Appendix 1 Worksheet - Annual Report - Wyoming

ADVERTISEMENT

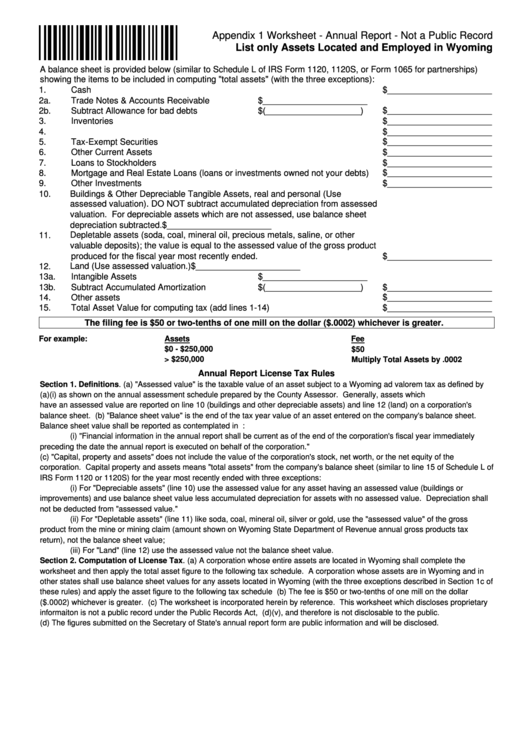

Appendix 1 Worksheet - Annual Report - Not a Public Record

List only Assets Located and Employed in Wyoming

A balance sheet is provided below (similar to Schedule L of IRS Form 1120, 1120S, or Form 1065 for partnerships)

showing the items to be included in computing "total assets" (with the three exceptions):

1.

Cash

$______________________

2a.

Trade Notes & Accounts Receivable

$______________________

2b.

Subtract Allowance for bad debts

$(____________________)

$______________________

3.

Inventories

$______________________

4.

U.S. Government Obligations

$______________________

5.

Tax-Exempt Securities

$______________________

6.

Other Current Assets

$______________________

7.

Loans to Stockholders

$______________________

8.

Mortgage and Real Estate Loans (loans or investments owned not your debts)

$______________________

9.

Other Investments

$______________________

10.

Buildings & Other Depreciable Tangible Assets, real and personal (Use

assessed valuation). DO NOT subtract accumulated depreciation from assessed

valuation. For depreciable assets which are not assessed, use balance sheet

depreciation subtracted.

$______________________

11.

Depletable assets (soda, coal, mineral oil, precious metals, saline, or other

valuable deposits); the value is equal to the assessed value of the gross product

produced for the fiscal year most recently ended.

$______________________

12.

Land (Use assessed valuation.)

$______________________

13a.

Intangible Assets

$______________________

13b.

Subtract Accumulated Amortization

$(____________________)

$______________________

14.

Other assets

$______________________

15.

Total Asset Value for computing tax (add lines 1-14)

$______________________

The filing fee is $50 or two-tenths of one mill on the dollar ($.0002) whichever is greater.

For example:

Assets

Fee

$0 - $250,000

$50

> $250,000

Multiply Total Assets by .0002

Annual Report License Tax Rules

Section 1. Definitions. (a) "Assessed value" is the taxable value of an asset subject to a Wyoming ad valorem tax as defined by

W.S. 39-11-101(a)(i) as shown on the annual assessment schedule prepared by the County Assessor. Generally, assets which

have an assessed value are reported on line 10 (buildings and other depreciable assets) and line 12 (land) on a corporation's

balance sheet. (b) "Balance sheet value" is the end of the tax year value of an asset entered on the company's balance sheet.

Balance sheet value shall be reported as contemplated in W.S. 17-16-1630 which states:

(i) "Financial information in the annual report shall be current as of the end of the corporation's fiscal year immediately

preceding the date the annual report is executed on behalf of the corporation."

(c) "Capital, property and assets" does not include the value of the corporation's stock, net worth, or the net equity of the

corporation. Capital property and assets means "total assets" from the company's balance sheet (similar to line 15 of Schedule L of

IRS Form 1120 or 1120S) for the year most recently ended with three exceptions:

(i) For "Depreciable assets" (line 10) use the assessed value for any asset having an assessed value (buildings or

improvements) and use balance sheet value less accumulated depreciation for assets with no assessed value. Depreciation shall

not be deducted from "assessed value."

(ii) For "Depletable assets" (line 11) like soda, coal, mineral oil, silver or gold, use the "assessed value" of the gross

product from the mine or mining claim (amount shown on Wyoming State Department of Revenue annual gross products tax

return), not the balance sheet value;

(iii) For "Land" (line 12) use the assessed value not the balance sheet value.

Section 2. Computation of License Tax. (a) A corporation whose entire assets are located in Wyoming shall complete the

worksheet and then apply the total asset figure to the following tax schedule. A corporation whose assets are in Wyoming and in

other states shall use balance sheet values for any assets located in Wyoming (with the three exceptions described in Section 1c of

these rules) and apply the asset figure to the following tax schedule (b) The fee is $50 or two-tenths of one mill on the dollar

($.0002) whichever is greater. (c) The worksheet is incorporated herein by reference. This worksheet which discloses proprietary

informaiton is not a public record under the Public Records Act, W.S. 16-4-203(d)(v), and therefore is not disclosable to the public.

(d) The figures submitted on the Secretary of State's annual report form are public information and will be disclosed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1