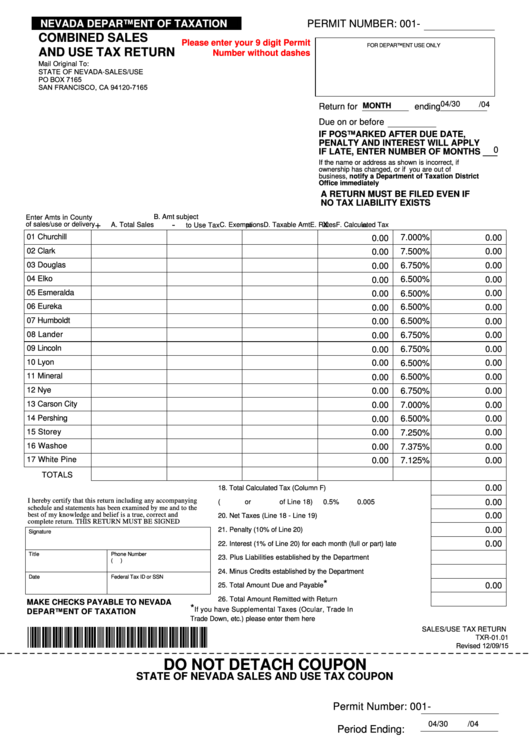

NEVADA DEPARTMENT OF TAXATION

PERMIT NUMBER: 001-

COMBINED SALES

Please enter your 9 digit Permit

FOR DEPARTMENT USE ONLY

AND USE TAX RETURN

Number without dashes

Mail Original To:

STATE OF NEVADA-SALES/USE

PO BOX 7165

SAN FRANCISCO, CA 94120-7165

04/30

/04

MONTH

Return for

ending

Due on or before

IF POSTMARKED AFTER DUE DATE,

PENALTY AND INTEREST WILL APPLY

0

IF LATE, ENTER NUMBER OF MONTHS ___

If the name or address as shown is incorrect, if

ownership has changed, or if you are out of

business, notify a Department of Taxation District

Office immediately

A RETURN MUST BE FILED EVEN IF

NO TAX LIABILITY EXISTS

B. Amt subject

Enter Amts in County

x

+

-

=

=

of sales/use or delivery

A. Total Sales

C. Exemptions

D. Taxable Amt

E. Rates

F. Calculated Tax

to Use Tax

01 Churchill

0.00

0.00

7.000%

02 Clark

0.00

0.00

7.500%

03 Douglas

6.750%

0.00

0.00

04 Elko

6.500%

0.00

0.00

05 Esmeralda

6.500%

0.00

0.00

06 Eureka

6.500%

0.00

0.00

07 Humboldt

6.500%

0.00

0.00

08 Lander

6.750%

0.00

0.00

09 Lincoln

6.750%

0.00

0.00

10 Lyon

6.500%

0.00

0.00

11 Mineral

6.500%

0.00

0.00

12 Nye

6.750%

0.00

0.00

13 Carson City

7.000%

0.00

0.00

14 Pershing

6.500%

0.00

0.00

15 Storey

7.250%

0.00

0.00

16 Washoe

7.375%

0.00

0.00

17 White Pine

7.125%

0.00

0.00

TOTALS

0.00

18. Total Calculated Tax (Column F)

I hereby certify that this return including any accompanying

0.00

19. Enter Collection Allowance (

0.5%

or

0.005

of Line 18)

schedule and statements has been examined by me and to the

best of my knowledge and belief is a true, correct and

0.00

20. Net Taxes (Line 18 - Line 19)

complete return. THIS RETURN MUST BE SIGNED

0.00

21. Penalty (10% of Line 20)

Signature

0.00

22. Interest (1% of Line 20) for each month (full or part) late

Title

Phone Number

23. Plus Liabilities established by the Department

(

)

24. Minus Credits established by the Department

Date

Federal Tax ID or SSN

*

25. Total Amount Due and Payable

0.00

26. Total Amount Remitted with Return

MAKE CHECKS PAYABLE TO NEVADA

*

If you have Supplemental Taxes (Ocular, Trade In

DEPARTMENT OF TAXATION

Trade Down, etc.) please enter them here

*001043004000000*

SALES/USE TAX RETURN

TXR-01.01

Revised 12/09/15

DO NOT DETACH COUPON

STATE OF NEVADA SALES AND USE TAX COUPON

Permit Number: 001-

04/30

/04

Period Ending:

TOTAL AMOUNT DUE

STATE OF NEVADA SALES/USE

0.00

P.O. BOX 52609

PHOENIX AZ 85072-2609

1

1 2

2