Filing The Return Of Income - India

ADVERTISEMENT

FILING THE RETURN OF INCOME

The taxpayer has to communicate the details of his taxable income/loss to the Income-tax

Department. These details are communicated to the Income-tax Department in the form

of return of income. In this part you can gain knowledge about various provisions and

procedure relating to furnishing (i.e. filing) the return of income. The provisions

discussed in this part are applicable for furnishing the return of income for the assessment

year 2016-17, i.e., financial year 2015-16.

Forms of return prescribed under the Income-tax Law

Under the Income-tax Law, different forms of return of income are prescribed for

different classes of taxpayers. The return forms are known as ITR forms (Income-tax

Return Forms).

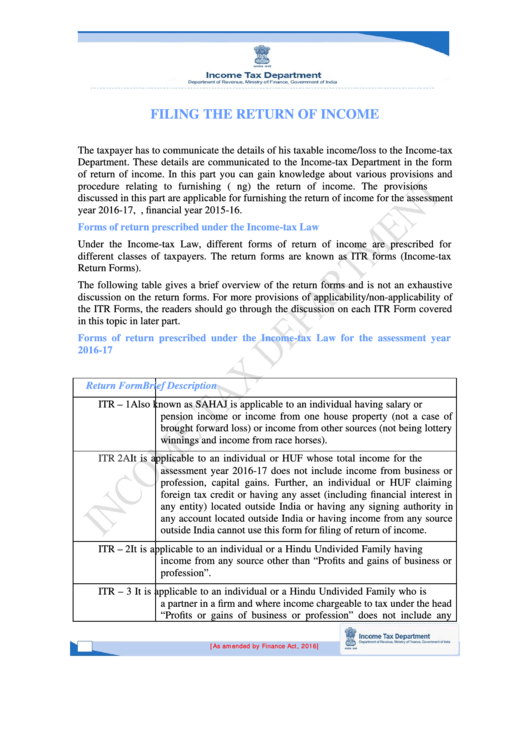

The following table gives a brief overview of the return forms and is not an exhaustive

discussion on the return forms. For more provisions of applicability/non-applicability of

the ITR Forms, the readers should go through the discussion on each ITR Form covered

in this topic in later part.

Forms of return prescribed under the Income-tax Law for the assessment year

2016-17

Return Form

Brief Description

ITR – 1

Also known as SAHAJ is applicable to an individual having salary or

pension income or income from one house property (not a case of

brought forward loss) or income from other sources (not being lottery

winnings and income from race horses).

ITR 2A

It is applicable to an individual or HUF whose total income for the

assessment year 2016-17 does not include income from business or

profession, capital gains. Further, an individual or HUF claiming

foreign tax credit or having any asset (including financial interest in

any entity) located outside India or having any signing authority in

any account located outside India or having income from any source

outside India cannot use this form for filing of return of income.

ITR – 2

It is applicable to an individual or a Hindu Undivided Family having

income from any source other than “Profits and gains of business or

profession”.

ITR – 3

It is applicable to an individual or a Hindu Undivided Family who is

a partner in a firm and where income chargeable to tax under the head

“Profits or gains of business or profession” does not include any

[As amended by Finance Act, 2016]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15