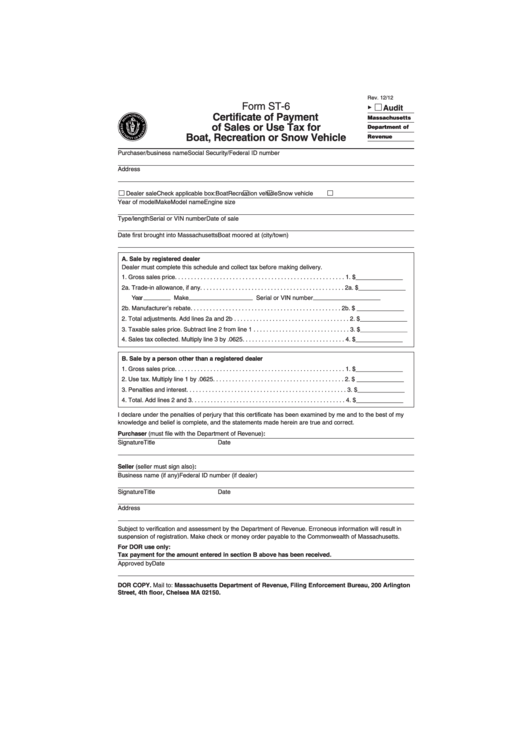

Form St-6 - Certificate Of Payment Of Sales Or Use Tax For Boat Recreation Or Snow Vehicle

ADVERTISEMENT

Rev. 12/12

Form ST-6

Audit

3

Certificate of Payment

Massachusetts

of Sales or Use Tax for

Department of

Boat, Recreation or Snow Vehicle

Revenue

Purchaser/business name

Social Security/Federal ID number

Address

Dealer sale

Check applicable box:

Boat

Recreation vehicle

Snow vehicle

Year of model

Make

Model name

Engine size

Type/length

Serial or VIN number

Date of sale

Date first brought into Massachusetts

Boat moored at (city/town)

A. Sale by registered dealer

Dealer must complete this schedule and collect tax before making delivery.

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2a. Trade-in allowance, if any. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. $ ______________

Year ________ Make ___________________ Serial or VIN number ____________________

2b.

2b. Manufacturer’s rebate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b. $ ______________

2. Total adjustments. Add lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Taxable sales price. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Sales tax collected. Multiply line 3 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

B. Sale by a person other than a registered dealer

1. Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $ ______________

2. Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. $ ______________

3. Penalties and interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. $ ______________

4. Total. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. $ ______________

I declare under the penalties of perjury that this certificate has been examined by me and to the best of my

knowledge and belief is complete, and the statements made herein are true and correct.

Purchaser (must file with the Department of Revenue):

Signature

Title

Date

Seller (seller must sign also):

Business name (if any)

Federal ID number (if dealer)

Signature

Title

Date

Address

Subject to verification and assessment by the Department of Revenue. Erroneous information will result in

suspension of registration. Make check or money order payable to the Commonwealth of Massachusetts.

For DOR use only:

Tax payment for the amount entered in section B above has been received.

Approved by

Date

DOR COPY. Mail to: Massachusetts Department of Revenue, Filing Enforcement Bureau, 200 Arlington

Street, 4th floor, Chelsea MA 02150.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4