L

A

O A N

G R E E M E N T

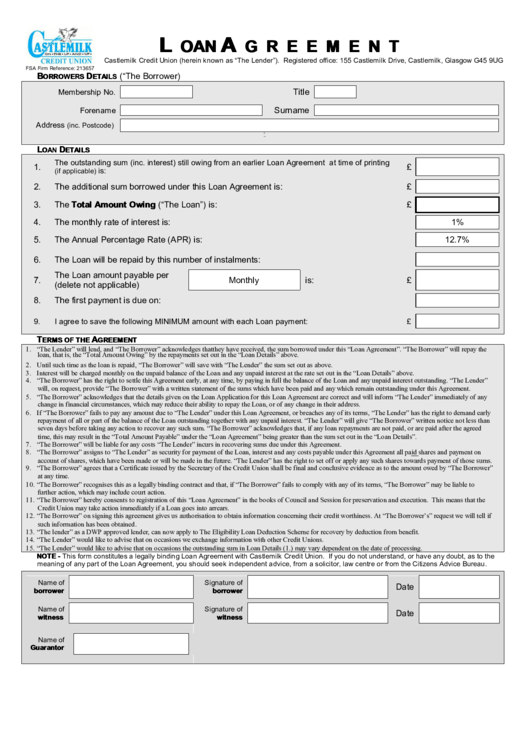

Castlemilk Credit Union (herein known as “The Lender”). Registered office: 155 Castlemilk Drive, Castlemilk, Glasgow G45 9UG

FSA Firm Reference: 213657

(“The Borrower)

B

D

ORROWERS

ETAILS

Title

Membership No.

Forename

Surname

Address

(inc. Postcode)

A

rn

L

D

OAN

ETAILS

The outstanding sum (inc. interest) still owing from an earlier Loan Agreement at time of printing

1.

£

is:

(if applicable)

2.

The additional sum borrowed under this Loan Agreement is:

£

The Total Amount Owing (“The Loan”) is:

3.

£

4.

The monthly rate of interest is:

1%

5.

The Annual Percentage Rate (APR) is:

12.7%

6.

The Loan will be repaid by this number of instalments:

The Loan amount payable per

7.

Monthly

is:

£

(delete not applicable)

8.

The first payment is due on:

9.

I agree to save the following MINIMUM amount with each Loan payment:

£

T

A

ERMS OF THE

GREEMENT

1. “The Lender” will lend, and “The Borrower” acknowledges that they have received, the sum borrowed under this “Loan Agreement”. “The Borrower” will repay the

loan, that is, the “Total Amount Owing” by the repayments set out in the “Loan Details” above.

2. Until such time as the loan is repaid, “The Borrower” will save with “The Lender” the sum set out as above.

3. Interest will be charged monthly on the unpaid balance of the Loan and any unpaid interest at the rate set out in the “Loan Details” above.

4. “The Borrower” has the right to settle this Agreement early, at any time, by paying in full the balance of the Loan and any unpaid interest outstanding. “The Lender”

will, on request, provide “The Borrower” with a written statement of the sums which have been paid and any which remain outstanding under this Agreement.

5. “The Borrower” acknowledges that the details given on the Loan Application for this Loan Agreement are correct and will inform “The Lender” immediately of any

change in financial circumstances, which may reduce their ability to repay the Loan, or of any change in their address.

6. If “The Borrower” fails to pay any amount due to “The Lender” under this Loan Agreement, or breaches any of its terms, “The Lender” has the right to demand early

repayment of all or part of the balance of the Loan outstanding together with any unpaid interest. “The Lender” will give “The Borrower” written notice not less than

seven days before taking any action to recover any such sum. “The Borrower” acknowledges that, if any loan repayments are not paid, or are paid after the agreed

time, this may result in the “Total Amount Payable” under the “Loan Agreement” being greater than the sum set out in the “Loan Details”.

7. “The Borrower” will be liable for any costs “The Lender” incurs in recovering sums due under this Agreement.

8. “The Borrower” assigns to “The Lender” as security for payment of the Loan, interest and any costs payable under this Agreement all paid shares and payment on

account of shares, which have been made or will be made in the future. “The Lender” has the right to set off or apply any such shares towards payment of those sums.

9. “The Borrower” agrees that a Certificate issued by the Secretary of the Credit Union shall be final and conclusive evidence as to the amount owed by “The Borrower”

at any time.

10. “The Borrower” recognises this as a legally binding contract and that, if “The Borrower” fails to comply with any of its terms, “The Borrower” may be liable to

further action, which may include court action.

11. “The Borrower” hereby consents to registration of this “Loan Agreement” in the books of Council and Session for preservation and execution. This means that the

Credit Union may take action immediately if a Loan goes into arrears.

12. “The Borrower” on signing this agreement gives us authorisation to obtain information concerning their credit worthiness. At “The Borrower’s” request we will tell if

such information has been obtained.

13. “The lender” as a DWP approved lender, can now apply to The Eligibility Loan Deduction Scheme for recovery by deduction from benefit.

14. “The Lender” would like to advise that on occasions we exchange information with other Credit Unions.

15. “The Lender” would like to advise that on occasions the outstanding sum in Loan Details (1.) may vary dependent on the date of processing.

NOTE - This form constitutes a legally binding Loan Agreement with Castlemilk Credit Union. If you do not understand, or have any doubt, as to the

meaning of any part of the Loan Agreement, you should seek independent advice, from a solicitor, law centre or from the Citizens Advice Bureau.

Name of

Signature of

Date

borrower

borrower

Name of

Signature of

Date

witness

witness

Name of

Guarantor

1

1