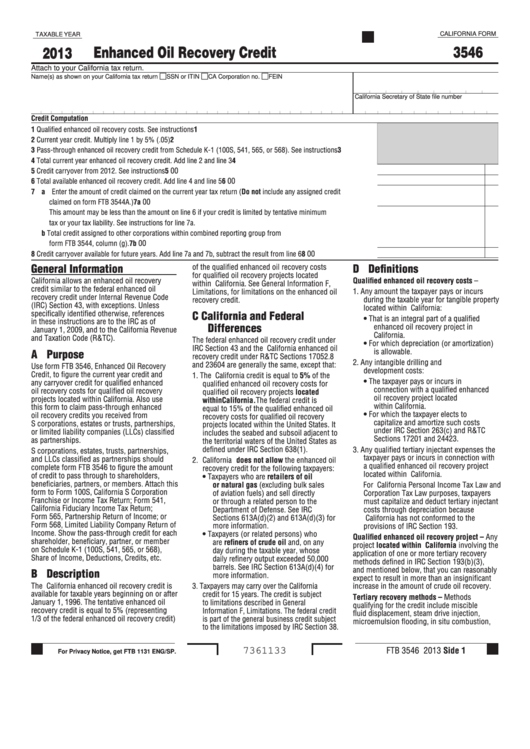

CALIFORNIA FORM

TAXABLE YEAR

3546

Enhanced Oil Recovery Credit

2013

Attach to your California tax return.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

California Secretary of State file number

Credit Computation

1 Qualified enhanced oil recovery costs. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Current year credit. Multiply line 1 by 5% (.05). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Pass-through enhanced oil recovery credit from Schedule K-1 (100S, 541, 565, or 568). See instructions . . . . . . 3

4 Total current year enhanced oil recovery credit. Add line 2 and line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Credit carryover from 2012. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Total available enhanced oil recovery credit. Add line 4 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 a Enter the amount of credit claimed on the current year tax return (Do not include any assigned credit

claimed on form FTB 3544A.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

00

This amount may be less than the amount on line 6 if your credit is limited by tentative minimum

tax or your tax liability. See instructions for line 7a.

b Total credit assigned to other corporations within combined reporting group from

00

form FTB 3544, column (g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

00

8 Credit carryover available for future years. Add line 7a and 7b, subtract the result from line 6. . . . . . . . . . . . . . . . 8

General Information

D Definitions

of the qualified enhanced oil recovery costs

for qualified oil recovery projects located

California allows an enhanced oil recovery

Qualified enhanced oil recovery costs –

within California. See General Information F,

credit similar to the federal enhanced oil

1. Any amount the taxpayer pays or incurs

Limitations, for limitations on the enhanced oil

recovery credit under Internal Revenue Code

recovery credit.

during the taxable year for tangible property

(IRC) Section 43, with exceptions. Unless

located within California:

specifically identified otherwise, references

C California and Federal

• That is an integral part of a qualified

in these instructions are to the IRC as of

Differences

enhanced oil recovery project in

January 1, 2009, and to the California Revenue

California.

and Taxation Code (R&TC).

The federal enhanced oil recovery credit under

• For which depreciation (or amortization)

IRC Section 43 and the California enhanced oil

is allowable.

A Purpose

recovery credit under R&TC Sections 17052.8

2. Any intangible drilling and

and 23604 are generally the same, except that:

Use form FTB 3546, Enhanced Oil Recovery

development costs:

Credit, to figure the current year credit and

1. The California credit is equal to 5% of the

• The taxpayer pays or incurs in

any carryover credit for qualified enhanced

qualified enhanced oil recovery costs for

connection with a qualified enhanced

oil recovery costs for qualified oil recovery

qualified oil recovery projects located

oil recovery project located

projects located within California. Also use

within California. The federal credit is

within California.

this form to claim pass-through enhanced

equal to 15% of the qualified enhanced oil

• For which the taxpayer elects to

oil recovery credits you received from

recovery costs for qualified oil recovery

capitalize and amortize such costs

S corporations, estates or trusts, partnerships,

projects located within the United States. It

under IRC Section 263(c) and R&TC

or limited liability companies (LLCs) classified

includes the seabed and subsoil adjacent to

Sections 17201 and 24423.

as partnerships.

the territorial waters of the United States as

defined under IRC Section 638(1).

3. Any qualified tertiary injectant expenses the

S corporations, estates, trusts, partnerships,

taxpayer pays or incurs in connection with

and LLCs classified as partnerships should

2. California does not allow the enhanced oil

a qualified enhanced oil recovery project

complete form FTB 3546 to figure the amount

recovery credit for the following taxpayers:

located within California.

of credit to pass through to shareholders,

• Taxpayers who are retailers of oil

beneficiaries, partners, or members. Attach this

or natural gas (excluding bulk sales

For California Personal Income Tax Law and

form to Form 100S, California S Corporation

of aviation fuels) and sell directly

Corporation Tax Law purposes, taxpayers

Franchise or Income Tax Return; Form 541,

or through a related person to the

must capitalize and deduct tertiary injectant

California Fiduciary Income Tax Return;

Department of Defense. See IRC

costs through depreciation because

Form 565, Partnership Return of Income; or

Sections 613A(d)(2) and 613A(d)(3) for

California has not conformed to the

Form 568, Limited Liability Company Return of

more information.

provisions of IRC Section 193.

Income. Show the pass-through credit for each

• Taxpayers (or related persons) who

Qualified enhanced oil recovery project – Any

shareholder, beneficiary, partner, or member

are refiners of crude oil and, on any

project located within California involving the

on Schedule K-1 (100S, 541, 565, or 568),

day during the taxable year, whose

application of one or more tertiary recovery

Share of Income, Deductions, Credits, etc.

daily refinery output exceeded 50,000

methods defined in IRC Section 193(b)(3),

barrels. See IRC Section 613A(d)(4) for

and mentioned below, that you can reasonably

B Description

more information.

expect to result in more than an insignificant

The California enhanced oil recovery credit is

3. Taxpayers may carry over the California

increase in the amount of crude oil recovery.

available for taxable years beginning on or after

credit for 15 years. The credit is subject

Tertiary recovery methods – Methods

January 1, 1996. The tentative enhanced oil

to limitations described in General

qualifying for the credit include miscible

recovery credit is equal to 5% (representing

Information F, Limitations. The federal credit

fluid displacement, steam drive injection,

1/3 of the federal enhanced oil recovery credit)

is part of the general business credit subject

microemulsion flooding, in situ combustion,

to the limitations imposed by IRC Section 38.

FTB 3546 2013 Side 1

7361133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2