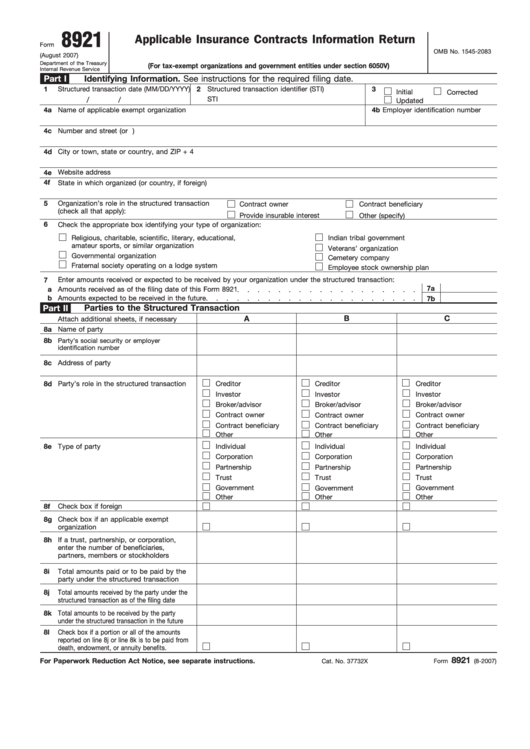

Form 8921 - Applicable Insurance Contracts Information Return

ADVERTISEMENT

8921

Applicable Insurance Contracts Information Return

Form

OMB No. 1545-2083

(August 2007)

Department of the Treasury

(For tax-exempt organizations and government entities under section 6050V)

Internal Revenue Service

Part I

Identifying Information. See instructions for the required filing date.

1

Structured transaction date (MM/DD/YYYY)

2

Structured transaction identifier (STI)

3

Initial

Corrected

STI

/

/

Updated

4a

Name of applicable exempt organization

4b

Employer identification number

4c

Number and street (or P.O. box if mail is not delivered to street address)

4d

City or town, state or country, and ZIP + 4

4e

Website address

4f

State in which organized (or country, if foreign)

5

Organization’s role in the structured transaction

Contract owner

Contract beneficiary

(check all that apply):

Provide insurable interest

Other (specify)

6

Check the appropriate box identifying your type of organization:

Religious, charitable, scientific, literary, educational,

Indian tribal government

amateur sports, or similar organization

Veterans’ organization

Governmental organization

Cemetery company

Fraternal society operating on a lodge system

Employee stock ownership plan

7

Enter amounts received or expected to be received by your organization under the structured transaction:

7a

a

Amounts received as of the filing date of this Form 8921

b

Amounts expected to be received in the future

7b

Part II

Parties to the Structured Transaction

A

B

C

Attach additional sheets, if necessary

8a

Name of party

8b

Party’s social security or employer

identification number

8c

Address of party

8d

Party’s role in the structured transaction

Creditor

Creditor

Creditor

Investor

Investor

Investor

Broker/advisor

Broker/advisor

Broker/advisor

Contract owner

Contract owner

Contract owner

Contract beneficiary

Contract beneficiary

Contract beneficiary

Other

Other

Other

8e

Type of party

Individual

Individual

Individual

Corporation

Corporation

Corporation

Partnership

Partnership

Partnership

Trust

Trust

Trust

Government

Government

Government

Other

Other

Other

8f

Check box if foreign

8g

Check box if an applicable exempt

organization

8h

If a trust, partnership, or corporation,

enter the number of beneficiaries,

partners, members or stockholders

8i

Total amounts paid or to be paid by the

party under the structured transaction

8j

Total amounts received by the party under the

structured transaction as of the filing date

8k

Total amounts to be received by the party

under the structured transaction in the future

8l

Check box if a portion or all of the amounts

reported on line 8j or line 8k is to be paid from

death, endowment, or annuity benefits.

8921

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 37732X

Form

(8-2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2