Cash Flow Statement Page 21

ADVERTISEMENT

MODULE - 6A

Cash Flow Statement

Analysis of Financial Statements

Solution

To solve this problem, one should find out the amount of provision for tax

charged to Profit and Loss Account in the year 2007.

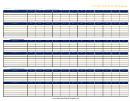

Provision for Taxation Account

Notes

Dr

Cr

Particulars

Amount

Particulars

Amount

Rs.

Rs.

Bank (payment)

40,000

Balance b/d

50000

Balance c/d

70000

Profit and loss A/c

60000

(Balances Figure)

110000

110,000

(i) Rs. 40000 is an outflow of cash

(ii) Cash provided from operating activities will be calculated as

Net Income after taxation

80000

Add: Provision for taxation treated as non-cash expense

60,000

140,000

Illustration 9

The following comparative balance sheets contain the relevant information

about provision for taxation.

Labilities

2006

2007

Rs.

Rs.

Provision for Taxation

20000

30000

You are informed that Rs. 50,000 was charged to Profit and Loss Account

for the year 2007. Ascertain how much cash was used.

Solution

Provision for Taxation Account

Dr

Cr

Particulars

Amount Particulars

Amount

Rs

Rs

Bank (Balancing figure)

40000 Balance b/d

20000

Balance c/d

30000 Profit and Loss Account

50000

70000

70000

82

ACCOUNTANCY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30