Irs Form 1099-S - Certification Exemption Form

ADVERTISEMENT

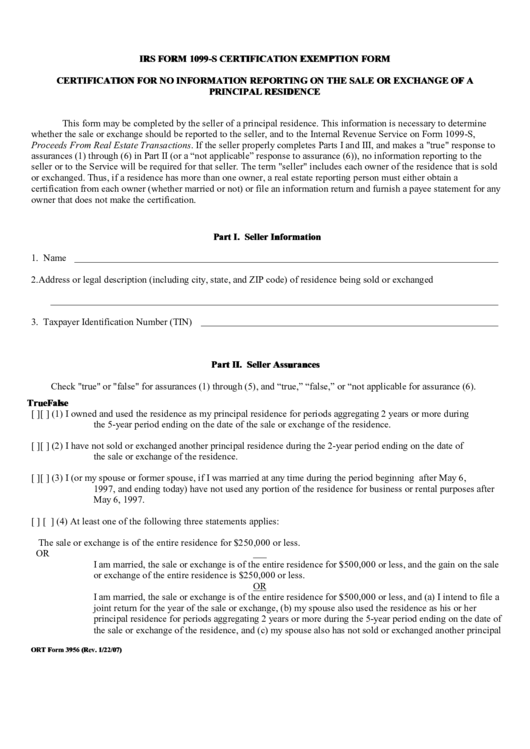

IRS FORM 1099-S CERTIFICATION EXEMPTION FORM

CERTIFICATION FOR NO INFORMATION REPORTING ON THE SALE OR EXCHANGE OF A

PRINCIPAL RESIDENCE

This form may be completed by the seller of a principal residence. This information is necessary to determine

whether the sale or exchange should be reported to the seller, and to the Internal Revenue Service on Form 1099-S,

Proceeds From Real Estate Transactions. If the seller properly completes Parts I and III, and makes a "true" response to

assurances (1) through (6) in Part II (or a “not applicable” response to assurance (6)), no information reporting to the

seller or to the Service will be required for that seller. The term "seller" includes each owner of the residence that is sold

or exchanged. Thus, if a residence has more than one owner, a real estate reporting person must either obtain a

certification from each owner (whether married or not) or file an information return and furnish a payee statement for any

owner that does not make the certification.

Part I. Seller Information

1.

Name

2.

Address or legal description (including city, state, and ZIP code) of residence being sold or exchanged

3.

Taxpayer Identification Number (TIN)

Part II. Seller Assurances

Check "true" or "false" for assurances (1) through (5), and “true,” “false,” or “not applicable for assurance (6).

True False

[ ]

[ ]

(1) I owned and used the residence as my principal residence for periods aggregating 2 years or more during

the 5-year period ending on the date of the sale or exchange of the residence.

[ ]

[ ]

(2) I have not sold or exchanged another principal residence during the 2-year period ending on the date of

the sale or exchange of the residence.

[ ]

[ ]

(3) I (or my spouse or former spouse, if I was married at any time during the period beginning after May 6,

1997, and ending today) have not used any portion of the residence for business or rental purposes after

May 6, 1997.

[ ]

[ ] (4) At least one of the following three statements applies:

The sale or exchange is of the entire residence for $250,000 or less.

OR

I am married, the sale or exchange is of the entire residence for $500,000 or less, and the gain on the sale

or exchange of the entire residence is $250,000 or less.

OR

I am married, the sale or exchange is of the entire residence for $500,000 or less, and (a) I intend to file a

joint return for the year of the sale or exchange, (b) my spouse also used the residence as his or her

principal residence for periods aggregating 2 years or more during the 5-year period ending on the date of

the sale or exchange of the residence, and (c) my spouse also has not sold or exchanged another principal

ORT Form 3956 (Rev. 1/22/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2