Retirement Needs Worksheet

Download a blank fillable Retirement Needs Worksheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Retirement Needs Worksheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

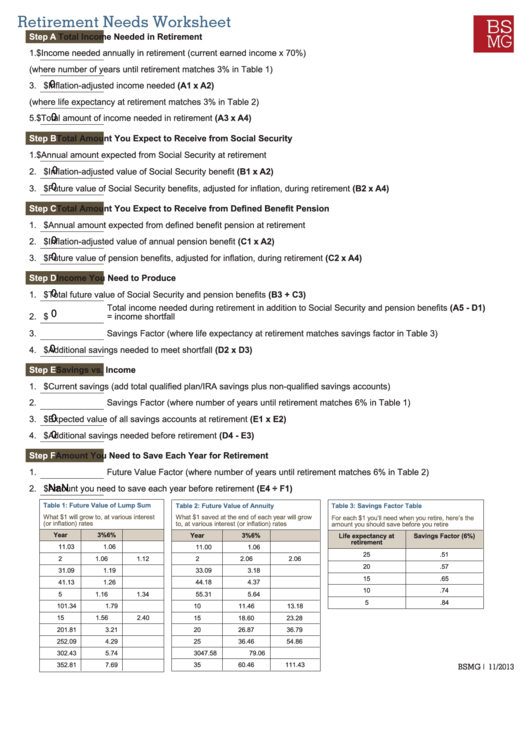

Retirement Needs Worksheet

Step A

Total Income Needed in Retirement

1. $

Income needed annually in retirement (current earned income x 70%)

2.

Growth Factor (where number of years until retirement matches 3% in Table 1)

3. $

0

Inflation-adjusted income needed (A1 x A2)

4.

Future Value Factor (where life expectancy at retirement matches 3% in Table 2)

5. $

Total amount of income needed in retirement (A3 x A4)

0

Step B

Total Amount You Expect to Receive from Social Security

1. $

Annual amount expected from Social Security at retirement

2. $

0

Inflation-adjusted value of Social Security benefit (B1 x A2)

0

Future value of Social Security benefits, adjusted for inflation, during retirement (B2 x A4)

3. $

Step C

Total Amount You Expect to Receive from Defined Benefit Pension

1. $

Annual amount expected from defined benefit pension at retirement

Inflation-adjusted value of annual pension benefit (C1 x A2)

2. $

0

Future value of pension benefits, adjusted for inflation, during retirement (C2 x A4)

3. $

0

Step D

Income You Need to Produce

1. $

0

Total future value of Social Security and pension benefits (B3 + C3)

Total income needed during retirement in addition to Social Security and pension benefits (A5 - D1)

0

2. $

= income shortfall

3.

Savings Factor (where life expectancy at retirement matches savings factor in Table 3)

4. $

Additional savings needed to meet shortfall (D2 x D3)

0

Step E

Savings vs. Income

1. $

Current savings (add total qualified plan/IRA savings plus non-qualified savings accounts)

2.

Savings Factor (where number of years until retirement matches 6% in Table 1)

3. $

Expected value of all savings accounts at retirement (E1 x E2)

0

4. $

Additional savings needed before retirement (D4 - E3)

0

Step F

Amount You Need to Save Each Year for Retirement

1.

Future Value Factor (where number of years until retirement matches 6% in Table 2)

2. $

Amount you need to save each year before retirement (E4 ÷ F1)

Table 1: Future Value of Lump Sum

Table 2: Future Value of Annuity

Table 3: Savings Factor Table

What $1 will grow to, at various interest

What $1 saved at the end of each year will grow

For each $1 you’ll need when you retire, here’s the

(or inflation) rates

to, at various interest (or inflation) rates

amount you should save before you retire

Year

3%

6%

Year

3%

6%

Life expectancy at

Savings Factor (6%)

retirement

1

1.03

1.06

1

1.00

1.06

25

.51

2

2.06

2.06

2

1.06

1.12

20

.57

3

1.09

1.19

3

3.09

3.18

15

.65

4

1.13

1.26

4

4.18

4.37

10

.74

5

1.16

1.34

5

5.31

5.64

5

.84

10

1.34

1.79

10

11.46

13.18

15

1.56

2.40

15

18.60

23.28

20

1.81

3.21

20

26.87

36.79

25

2.09

4.29

25

36.46

54.86

30

2.43

5.74

30

47.58

79.06

35

2.81

7.69

35

60.46

111.43

BSMG | 11/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1