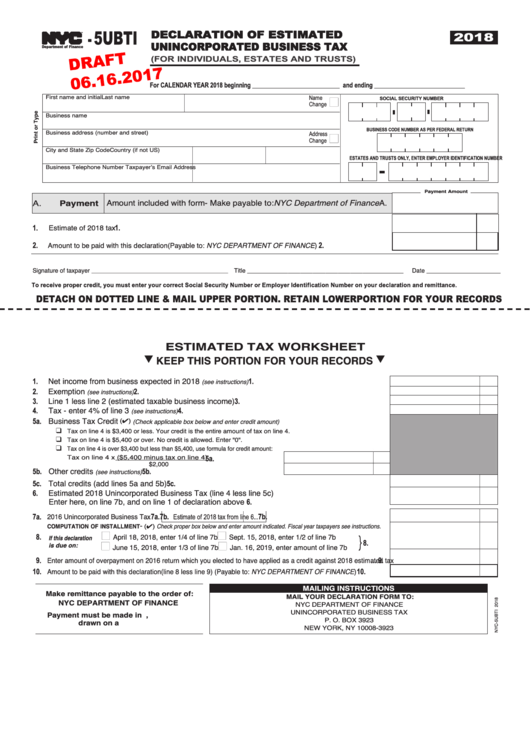

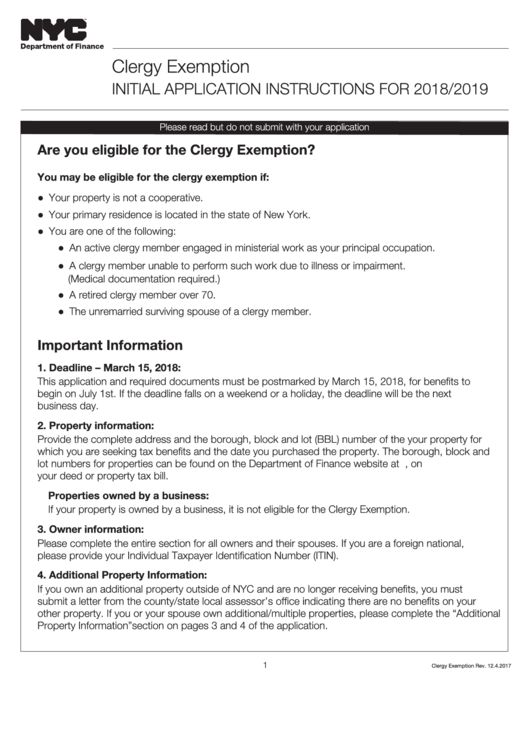

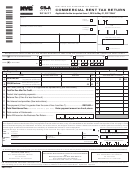

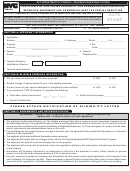

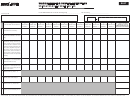

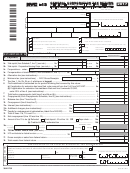

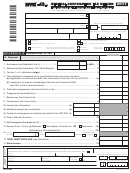

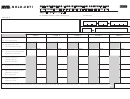

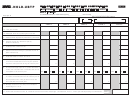

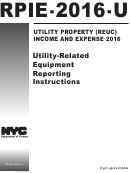

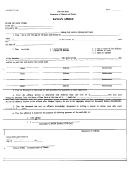

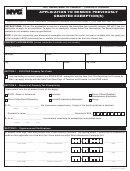

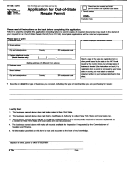

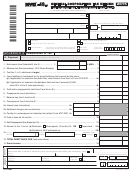

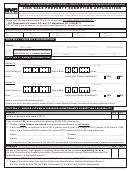

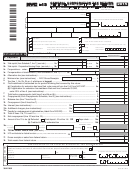

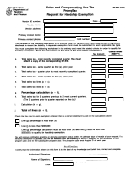

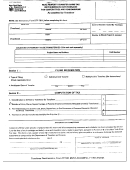

- New York City Department Of Finance Forms

New York City Department Of Finance Forms

Total 1027 templates

New York City Department Of Finance Forms And Templates

New York City Department Of Finance Forms Categories

Unsorted New York City Department Of Finance Forms

Related Articles

Related categories

- New York Department Of Labor Forms

- New York State Department Of Taxation And Finance Sales Tax Forms

- New York State Department Of Taxation And Finance Forms

- City Of Pasadena,ca Department Of Finance Forms

- New York State Department Of Health Forms

- Kentucky Department Of Finance Forms

- Virginia Department Of Finance Forms

- New Jersey Department Of Treasury Forms

- New Hampshire Department Of State Forms

- New Hampshire Department Of Safety Forms