Instructions For Form 1099-Patr - 2016

ADVERTISEMENT

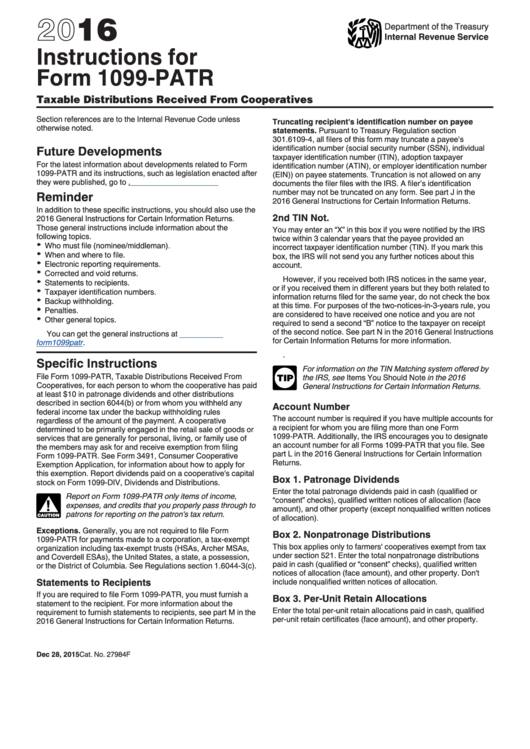

2016

Department of the Treasury

Internal Revenue Service

Instructions for

Form 1099-PATR

Taxable Distributions Received From Cooperatives

Section references are to the Internal Revenue Code unless

Truncating recipient's identification number on payee

otherwise noted.

statements. Pursuant to Treasury Regulation section

301.6109-4, all filers of this form may truncate a payee’s

Future Developments

identification number (social security number (SSN), individual

taxpayer identification number (ITIN), adoption taxpayer

For the latest information about developments related to Form

identification number (ATIN), or employer identification number

1099-PATR and its instructions, such as legislation enacted after

(EIN)) on payee statements. Truncation is not allowed on any

they were published, go to

documents the filer files with the IRS. A filer’s identification

number may not be truncated on any form. See part J in the

Reminder

2016 General Instructions for Certain Information Returns.

In addition to these specific instructions, you should also use the

2nd TIN Not.

2016 General Instructions for Certain Information Returns.

Those general instructions include information about the

You may enter an “X” in this box if you were notified by the IRS

following topics.

twice within 3 calendar years that the payee provided an

Who must file (nominee/middleman).

incorrect taxpayer identification number (TIN). If you mark this

When and where to file.

box, the IRS will not send you any further notices about this

Electronic reporting requirements.

account.

Corrected and void returns.

However, if you received both IRS notices in the same year,

Statements to recipients.

or if you received them in different years but they both related to

Taxpayer identification numbers.

information returns filed for the same year, do not check the box

Backup withholding.

at this time. For purposes of the two-notices-in-3-years rule, you

Penalties.

are considered to have received one notice and you are not

Other general topics.

required to send a second “B” notice to the taxpayer on receipt

of the second notice. See part N in the 2016 General Instructions

You can get the general instructions at

for Certain Information Returns for more information.

form1099patr.

.

Specific Instructions

For information on the TIN Matching system offered by

File Form 1099-PATR, Taxable Distributions Received From

the IRS, see Items You Should Note in the 2016

TIP

Cooperatives, for each person to whom the cooperative has paid

General Instructions for Certain Information Returns.

at least $10 in patronage dividends and other distributions

described in section 6044(b) or from whom you withheld any

Account Number

federal income tax under the backup withholding rules

The account number is required if you have multiple accounts for

regardless of the amount of the payment. A cooperative

a recipient for whom you are filing more than one Form

determined to be primarily engaged in the retail sale of goods or

1099-PATR. Additionally, the IRS encourages you to designate

services that are generally for personal, living, or family use of

an account number for all Forms 1099-PATR that you file. See

the members may ask for and receive exemption from filing

part L in the 2016 General Instructions for Certain Information

Form 1099-PATR. See Form 3491, Consumer Cooperative

Returns.

Exemption Application, for information about how to apply for

this exemption. Report dividends paid on a cooperative's capital

Box 1. Patronage Dividends

stock on Form 1099-DIV, Dividends and Distributions.

Enter the total patronage dividends paid in cash (qualified or

Report on Form 1099-PATR only items of income,

“consent” checks), qualified written notices of allocation (face

expenses, and credits that you properly pass through to

!

amount), and other property (except nonqualified written notices

patrons for reporting on the patron's tax return.

of allocation).

CAUTION

Exceptions. Generally, you are not required to file Form

Box 2. Nonpatronage Distributions

1099-PATR for payments made to a corporation, a tax-exempt

This box applies only to farmers' cooperatives exempt from tax

organization including tax-exempt trusts (HSAs, Archer MSAs,

under section 521. Enter the total nonpatronage distributions

and Coverdell ESAs), the United States, a state, a possession,

paid in cash (qualified or “consent” checks), qualified written

or the District of Columbia. See Regulations section 1.6044-3(c).

notices of allocation (face amount), and other property. Don't

Statements to Recipients

include nonqualified written notices of allocation.

If you are required to file Form 1099-PATR, you must furnish a

Box 3. Per-Unit Retain Allocations

statement to the recipient. For more information about the

Enter the total per-unit retain allocations paid in cash, qualified

requirement to furnish statements to recipients, see part M in the

per-unit retain certificates (face amount), and other property.

2016 General Instructions for Certain Information Returns.

Dec 28, 2015

Cat. No. 27984F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2