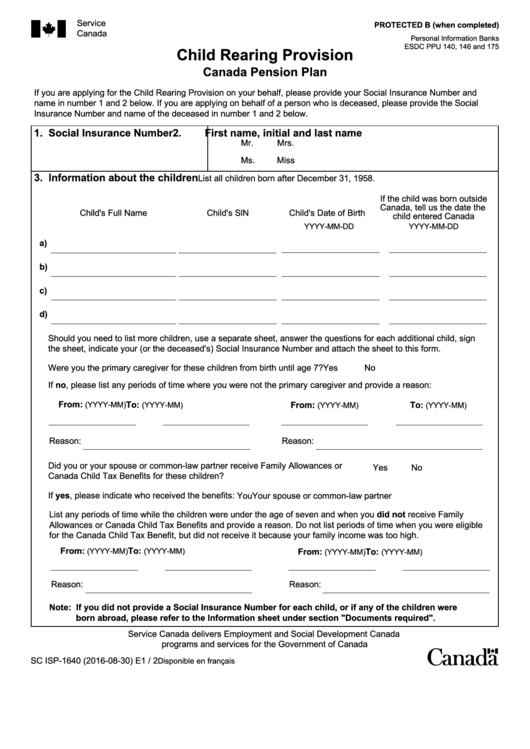

Service

PROTECTED B (when completed)

Canada

Personal Information Banks

ESDC PPU 140, 146 and 175

Child Rearing Provision

Canada Pension Plan

If you are applying for the Child Rearing Provision on your behalf, please provide your Social Insurance Number and

name in number 1 and 2 below. If you are applying on behalf of a person who is deceased, please provide the Social

Insurance Number and name of the deceased in number 1 and 2 below.

1. Social Insurance Number

2.

First name, initial and last name

Mr.

Mrs.

Ms.

Miss

3. Information about the children

List all children born after December 31, 1958.

If the child was born outside

Canada, tell us the date the

Child's Full Name

Child's SlN

Child's Date of Birth

child entered Canada

YYYY-MM-DD

YYYY-MM-DD

a)

b)

c)

d)

Should you need to list more children, use a separate sheet, answer the questions for each additional child, sign

the sheet, indicate your (or the deceased's) Social Insurance Number and attach the sheet to this form.

Were you the primary caregiver for these children from birth until age 7?

Yes

No

If no, please list any periods of time where you were not the primary caregiver and provide a reason:

From:

To:

From:

To:

(YYYY-MM)

(YYYY-MM)

(YYYY-MM)

(YYYY-MM)

Reason:

Reason:

Did you or your spouse or common-law partner receive Family Allowances or

Yes

No

Canada Child Tax Benefits for these children?

If yes, please indicate who received the benefits:

You

Your spouse or common-law partner

List any periods of time while the children were under the age of seven and when you did not receive Family

Allowances or Canada Child Tax Benefits and provide a reason. Do not list periods of time when you were eligible

for the Canada Child Tax Benefit, but did not receive it because your family income was too high.

From:

To:

From:

To:

(YYYY-MM)

(YYYY-MM)

(YYYY-MM)

(YYYY-MM)

Reason:

Reason:

Note: If you did not provide a Social Insurance Number for each child, or if any of the children were

born abroad, please refer to the Information sheet under section "Documents required".

Service Canada delivers Employment and Social Development Canada

programs and services for the Government of Canada

SC ISP-1640 (2016-08-30) E

1 / 2

Disponible en français

1

1 2

2 3

3