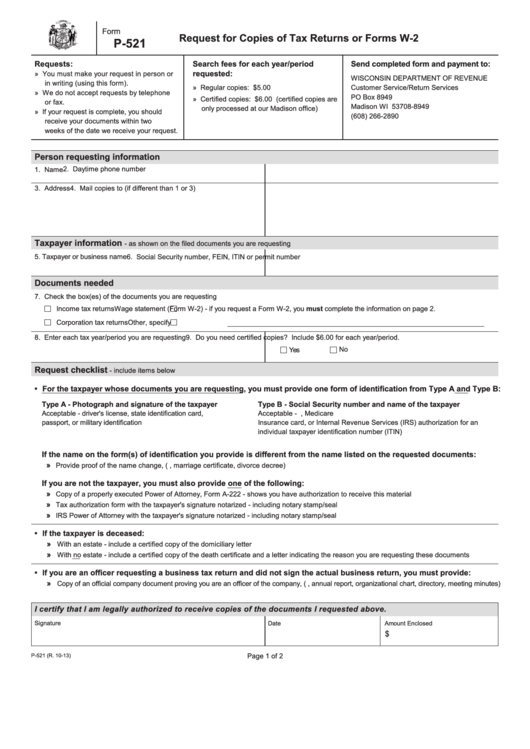

Form P-521 - Request For Copies Of Tax Returns Or Forms W-2

ADVERTISEMENT

Form

Request for Copies of Tax Returns or Forms W-2

P-521

Requests:

Search fees for each year/period

Send completed form and payment to:

requested:

» You must make your request in person or

WISCONSIN DEPARTMENT OF REVENUE

in writing (using this form).

» Regular copies:

$5.00

Customer Service/Return Services

» We do not accept requests by telephone

PO Box 8949

» Certified copies:

$6.00 (certified copies are

or fax.

Madison WI 53708-8949

only processed at our Madison office)

» If your request is complete, you should

(608) 266-2890

receive your documents within two

weeks of the date we receive your request.

Person requesting information

2. Daytime phone number

1. Name

3. Address

4. Mail copies to (if different than 1 or 3)

Taxpayer information

- as shown on the filed documents you are requesting

5. Taxpayer or business name

6. Social Security number, FEIN, ITIN or permit number

Documents needed

7. Check the box(es) of the documents you are requesting

Income tax returns

Wage statement (Form W-2) - if you request a Form W-2, you must complete the information on page 2.

Corporation tax returns

Other, specify

8. Enter each tax year/period you are requesting

9. Do you need certified copies? Include $6.00 for each year/period.

No

Yes

Request checklist

- include items below

• For the taxpayer whose documents you are requesting, you must provide one form of identification from Type A and Type B:

Type A - Photograph and signature of the taxpayer

Type B - Social Security number and name of the taxpayer

Acceptable - driver's license, state identification card,

Acceptable - U.S. Government issued Social Security card, Medicare

passport, or military identification

Insurance card, or Internal Revenue Services (IRS) authorization for an

individual taxpayer identification number (ITIN)

If the name on the form(s) of identification you provide is different from the name listed on the requested documents:

»

Provide proof of the name change, (e.g., marriage certificate, divorce decree)

If you are not the taxpayer, you must also provide one of the following:

»

Copy of a properly executed Power of Attorney, Form A-222 - shows you have authorization to receive this material

»

Tax authorization form with the taxpayer's signature notarized - including notary stamp/seal

»

IRS Power of Attorney with the taxpayer's signature notarized - including notary stamp/seal

• If the taxpayer is deceased:

»

With an estate - include a certified copy of the domiciliary letter

»

With no estate - include a certified copy of the death certificate and a letter indicating the reason you are requesting these documents

• If you are an officer requesting a business tax return and did not sign the actual business return, you must provide:

»

Copy of an official company document proving you are an officer of the company, (e.g., annual report, organizational chart, directory, meeting minutes)

I certify that I am legally authorized to receive copies of the documents I requested above.

Signature

Date

Amount Enclosed

$

Page 1 of 2

P-521 (R. 10-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2