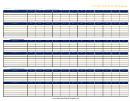

Cash Flow Statement Page 17

ADVERTISEMENT

MODULE - 6A

Cash Flow Statement

Analysis of Financial Statements

(ii) Proposed dividend

The dividend is always declared in the general meeting after the preparation

of Balance Sheet. It is therefore, a non-operating item which should not be

permitted to affect the calculation of cash generated by operating activities.

Thus, the amount of proposed dividends would be added back to current

Notes

years profit and payments made during the year in respect of dividends

would be shown as an outflow of cash.

(iii) Share Capital

The increase in share capital is regarded as inflow of cash only when there

is a increase in share capital. For example, if a company issues 10000 equity

shares of Rs.10 each for cash only, Rs. 100,000 would be shown as inflow

of cash from financing activities. Similarly, the redemption of preference

share is an outflow of cash. But where the share capital is issued to finance

the purchase of fixed assets or the debentures are converted into equity

shares there is no cash flow. Further, the issue of bonus shares does not

cause any cash flows.

(iv) Purchase or sale of fixed Assets

The figures appearing in the comparative balance sheets at two dates in

respect of fixed assets might indicate whether a particular fixed asset has

been purchased or sold during the year. This would enable to determine the

inflows or outflows of cash. For example, If the plant and machinery appears

at Rs 60,000 in the current year and Rs.50,000 in the previous year, the only

conclusion, in the absence of any other information is that there is a

purchase of fixed assets for Rs.10000 during the year. Hence, Rs.10000

would be shown as outflow of cash.

(v) Provision for Taxation

It is a non-operating expenses or an item of appropriation in the Income

statement/Profit and Loss Account and therefore should not be allowed to

reduce the cash provided from operating activities. Hence, if the profit is

given after tax and the amount of the provision for tax made during the year

is given, the same would be added back to the current year profit figure.

In the cash flow statement, the tax paid would be recorded separately as

an outflow of cash. The item of provision for taxation, would not be treated

as current assets.

Sometimes, the only information available about provision for taxation is

two figures appearing in the opening balance sheet and closing balance

78

ACCOUNTANCY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30