Debit Card Transaction Fraud/dispute Form

ADVERTISEMENT

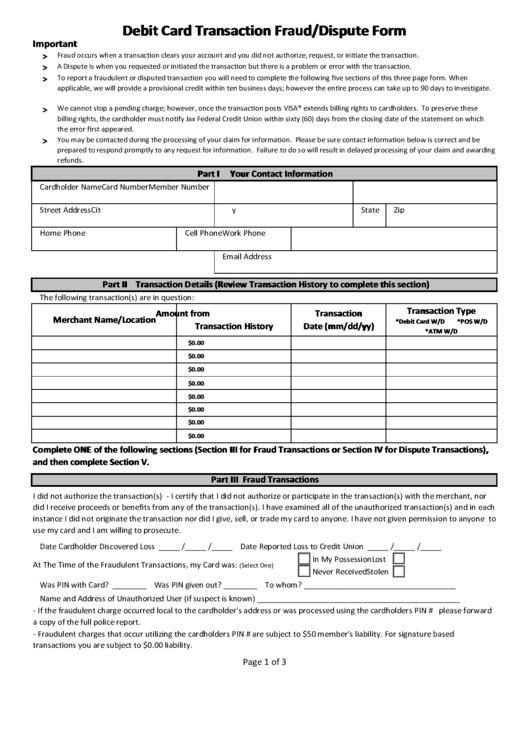

Debit Card Transaction Fraud/Dispute Form

Important

Fraud occurs when a transaction clears your account and you did not authorize, request, or initiate the transaction.

>

A Dispute is when you requested or initiated the transaction but there is a problem or error with the transaction.

>

>

To report a fraudulent or disputed transaction you will need to complete the following five sections of this three page form. When

applicable, we will provide a provisional credit within ten business days; however the entire process can take up to 90 days to investigate.

We cannot stop a pending charge; however, once the transaction posts VISA® extends billing rights to cardholders. To preserve these

>

billing rights, the cardholder must notify Jax Federal Credit Union within sixty (60) days from the closing date of the statement on which

the error first appeared.

You may be contacted during the processing of your claim for information. Please be sure contact information below is correct and be

>

prepared to respond promptly to any request for information. Failure to do so will result in delayed processing of your claim and awarding

refunds.

Part I

Your Contact Information

Cardholder Name

Card Number

Member Number

Street Address

City

State

Zip

Home Phone

Cell Phone

Work Phone

Email Address

Part II Transaction Details (Review Transaction History to complete this section)

The following transaction(s) are in question:

Transaction Type

Amount from

Transaction

Merchant Name/Location

*Debit Card W/D

*POS W/D

Transaction History

Date (mm/dd/yy)

*ATM W/D

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Complete ONE of the following sections (Section III for Fraud Transactions or Section IV for Dispute Transactions),

and then complete Section V.

Part III Fraud Transactions

I did not authorize the transaction(s) - I certify that I did not authorize or participate in the transaction(s) with the merchant, nor

did I receive proceeds or benefits from any of the transaction(s). I have examined all of the unauthorized transaction(s) and in each

instance I did not originate the transaction nor did I give, sell, or trade my card to anyone. I have not given permission to anyone to

use my card and I am willing to prosecute.

Date Cardholder Discovered Loss _____ /_____ /_____ Date Reported Loss to Credit Union _____ /_____ /_____

In My Possession

Lost

At The Time of the Fraudulent Transactions, my Card was:

(Select One)

Never Received

Stolen

Was PIN with Card? ________ Was PIN given out? ________ To whom? ____________________________________

Name and Address of Unauthorized User (if suspect is known) ________________________________________________

- If the fraudulent charge occurred local to the cardholder's address or was processed using the cardholders PIN # please forward

a copy of the full police report.

- Fraudulent charges that occur utilizing the cardholders PIN # are subject to $50 member's liability. For signature based

transactions you are subject to $0.00 liability.

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3