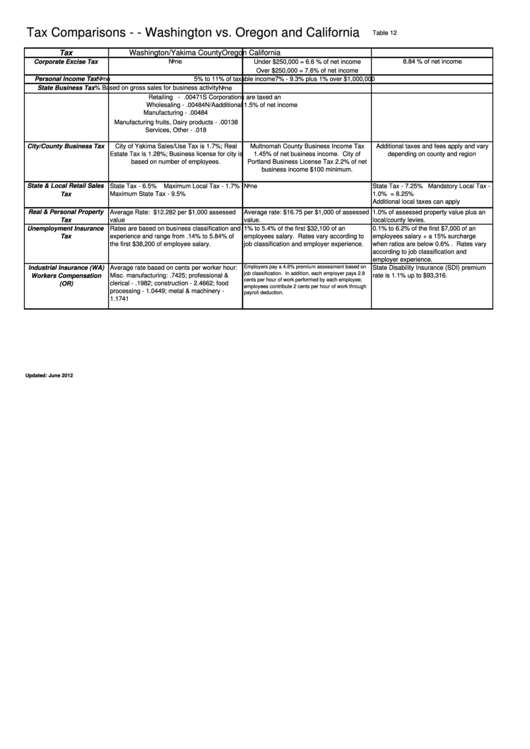

Tax Comparison Chart - Washington Vs. Oregon And California - 2012

ADVERTISEMENT

Tax Comparisons - - Washington vs. Oregon and California

Table 12

Tax

Washington/Yakima County

Oregon

California

Corporate Excise Tax

None

Under $250,000 = 6.6 % of net income

8.84 % of net income

Over $250,000 = 7.6% of net income

None

5% to 11% of taxable income

7% - 9.3% plus 1% over $1,000,000

Personal Income Tax

% Based on gross sales for business activity

State Business Tax

None

Retailing - .00471

S Corporations are taxed an

Wholesaling - .00484

N/A

additional 1.5% of net income

Manufacturing - .00484

Manufacturing fruits, Dairy products - .00138

Services, Other - .018

City/County Business Tax

City of Yakima Sales/Use Tax is 1.7%; Real

Multnomah County Business Income Tax

Additional taxes and fees apply and vary

Estate Tax is 1.28%; Business license for city is

1.45% of net business income. City of

depending on county and region

based on number of employees.

Portland Business License Tax 2.2% of net

business income $100 minimum.

State & Local Retail Sales

State Tax - 6.5%

Maximum Local Tax - 1.7%

None

State Tax - 7.25% Mandatory Local Tax -

Maximum State Tax - 9.5%

1.0% = 8.25%

Tax

Additional local taxes can apply

Real & Personal Property

Average Rate: $12.282 per $1,000 assessed

Average rate: $16.75 per $1,000 of assessed

1.0% of assessed property value plus an

Tax

value

value.

local/county levies.

Unemployment Insurance

Rates are based on business classification and

1% to 5.4% of the first $32,100 of an

0.1% to 6.2% of the first $7,000 of an

Tax

experience and range from .14% to 5.84% of

employees salary. Rates vary according to

employees salary + a 15% surcharge

the first $38,200 of employee salary.

job classification and employer experience.

when ratios are below 0.6% . Rates vary

according to job classification and

employer experience.

Average rate based on cents per worker hour:

Employers pay a 4.6% premium assessment based on

State Disability Insurance (SDI) premium

Industrial Insurance (WA)

job classification. In addition, each employer pays 2.8

Misc. manufacturing: .7425; professional &

rate is 1.1% up to $93,316.

Workers Compensation

cents per hour of work performed by each employee;

clerical - .1982; construction - 2.4662; food

(OR)

employees contribute 2 cents per hour of work through

processing - 1.0449; metal & machinery -

payroll deduction.

1.1741

Updated: June 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1