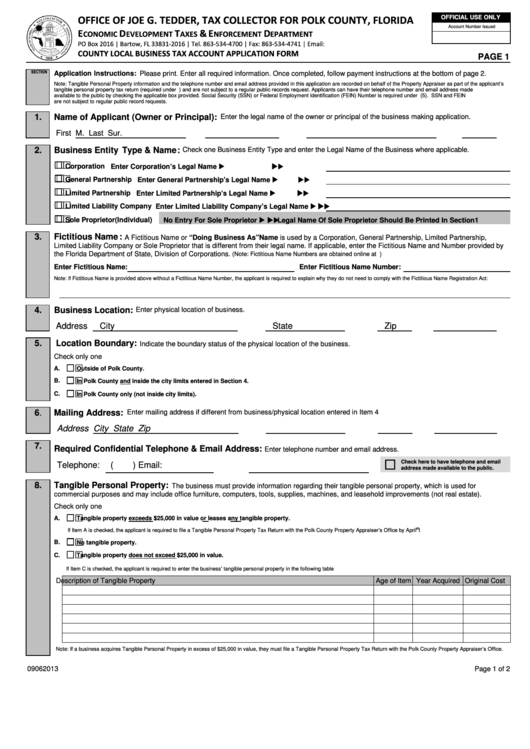

Form Fl 33831 - County Local Business Tax Account Application - 2013

ADVERTISEMENT

OFFICIAL USE ONLY

OFFICE OF JOE G. TEDDER, TAX COLLECTOR FOR POLK COUNTY, FLORIDA

Account Number Issued

E

D

T

& E

D

CONOMIC

EVELOPMENT

AXES

NFORCEMENT

EPARTMENT

PO Box 2016 | Bartow, FL 33831-2016 | Tel. 863-534-4700 | Fax: 863-534-4741 | Email:

COUNTY LOCAL BUSINESS TAX ACCOUNT APPLICATION FORM

PAGE 1

SECTION

Application Instructions: Please print. Enter all required information. Once completed, follow payment instructions at the bottom of page 2.

Note: Tangible Personal Property information and the telephone number and email address provided in this application are recorded on behalf of the Property Appraiser as part of the applicant’s

tangible personal property tax return (required under F.S. 193) and are not subject to a regular public records request. Applicants can have their telephone number and email address made

available to the public by checking the applicable box provided. Social Security (SSN) or Federal Employment Identification (FEIN) Number is required under F.S. 205.0535 (5). SSN and FEIN

are not subject to regular public record requests.

1.

Name of Applicant (Owner or Principal):

Enter the legal name of the owner or principal of the business making application.

First

M.

Last

Sur.

2.

Business Entity Type & Name:

Check one Business Entity Type and enter the Legal Name of the Business where applicable.

Corporation

Enter Corporation’s Legal Name

General Partnership

Enter General Partnership’s Legal Name

Limited Partnership

Enter Limited Partnership’s Legal Name

Limited Liability Company

Enter Limited Liability Company’s Legal Name

Sole Proprietor (Individual)

No Entry For Sole Proprietor

Legal Name Of Sole Proprietor Should Be Printed In Section1

3.

Fictitious Name:

A Fictitious Name or “Doing Business As” Name is used by a Corporation, General Partnership, Limited Partnership,

Limited Liability Company or Sole Proprietor that is different from their legal name. If applicable, enter the Fictitious Name and Number provided by

the Florida Department of State, Division of Corporations.

(Note: Fictitious Name Numbers are obtained online at )

Enter Fictitious Name:

Enter Fictitious Name Number:

Note: If Fictitious Name is provided above without a Fictitious Name Number, the applicant is required to explain why they do not need to comply with the Fictitious Name Registration Act:

4.

Business Location:

Enter physical location of business.

Address

City

State

Zip

5.

Location Boundary:

Indicate the boundary status of the physical location of the business.

Check only one

A.

Outside of Polk County.

B.

In Polk County and inside the city limits entered in Section 4.

C.

In Polk County only (not inside city limits).

6.

Mailing Address:

Enter mailing address if different from business/physical location entered in Item 4

Address

City

State

Zip

7.

Required Confidential Telephone & Email Address:

Enter telephone number and email address.

Check here to have telephone and email

Telephone:

(

)

Email:

address made available to the public.

8.

Tangible Personal Property:

The business must provide information regarding their tangible personal property, which is used for

commercial purposes and may include office furniture, computers, tools, supplies, machines, and leasehold improvements (not real estate).

Check only one

A.

Tangible property exceeds $25,000 in value or leases any tangible property.

st

If Item A is checked, the applicant is required to file a Tangible Personal Property Tax Return with the Polk County Property Appraiser’s Office by April 1

.

B.

No tangible property.

C.

Tangible property does not exceed $25,000 in value.

If Item C is checked, the applicant is required to enter the business’ tangible personal property in the following table

Description of Tangible Property

Age of Item Year Acquired Original Cost

Note: If a business acquires Tangible Personal Property in excess of $25,000 in value, they must file a Tangible Personal Property Tax Return with the Polk County Property Appraiser’s Office.

09062013

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4