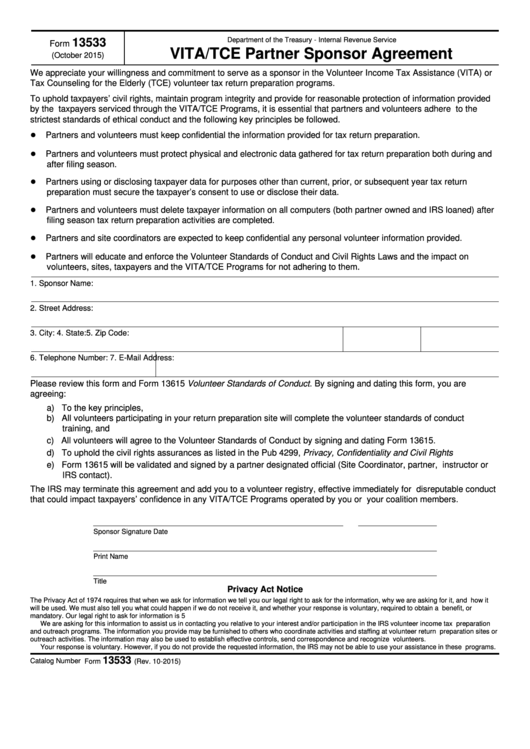

Form 13533 - Vita/tce Partner Sponsor Agreement

ADVERTISEMENT

Department of the Treasury - Internal Revenue Service

13533

Form

VITA/TCE Partner Sponsor Agreement

(October 2015)

We appreciate your willingness and commitment to serve as a sponsor in the Volunteer Income Tax Assistance (VITA) or

Tax Counseling for the Elderly (TCE) volunteer tax return preparation programs.

To uphold taxpayers’ civil rights, maintain program integrity and provide for reasonable protection of information provided

by the taxpayers serviced through the VITA/TCE Programs, it is essential that partners and volunteers adhere to the

strictest standards of ethical conduct and the following key principles be followed.

•

Partners and volunteers must keep confidential the information provided for tax return preparation.

•

Partners and volunteers must protect physical and electronic data gathered for tax return preparation both during and

after filing season.

•

Partners using or disclosing taxpayer data for purposes other than current, prior, or subsequent year tax return

preparation must secure the taxpayer’s consent to use or disclose their data.

•

Partners and volunteers must delete taxpayer information on all computers (both partner owned and IRS loaned) after

filing season tax return preparation activities are completed.

•

Partners and site coordinators are expected to keep confidential any personal volunteer information provided.

•

Partners will educate and enforce the Volunteer Standards of Conduct and Civil Rights Laws and the impact on

volunteers, sites, taxpayers and the VITA/TCE Programs for not adhering to them.

1. Sponsor Name:

2. Street Address:

3. City:

4. State:

5. Zip Code:

6. Telephone Number:

7. E-Mail Address:

Please review this form and Form 13615 Volunteer Standards of Conduct. By signing and dating this form, you are

agreeing:

a) To the key principles,

b) All volunteers participating in your return preparation site will complete the volunteer standards of conduct

training, and

c) All volunteers will agree to the Volunteer Standards of Conduct by signing and dating Form 13615.

d) To uphold the civil rights assurances as listed in the Pub 4299, Privacy, Confidentiality and Civil Rights

e) Form 13615 will be validated and signed by a partner designated official (Site Coordinator, partner, instructor or

IRS contact).

The IRS may terminate this agreement and add you to a volunteer registry, effective immediately for disreputable conduct

that could impact taxpayers’ confidence in any VITA/TCE Programs operated by you or your coalition members.

Sponsor Signature

Date

Print Name

Title

Privacy Act Notice

The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it

will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or

mandatory. Our legal right to ask for information is 5 U.S.C. 301.

We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation

and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or

outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers.

Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs.

13533

Catalog Number 38129E

Form

(Rev. 10-2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1