Financial Statement Analysis

ADVERTISEMENT

15

Financial Statement

Analysis

How can we use the

financial statement results

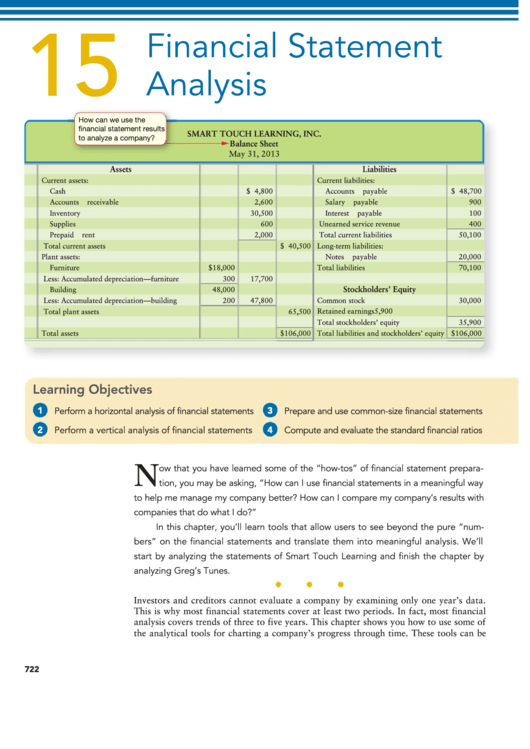

SMART TOUCH LEARNING, INC.

to analyze a company?

Balance Sheet

May 31, 2013

Assets

Liabilities

Current assets:

Current liabilities:

Cash

$ 4,800

Accounts payable

$ 48,700

Accounts receivable

2,600

Salary payable

900

Inventory

30,500

Interest payable

100

Supplies

600

Unearned service revenue

400

Prepaid rent

2,000

Total current liabilities

50,100

Total current assets

$ 40,500

Long-term liabilities:

Plant assets:

Notes payable

20,000

Furniture

$18,000

Total liabilities

70,100

Less: Accumulated depreciation—furniture

300

17,700

Stockholders’ Equity

Building

48,000

Less: Accumulated depreciation—building

47,800

200

Common stock

30,000

Retained earnings

5,900

Total plant assets

65,500

Total stockholders’ equity

35,900

Total assets

$106,000

Total liabilities and stockholders’ equity

$106,000

Learning Objectives

1

Perform a horizontal analysis of financial statements

3

Prepare and use common-size financial statements

2

4

Perform a vertical analysis of financial statements

Compute and evaluate the standard financial ratios

N

ow that you have learned some of the “how-tos” of financial statement prepara-

tion, you may be asking, “How can I use financial statements in a meaningful way

to help me manage my company better? How can I compare my company’s results with

companies that do what I do?”

In this chapter, you’ll learn tools that allow users to see beyond the pure “num-

bers” on the financial statements and translate them into meaningful analysis. We’ll

start by analyzing the statements of Smart Touch Learning and finish the chapter by

analyzing Greg’s Tunes.

Investors and creditors cannot evaluate a company by examining only one year’s data.

This is why most financial statements cover at least two periods. In fact, most financial

analysis covers trends of three to five years. This chapter shows you how to use some of

the analytical tools for charting a company’s progress through time. These tools can be

722

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51