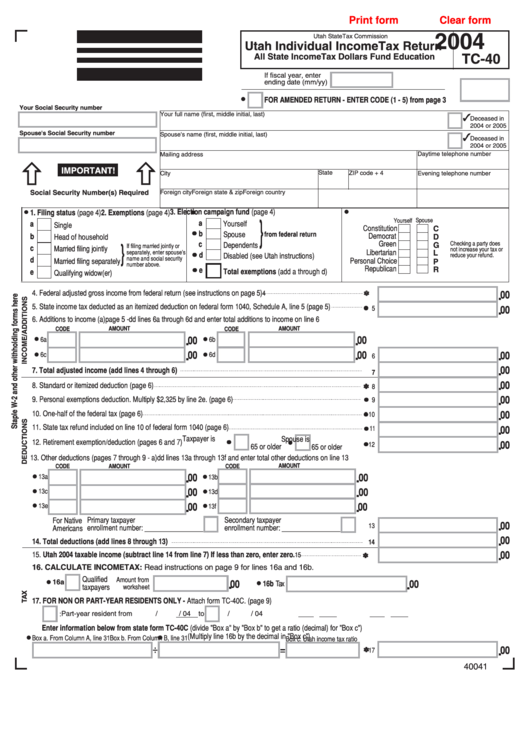

Print form

Clear form

2004

Utah State Tax Commission

Utah Individual Income Tax Return

All State Income Tax Dollars Fund Education

TC-40

incometax.utah.gov

If fiscal year, enter

ending date (mm/yy)

FOR AMENDED RETURN - ENTER CODE (1 - 5) from page 3

Your Social Security number

Your full name (first, middle initial, last)

Deceased in

2004 or 2005

Spouse's Social Security number

Spouse's name (first, middle initial, last)

Deceased in

2004 or 2005

Daytime telephone number

Mailing address

IMPORTANT!

State

ZIP code + 4

Evening telephone number

City

Social Security Number(s) Required

Foreign city

Foreign state & zip

Foreign country

3. Election campaign fund (page 4)

1. Filing status (page 4)

2. Exemptions (page 4)

Yourself Spouse

}

a

a

Yourself

Single

Constitution

C

b

Spouse

from federal return

b

Democrat

Head of household

D

c

Green

Checking a party does

Dependents

G

If filing married jointly or

}

c

Married filing jointly

not increase your tax or

separately, enter spouse’s

Libertarian

L

d

reduce your refund.

Disabled (see Utah instructions)

name and social security

d

Personal Choice

Married filing separately

P

number above.

Republican

R

e

e

Total exemptions (add a through d)

Qualifying widow(er)

4. Federal adjusted gross income from federal return (see instructions on page 5)

.

4

00

5. State income tax deducted as an itemized deduction on federal form 1040, Schedule A, line 5 (page 5)

.

5

00

6. Additions to income (

page 5 - dd lines 6a through 6d and enter total additions to income on line 6

a

)

AMOUNT

AMOUNT

CODE

CODE

.

.

00

00

6a

6b

.

.

.

00

00

00

6c

6d

6

.

00

7. Total adjusted income (add lines 4 through 6)

7

.

00

8. Standard or itemized deduction (page 6)

8

.

00

9. Personal exemptions deduction. Multiply $2,325 by line 2e. (page 6)

9

.

10. One-half of the federal tax (page 6)

00

10

11. State tax refund included on line 10 of federal form 1040 (page 6)

.

11

00

Taxpayer is

Spouse is

12. Retirement exemption/deduction (pages 6 and 7)

.

00

12

65 or older

65 or older

13. Other deductions (pages 7 through 9 - a

dd lines 13a through 13f and enter total other deductions on line 13

)

CODE

CODE

AMOUNT

AMOUNT

.

.

00

00

13a

13b

.

.

00

00

13c

13d

.

.

13e

00

00

13f

Primary taxpayer

Secondary taxpayer

For Native

.

00

13

enrollment number: ________________

enrollment number: ________________

Americans

.

00

14. Total deductions (add lines 8 through 13)

14

.

00

15. Utah 2004 taxable income (subtract line 14 from line 7) If less than zero, enter zero.

15

16. CALCULATE INCOME TAX: Read instructions on page 9 for lines 16a and 16b.

Qualified

Amount from

16a

.

.

00

16b Tax

00

taxpayers

worksheet

17. FOR NON OR PART-YEAR RESIDENTS ONLY - Attach form TC-40C. (page 9)

Part-year resident from

/

/ 04

to

/

/ 04

Nonresident. Home state abbreviation:

Enter information below from state form TC-40C (divide "Box a" by "Box b" to get a ratio (decimal) for "Box c")

(Multiply line 16b by the decimal in "Box c")

Box a. From Column A, line 31

Box b. From Column B, line 31

Box c. Utah income tax ratio

.

00

17

40041

1

1 2

2