Property Tax Notice Of Protest

Download a blank fillable Property Tax Notice Of Protest in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Property Tax Notice Of Protest with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

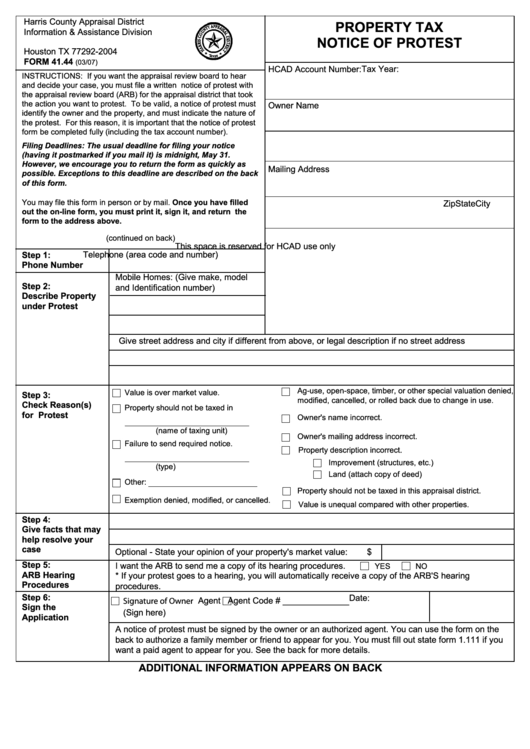

Harris County Appraisal District

PROPERTY TAX

Information & Assistance Division

NOTICE OF PROTEST

P.O. Box 922004

Houston TX 77292-2004

FORM 41.44

(03/07)

HCAD Account Number:

Tax Year:

INSTRUCTIONS: If you want the appraisal review board to hear

and decide your case, you must file a written notice of protest with

the appraisal review board (ARB) for the appraisal district that took

the action you want to protest. To be valid, a notice of protest must

Owner Name

identify the owner and the property, and must indicate the nature of

the protest. For this reason, it is important that the notice of protest

form be completed fully (including the tax account number).

Filing Deadlines: The usual deadline for filing your notice

(having it postmarked if you mail it) is midnight, May 31.

However, we encourage you to return the form as quickly as

Mailing Address

possible. Exceptions to this deadline are described on the back

of this form.

You may file this form in person or by mail. Once you have filled

City

State

Zip

out the on-line form, you must print it, sign it, and return the

form to the address above.

(continued on back)

This space is reserved for HCAD use only

Telephone (area code and number)

Step 1:

Phone Number

Mobile Homes: (Give make, model

Step 2:

and Identification number)

Describe Property

under Protest

Give street address and city if different from above, or legal description if no street address

Ag-use, open-space, timber, or other special valuation denied,

Value is over market value.

Step 3:

modified, cancelled, or rolled back due to change in use.

Check Reason(s)

Property should not be taxed in

for Protest

Owner's name incorrect.

(name of taxing unit)

Owner's mailing address incorrect.

Failure to send required notice.

Property description incorrect.

Improvement (structures, etc.)

(type)

Land (attach copy of deed)

Other:

Property should not be taxed in this appraisal district.

Exemption denied, modified, or cancelled.

Value is unequal compared with other properties.

Step 4:

Give facts that may

help resolve your

case

Optional - State your opinion of your property's market value:

$

Step 5:

I want the ARB to send me a copy of its hearing procedures.

YES

NO

ARB Hearing

* If your protest goes to a hearing, you will automatically receive a copy of the ARB'S hearing

Procedures

procedures.

Step 6:

Date:

Agent Agent Code # ______________

Signature of Owner

Sign the

(Sign here)

Application

A notice of protest must be signed by the owner or an authorized agent. You can use the form on the

back to authorize a family member or friend to appear for you. You must fill out state form 1.111 if you

want a paid agent to appear for you. See the back for more details.

ADDITIONAL INFORMATION APPEARS ON BACK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2