Mileage Weight Tax Registration Instructions And Certification - Illinois Secretary Of State

ADVERTISEMENT

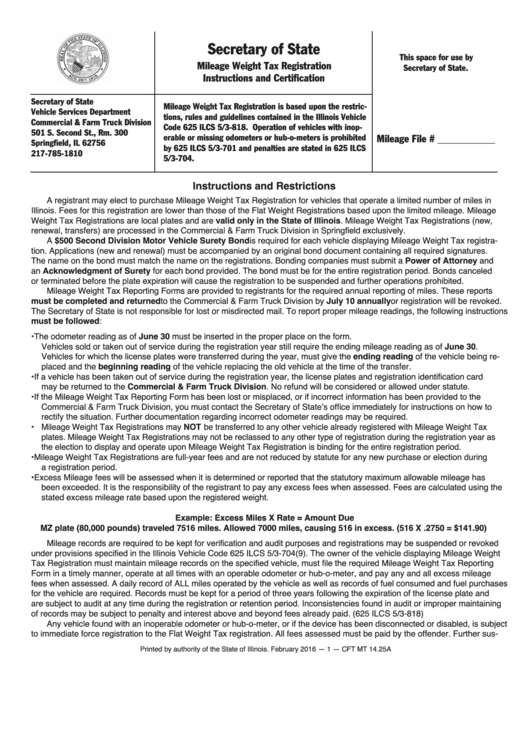

Secretary of State

This space for use by

Mileage Weight Tax Registration

Secretary of State.

Instructions and ertification

Secretary of State

Mileage Weight Tax Registration is based upon the restric-

Vehicle Services Department

tions, rules and guidelines contained in the Illinois Vehicle

ommercial & Farm Truck Division

ode 625 IL S 5/3-818. Operation of vehicles with inop-

501 S. Second St., Rm. 300

erable or missing odometers or hub-o-meters is prohibited

Mileage File # ___________

Springfield, IL 62756

by 625 IL S 5/3-701 and penalties are stated in 625 IL S

217-785-1810

5/3-704.

Instructions and Restrictions

A registrant may elect to purchase Mileage Weight Tax Registration for vehicles that operate a limited number of miles in

Illinois. Fees for this registration are lower than those of the Flat Weight Registrations based upon the limited mileage. Mileage

Weight Tax Registrations are local plates and are valid only in the State of Illinois. Mileage Weight Tax Registrations (new,

renewal, transfers) are processed in the Commercial & Farm Truck Division in Springfield exclusively.

A $500 Second Division Motor Vehicle Surety Bond is required for each vehicle displaying Mileage Weight Tax registra-

tion. Applications (new and renewal) must be accompanied by an original bond document containing all required signatures.

The name on the bond must match the name on the registrations. Bonding companies must submit a Power of Attorney and

an Acknowledgment of Surety for each bond provided. The bond must be for the entire registration period. Bonds canceled

or terminated before the plate expiration will cause the registration to be suspended and further operations prohibited.

Mileage Weight Tax Reporting Forms are provided to registrants for the required annual reporting of miles. These reports

must be completed and returned to the Commercial & Farm Truck Division by July 10 annually or registration will be revoked.

The Secretary of State is not responsible for lost or misdirected mail. To report proper mileage readings, the following instructions

must be followed:

• The odometer reading as of June 30 must be inserted in the proper place on the form.

Vehicles sold or taken out of service during the registration year still require the ending mileage reading as of June 30.

Vehicles for which the license plates were transferred during the year, must give the ending reading of the vehicle being re-

placed and the beginning reading of the vehicle replacing the old vehicle at the time of the transfer.

• If a vehicle has been taken out of service during the registration year, the license plates and registration identification card

may be returned to the Commercial & Farm Truck Division. No refund will be considered or allowed under statute.

• If the Mileage Weight Tax Reporting Form has been lost or misplaced, or if incorrect information has been provided to the

Commercial & Farm Truck Division, you must contact the Secretary of State’s office immediately for instructions on how to

rectify the situation. Further documentation regarding incorrect odometer readings may be required.

• Mileage Weight Tax Registrations may NOT be transferred to any other vehicle already registered with Mileage Weight Tax

plates. Mileage Weight Tax Registrations may not be reclassed to any other type of registration during the registration year as

the election to display and operate upon Mileage Weight Tax Registration is binding for the entire registration period.

• Mileage Weight Tax Registrations are full-year fees and are not reduced by statute for any new purchase or election during

a registration period.

• Excess Mileage fees will be assessed when it is determined or reported that the statutory maximum allowable mileage has

been exceeded. It is the responsibility of the registrant to pay any excess fees when assessed. Fees are calculated using the

stated excess mileage rate based upon the registered weight.

Example: Excess Miles X Rate = Amount Due

MZ plate (80,000 pounds) traveled 7516 miles. Allowed 7000 miles, causing 516 in excess. (516 X .2750 = $141.90)

Mileage records are required to be kept for verification and audit purposes and registrations may be suspended or revoked

under provisions specified in the Illinois Vehicle Code 625 ILCS 5/3-704(9). The owner of the vehicle displaying Mileage Weight

Tax Registration must maintain mileage records on the specified vehicle, must file the required Mileage Weight Tax Reporting

Form in a timely manner, operate at all times with an operable odometer or hub-o-meter, and pay any and all excess mileage

fees when assessed. A daily record of ALL miles operated by the vehicle as well as records of fuel consumed and fuel purchases

for the vehicle are required. Records must be kept for a period of three years following the expiration of the license plate and

are subject to audit at any time during the registration or retention period. Inconsistencies found in audit or improper maintaining

of records may be subject to penalty and interest above and beyond fees already paid. (625 ILCS 5/3-818)

Any vehicle found with an inoperable odometer or hub-o-meter, or if the device has been disconnected or disabled, is subject

to immediate force registration to the Flat Weight Tax registration. All fees assessed must be paid by the offender. Further sus-

Printed by authority of the State of Illinois. February 2016 — 1 — CFT MT 14.25A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2