Deductions For Business Tax Form - Nashville Clerk

ADVERTISEMENT

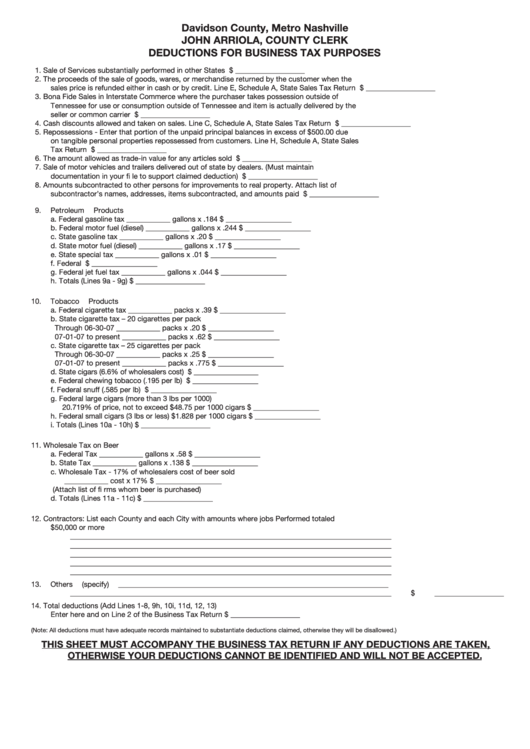

Davidson County, Metro Nashville

JOHN ARRIOLA, COUNTY CLERK

DEDUCTIONS FOR BUSINESS TAX PURPOSES

1.

Sale of Services substantially performed in other States ........................................................................ $ ___________________

2.

The proceeds of the sale of goods, wares, or merchandise returned by the customer when the

sales price is refunded either in cash or by credit. Line E, Schedule A, State Sales Tax Return ............ $ ___________________

3.

Bona Fide Sales in Interstate Commerce where the purchaser takes possession outside of

Tennessee for use or consumption outside of Tennessee and item is actually delivered by the

seller or common carrier .......................................................................................................................... $ ___________________

4.

Cash discounts allowed and taken on sales. Line C, Schedule A, State Sales Tax Return .................... $ ___________________

5.

Repossessions - Enter that portion of the unpaid principal balances in excess of $500.00 due

on tangible personal properties repossessed from customers. Line H, Schedule A, State Sales

Tax Return ................................................................................................................................................ $ ___________________

6.

The amount allowed as trade-in value for any articles sold .................................................................... $ ___________________

7.

Sale of motor vehicles and trailers delivered out of state by dealers. (Must maintain

documentation in your fi le to support claimed deduction) ...................................................................... $ ___________________

8.

Amounts subcontracted to other persons for improvements to real property. Attach list of

subcontractor’s names, addresses, items subcontracted, and amounts paid ........................................ $ ___________________

9.

Petroleum Products

a. Federal gasoline tax

____________ gallons x .184

$ __________________

b. Federal motor fuel (diesel)

____________ gallons x .244

$ __________________

c. State gasoline tax

____________ gallons x .20

$ __________________

d. State motor fuel (diesel)

____________ gallons x .17

$ __________________

e. State special tax

____________ gallons x .01

$ __________________

f. Federal L.U.S.T. tax

____________ gallons x .001

$ __________________

g. Federal jet fuel tax

____________ gallons x .044

$ __________________

h. Totals (Lines 9a - 9g)

$ ___________________

10.

Tobacco Products

a. Federal cigarette tax

____________ packs x .39

$ __________________

b. State cigarette tax – 20 cigarettes per pack

Through 06-30-07

____________ packs x .20

$ __________________

07-01-07 to present

____________ packs x .62

$ __________________

c. State cigarette tax – 25 cigarettes per pack

Through 06-30-07

____________ packs x .25

$ __________________

07-01-07 to present

____________ packs x .775

$ __________________

d. State cigars (6.6% of wholesalers cost)

$ __________________

e. Federal chewing tobacco (.195 per lb)

$ __________________

f. Federal snuff (.585 per lb)

$ __________________

g. Federal large cigars (more than 3 lbs per 1000)

20.719% of price, not to exceed $48.75 per 1000 cigars

$ __________________

h. Federal small cigars (3 lbs or less) $1.828 per 1000 cigars

$ __________________

i.

Totals (Lines 10a - 10h)

$ ___________________

11.

Wholesale Tax on Beer

a. Federal Tax

____________ gallons x .58

$ __________________

b. State Tax

____________ gallons x .138

$ __________________

c. Wholesale Tax - 17% of wholesalers cost of beer sold

____________ cost x 17%

$ __________________

(Attach list of fi rms whom beer is purchased)

d. Totals (Lines 11a - 11c)

$ ___________________

12.

Contractors: List each County and each City with amounts where jobs Performed totaled

$50,000 or more ....................................................................................................................................

________________________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

13.

Others (specify) __________________________________________________________________________

________________________________________________________________________________________ $ ___________________

14.

Total deductions (Add Lines 1-8, 9h, 10i, 11d, 12, 13)

Enter here and on Line 2 of the Business Tax Return

$ ___________________

(Note: All deductions must have adequate records maintained to substantiate deductions claimed, otherwise they will be disallowed.)

THIS SHEET MUST ACCOMPANY THE BUSINESS TAX RETURN IF ANY DEDUCTIONS ARE TAKEN,

OTHERWISE YOUR DEDUCTIONS CANNOT BE IDENTIFIED AND WILL NOT BE ACCEPTED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1