Instructions For Form 1098 - 2013

ADVERTISEMENT

2013

Department of the Treasury

Internal Revenue Service

Instructions for Form 1098

Mortgage Interest Statement

Section references are to the Internal Revenue Code unless

individual, including a sole proprietor. Report only interest on a

otherwise noted.

mortgage defined later.

Future Developments

The $600 threshold applies separately to each mortgage; thus,

file a separate Form 1098 for each mortgage. You may, at your

For the latest information about developments related to Form 1098

option, file Form 1098 to report mortgage interest of less than $600,

and its instructions, such as legislation enacted after they were

but if you do, you are subject to the rules in these instructions.

published, go to

If an overpayment of interest on an adjustable rate mortgage

What's New

(ARM) or other mortgage was made in a prior year and you refund

(or credit) that overpayment, you may have to file Form 1098 to

report the refund (or credit) of the overpayment. See

Truncating payer's/borrower's identification number on paper

Reimbursement of Overpaid Interest later.

payee statements. Pursuant to proposed regulations §§

1.6042-4(b) and 301.6109-4 (REG-148873-09), all filers of this form

Exceptions

may truncate a payer's/borrower's identification number (social

security number (SSN), individual taxpayer identification number

You need not file Form 1098 for interest received from a corporation,

(ITIN), or adoption taxpayer identification number (ATIN)) on payee

partnership, trust, estate, association, or company (other than a sole

statements. See part M in the 2013 General Instructions for Certain

proprietor) even if an individual is a co-borrower and all the trustees,

Information Returns.

beneficiaries, partners, members, or shareholders of the payer of

record are individuals.

Mortgage Insurance Premiums. IRC 163(h)(3)(E) has been

extended through December 31, 2013. Report mortgage insurance

Mortgage Defined

premiums in box 4.

A mortgage is any obligation secured by real property. Use the table

Reminder

below to determine which obligations are mortgages.

General Instructions. In addition to these specific instructions, you

Real property is land and generally anything built on it, growing

should also use the 2013 General Instructions for Certain

on it, or attached to the land. Among other things, real property

Information Returns. Those general instructions include information

includes a manufactured home with a minimum living space of 400

about the following topics.

square feet and a minimum width of more than 102 inches and

which is of a kind customarily used at a fixed location. See section

Backup withholding.

25(e)(10).

Electronic reporting requirements.

Penalties.

If property that secures the loan is not real property, you are not

Who must file (nominee/middleman).

required to file Form 1098. However, the borrower may be entitled to

When and where to file.

a deduction for qualified residence interest, such as may be the

Taxpayer identification numbers.

case for a boat, which has sleeping space and cooking and toilet

Statements to recipients.

facilities, that the borrower uses as a home.

Corrected and void returns.

Lines of credit and credit card obligations. Interest (other than

Other general topics.

points) received on any mortgage that is in the form of a line of credit

You can get the general instructions at

or

or credit card obligation is reportable regardless of how you

by calling 1-800-TAX-FORM (1-800-829-3676).

classified the obligation. A borrower incurs a line of credit or credit

card obligation when the borrower first has the right to borrow

Specific Instructions

against the line of credit or credit card, whether or not the borrower

actually borrows an amount at that time.

Use Form 1098, Mortgage Interest Statement, to report mortgage

Who Must File

interest (including points, defined later) of $600 or more received by

you during the year in the course of your trade or business from an

File this form if you are engaged in a trade or business and, in the

course of such trade or business, you receive from an individual

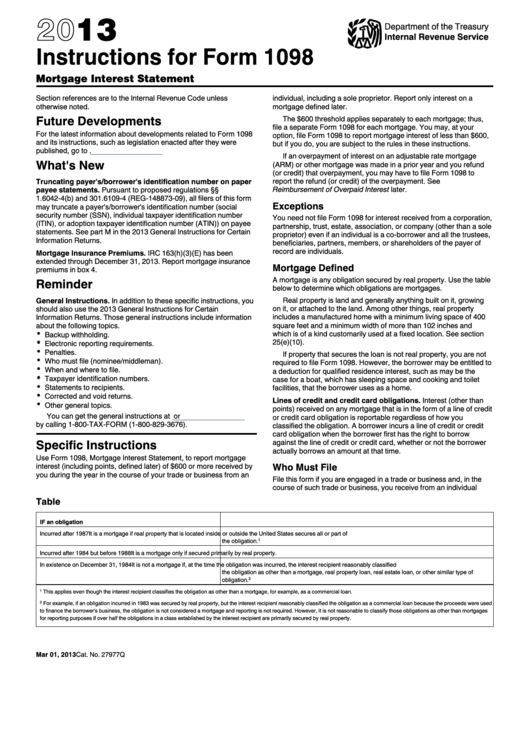

Table

IF an obligation is...

THEN...

Incurred after 1987

It is a mortgage if real property that is located inside or outside the United States secures all or part of

the obligation.

1

Incurred after 1984 but before 1988

It is a mortgage only if secured primarily by real property.

In existence on December 31, 1984

It is not a mortgage if, at the time the obligation was incurred, the interest recipient reasonably classified

the obligation as other than a mortgage, real property loan, real estate loan, or other similar type of

obligation.

2

This applies even though the interest recipient classifies the obligation as other than a mortgage, for example, as a commercial loan.

1

For example, if an obligation incurred in 1983 was secured by real property, but the interest recipient reasonably classified the obligation as a commercial loan because the proceeds were used

2

to finance the borrower's business, the obligation is not considered a mortgage and reporting is not required. However, it is not reasonable to classify those obligations as other than mortgages

for reporting purposes if over half the obligations in a class established by the interest recipient are primarily secured by real property.

Mar 01, 2013

Cat. No. 27977Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4