Standard Transfer Form - Computershare Investor Services Pty Limited

ADVERTISEMENT

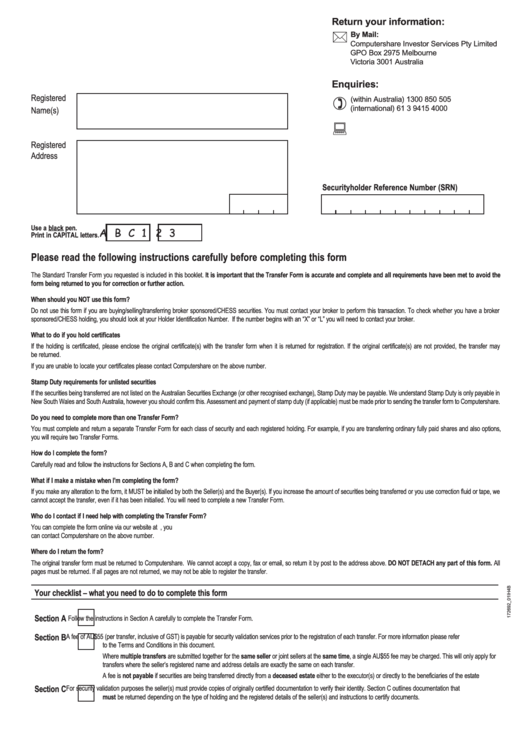

Return your information:

By Mail:

Computershare Investor Services Pty Limited

GPO Box 2975 Melbourne

Victoria 3001 Australia

Enquiries:

Registered

(within Australia) 1300 850 505

(international) 61 3 9415 4000

Name(s)

Registered

Address

Securityholder Reference Number (SRN)

Use a black pen.

A B C

1 2 3

Print in CAPITAL letters.

Please read the following instructions carefully before completing this form

The Standard Transfer Form you requested is included in this booklet. It is important that the Transfer Form is accurate and complete and all requirements have been met to avoid the

form being returned to you for correction or further action.

When should you NOT use this form?

Do not use this form if you are buying/selling/transferring broker sponsored/CHESS securities. You must contact your broker to perform this transaction. To check whether you have a broker

sponsored/CHESS holding, you should look at your Holder Identification Number. If the number begins with an “X” or “L” you will need to contact your broker.

What to do if you hold certificates

If the holding is certificated, please enclose the original certificate(s) with the transfer form when it is returned for registration. If the original certificate(s) are not provided, the transfer may

be returned.

If you are unable to locate your certificates please contact Computershare on the above number.

Stamp Duty requirements for unlisted securities

If the securities being transferred are not listed on the Australian Securities Exchange (or other recognised exchange), Stamp Duty may be payable. We understand Stamp Duty is only payable in

New South Wales and South Australia, however you should confirm this. Assessment and payment of stamp duty (if applicable) must be made prior to sending the transfer form to Computershare.

Do you need to complete more than one Transfer Form?

You must complete and return a separate Transfer Form for each class of security and each registered holding. For example, if you are transferring ordinary fully paid shares and also options,

you will require two Transfer Forms.

How do I complete the form?

Carefully read and follow the instructions for Sections A, B and C when completing the form.

What if I make a mistake when I’m completing the form?

If you make any alteration to the form, it MUST be initialled by both the Seller(s) and the Buyer(s). If you increase the amount of securities being transferred or you use correction fluid or tape, we

cannot accept the transfer, even if it has been initialled. You will need to complete a new Transfer Form.

Who do I contact if I need help with completing the Transfer Form?

You can complete the form online via our website at by clicking on Forms. Our electronic transfer form will guide you through the process step by step. Alternatively, you

can contact Computershare on the above number.

Where do I return the form?

The original transfer form must be returned to Computershare. We cannot accept a copy, fax or email, so return it by post to the address above. DO NOT DETACH any part of this form. All

pages must be returned. If all pages are not returned, we may not be able to register the transfer.

Your checklist – what you need to do to complete this form

Section A

Follow the instructions in Section A carefully to complete the Transfer Form.

Section B

A fee of AU$55 (per transfer, inclusive of GST) is payable for security validation services prior to the registration of each transfer. For more information please refer

to the Terms and Conditions in this document.

Where multiple transfers are submitted together for the same seller or joint sellers at the same time, a single AU$55 fee may be charged. This will only apply for

transfers where the seller’s registered name and address details are exactly the same on each transfer.

A fee is not payable if securities are being transferred directly from a deceased estate either to the executor(s) or directly to the beneficiaries of the estate

Section C

For security validation purposes the seller(s) must provide copies of originally certified documentation to verify their identity. Section C outlines documentation that

must be returned depending on the type of holding and the registered details of the seller(s) and instructions to certify documents.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4