Home Loan Application Form (For Individual / Sole Proprietorship) Page 2

ADVERTISEMENT

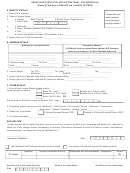

INCOME DETAILS

Borrower

Spouse

Gross Monthly Income

Other Monthly Income

(Please specify)

Total Monthly Income

Combined Gross

Monthly Income

Rentals

Loans and Credit Cards

Other Expenses

Monthly Expenses

FINANCIAL INFORMATION / BANK RELATIONSHIP

Deposits

Bank

Branch

Type of Account

Account Number

Date Opened

Outstanding Balance

(mm/yyyy)

Loans

Bank

Type of Loan

Original Loan Amount

Date Granted

Maturity Date

Monthly Payment

(mm/yyyy)

(mm/yyyy)

TRADE REFERENCES

Major

Company Name

Contact Person / Position

Contact Number

Customers

Major

Company Name

Contact Person / Position

Contact Number

Suppliers

UNDERTAKING

1.

The Borrower hereby certifies that the information contained herein is/are true and correct and shall form part of the loan documents and the signatures indicated herein are genuine. Any

information given by the Borrower or other persons authorized by the Borrower, which is not true or accurate, will automatically cause BDO Unibank, Inc. (BDO) to reject the Borrower's

loan application or cancel its approval.

2.

The Borrower authorizes BDO to obtain relevant information as it may require concerning this application from other institutions/persons. All information obtained by or provided to BDO

pursuant to this application shall be BDO's property whether or not the loan is granted.

3.

The Borrower agrees that this loan application shall be subject to BSP circulars, rules, regulations and policies of BDO and undertake to comply with/submit all the loan requirements.

4.

The Borrower hereby waives confidentiality of client information including without limitation, the provisions of Republic Act Nos. 9510 (Credit Information System Act), 1405 (Secrecy of

Bank Deposit Act), 6426 (Foreign Currency Deposit Act), 10173 (Data Privacy Act of 2012), and Sec. 55.1b of Republic Act No. 8791 (General Banking Law) and any law relating to the secrecy

of bank deposits. The Borrower authorizes BDO to: (a) pursuant to BSP Circular no. 472 Series of 2005 as implemented by BIR Revenue Regulation RR-4 2005, conduct random verification

with the Bureau of Internal Revenue in order to establish authenticity of the ITR, accompanying financial statements and such other documents/information/data submitted by the Borrower,

and/or (b) obtain or disclose such information regarding the Borrower or the loan/credit facilities applied for hereunder to any party as BDO may deem necessary (including without

limitation, BDO Insurance Brokers Inc.) or as may be required or allowed by applicable laws, rules and regulations.

5.

The Borrower authorizes BDO to conduct, through its representative accredited appraisers, an appraisal of any or all of the collateral to be used for this loan. The Borrower also agrees that

the appraisal report will be forwarded directly to the Bank for its sole use only. This is to authorize the Bank to debit account # _________________ for appraisal fees in the amount of

P___________.

Any payment of bank fees (appraisal fee, mortgage registration expenses, insurance premium, DST, notarial fee, handling fee, cancellation fee, and other amounts as may be required upon

6.

loan application and/or for the release of loan proceeds) should only be through a BDO branch. Payments made other than through a BDO branch shall not be honored or recognized.

Payments on principal and interest shall be made through the mode/s of payment as may be indicated in the appropriate loan document executed by the Borrower in favor of BDO.

7.

In case of disapproval, the Borrower understands that BDO is under no obligation to disclose the reason/s for such disapproval.

8.

The Borrower further certifies that the proceeds of the loan, if this application is approved, will be used solely for the purpose stated in this application.

9.

The Borrower hereby authorizes BDO to send notices and announcements to the Borrower as BDO may deem proper, including without limitation, information regarding the status of the

Borrower's loan application and details concerning the Borrower’s approved/availed loan, via email, as well as broadcast messaging service, multi media messaging service, and/or short

messaging service as these terms are defined in the regulations of the National Telecommunications Commission (NTC). The Borrower agrees to hold BDO free and harmless against any

loss, injury or damage that the Borrower may su er in relation to any notification/announcement sent by BDO to the Borrower in the format stated herein. It is agreed and understood that

unless and until BDO is in receipt of written notice from the Borrower not to be sent such messages, the Borrower's authority as given herein shall be deemed continuing, valid and e ective.

10.

The Borrower hereby agrees that BDO may allow its subsidiaries, a liates and third parties selected by BDO to o er its products and services to the Borrower through mail, email, fax, SMS

or other means of communication. For this purpose, the Borrower further agrees that BDO may transfer and disclose selected Borrower’s information to its subsidiaries, a liates and third

parties selected by BDO.

Signature of Borrower

Date

Signature of Spouse/Co-Borrower/Co-Maker

Date

over Printed Name

over Printed Name

Credit Card

By signing in this section, the Borrower agrees that this shall serve as the Borrower's application for issuance of BDO Credit Card/s. The Borrower undertakes to

submit documents as may be deemed necessary by BDO. The Borrower authorizes BDO to conduct whatever credit investigation and verification with government

agencies or third parties to ascertain credit standing, financial capability of the Borrower, and establish authenticity of the information declared and/or documents

submitted. The Borrower further waives applicable confidentiality rules and laws. The Borrower understands that the issuance of a BDO Credit Card shall be subject

to credit evaluation and discretion of BDO.

Signature of Borrower

Date

over Printed Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2