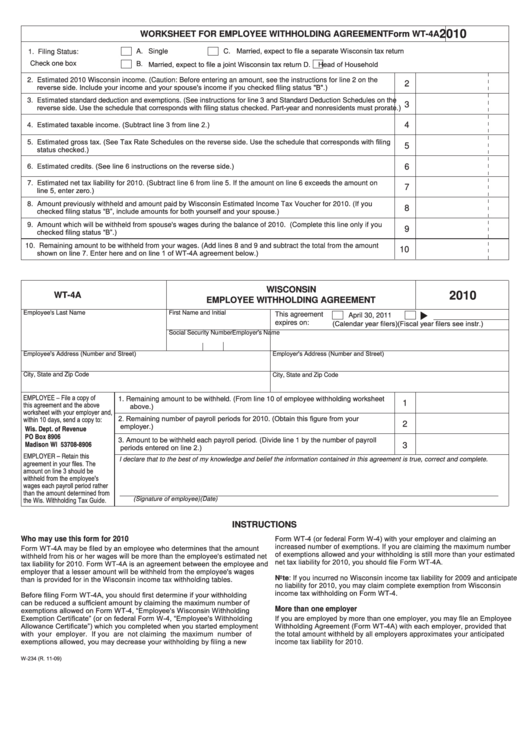

Employee Withholding Agreement Form Wt-4a

ADVERTISEMENT

2010

Form WT-4A

WORKSHEET FOR EMPLOYEE WITHHOLDING AGREEMENT

Married, expect to file a separate Wisconsin tax return

A.

Single

C.

1. Filing Status:

Married, expect to file a joint Wisconsin tax return

D.

Head of Household

Check one box

B.

2. Estimated 2010 Wisconsin income. (Caution: Before entering an amount, see the instructions for line 2 on the

2

reverse side. Include your income and your spouse's income if you checked filing status "B".)

3. Estimated standard deduction and exemptions. (See instructions for line 3 and Standard Deduction Schedules on the

3

reverse side. Use the schedule that corresponds with filing status checked. Part-year and nonresidents must prorate.)

4. Estimated taxable income. (Subtract line 3 from line 2.)

4

5. Estimated gross tax. (See Tax Rate Schedules on the reverse side. Use the schedule that corresponds with filing

5

status checked.)

6. Estimated credits. (See line 6 instructions on the reverse side.)

6

7. Estimated net tax liability for 2010. (Subtract line 6 from line 5. If the amount on line 6 exceeds the amount on

7

line 5, enter zero.)

8. Amount previously withheld and amount paid by Wisconsin Estimated Income Tax Voucher for 2010. (If you

8

checked filing status “B”, include amounts for both yourself and your spouse.)

9. Amount which will be withheld from spouse's wages during the balance of 2010. (Complete this line only if you

9

checked filing status “B”.)

1 0. Remaining amount to be withheld from your wages. (Add lines 8 and 9 and subtract the total from the amount

10

shown on line 7. Enter here and on line 1 of WT-4A agreement below.)

WISCONSIN

2010

WT-4A

EMPLOYEE WITHHOLDING AGREEMENT

Employee's Last Name

First Name and Initial

This agreement

April 30, 2011

(Calendar year filers)

(Fiscal year filers see instr.)

expires on:

Social Security Number

Employer's Name

Employee's Address (Number and Street)

Employer's Address (Number and Street)

City, State and Zip Code

City, State and Zip Code

EMPLOYEE – File a copy of

1. Remaining amount to be withheld. (From line 10 of employee withholding worksheet

1

this agreement and the above

above.)

worksheet with your employer and,

2. Remaining number of payroll periods for 2010. (Obtain this figure from your

within 10 days, send a copy to:

2

employer.)

Wis. Dept. of Revenue

PO Box 8906

3. Amount to be withheld each payroll period. (Divide line 1 by the number of payroll

Madison WI 53708-8906

3

periods entered on line 2.)

EMPLOYER – Retain this

I declare that to the best of my knowledge and belief the information contained in this agreement is true, correct and complete.

agreement in your files. The

amount on line 3 should be

withheld from the employee's

wages each payroll period rather

than the amount determined from

the Wis. Withholding Tax Guide.

(Signature of employee)

(Date)

INSTRUCTIONS

Form WT-4 (or federal Form W-4) with your employer and claiming an

Who may use this form for 2010

Form WT-4A may be filed by an employee who determines that the amount

increased number of exemptions. If you are claiming the maximum number

of exemptions allowed and your withholding is still more than your estimated

withheld from his or her wages will be more than the employee's estimated net

net tax liability for 2010, you should file Form WT-4A.

tax liability for 2010. Form WT-4A is an agreement between the employee and

employer that a lesser amount will be withheld from the employee's wages

Note: If you incurred no Wisconsin income tax liability for 2009 and anticipate

than is provided for in the Wisconsin income tax withholding tables.

no liability for 2010, you may claim complete exemption from Wisconsin

income tax withholding on Form WT-4.

Before filing Form WT-4A, you should first determine if your withholding

can be reduced a sufficient amount by claiming the maximum number of

exemptions allowed on Form WT-4, “Employee's Wisconsin Withholding

More than one employer

Exemption Certificate” (or on federal Form W-4, “Employee's Withholding

If you are employed by more than one employer, you may file an Employee

Allowance Certificate”) which you completed when you started employment

Withholding Agreement (Form WT-4A) with each employer, provided that

with your employer. If you are not claiming the maximum number of

the total amount withheld by all employers approximates your anticipated

exemptions allowed, you may decrease your withholding by filing a new

income tax liability for 2010.

W-234 (R. 11-09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2