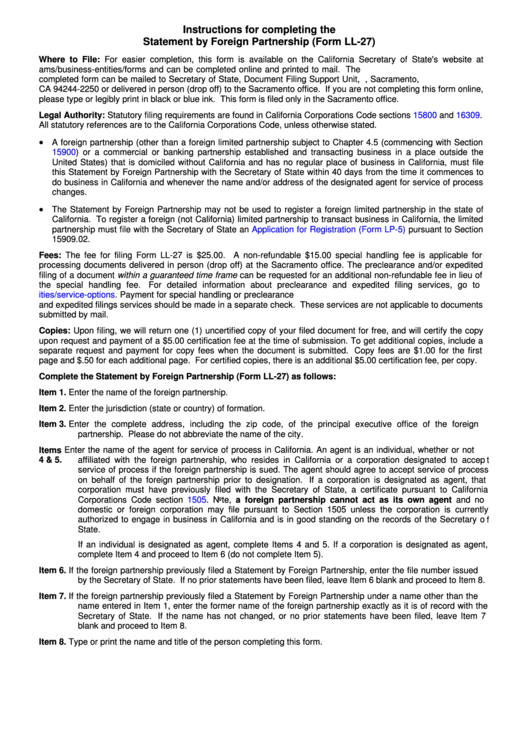

Instructions for completing the

Statement by Foreign Partnership (Form LL-27)

Where to File: For easier completion, this form is available on the California Secretary of State's website at

and can be completed online and printed to mail. The

completed form can be mailed to Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento,

CA 94244-2250 or delivered in person (drop off) to the Sacramento office. If you are not completing this form online,

please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

Legal Authority: Statutory filing requirements are found in California Corporations Code sections

15800

and 16309.

All statutory references are to the California Corporations Code, unless otherwise stated.

A foreign partnership (other than a foreign limited partnership subject to Chapter 4.5 (commencing with Section

15900) or a commercial or banking partnership established and transacting business in a place outside the

United States) that is domiciled without California and has no regular place of business in California, must file

this Statement by Foreign Partnership with the Secretary of State within 40 days from the time it commences to

do business in California and whenever the name and/or address of the designated agent for service of process

changes.

The Statement by Foreign Partnership may not be used to register a foreign limited partnership in the state of

California. To register a foreign (not California) limited partnership to transact business in California, the limited

partnership must file with the Secretary of State an

Application for Registration (Form LP-5)

pursuant to Section

15909.02.

Fees: The fee for filing Form LL-27 is $25.00. A non-refundable $15.00 special handling fee is applicable for

processing documents delivered in person (drop off) at the Sacramento office. The preclearance and/or expedited

filing of a document within a guaranteed time frame can be requested for an additional non-refundable fee in lieu of

the special handling fee.

For detailed information about preclearance and expedited filing services, go to

Payment for special handling or preclearance

and expedited filings services should be made in a separate check. These services are not applicable to documents

submitted by mail.

Copies: Upon filing, we will return one (1) uncertified copy of your filed document for free, and will certify the copy

upon request and payment of a $5.00 certification fee at the time of submission. To get additional copies, include a

separate request and payment for copy fees when the document is submitted. Copy fees are $1.00 for the first

page and $.50 for each additional page. For certified copies, there is an additional $5.00 certification fee, per copy.

Complete the Statement by Foreign Partnership (Form LL-27) as follows:

Item 1.

Enter the name of the foreign partnership.

Enter the jurisdiction (state or country) of formation.

Item 2.

Item 3.

Enter the complete address, including the zip code, of the principal executive office of the foreign

partnership. Please do not abbreviate the name of the city.

Items

Enter the name of the agent for service of process in California. An agent is an individual, whether or not

affiliated with the foreign partnership, who resides in California or a corporation designated to accept

4 & 5.

service of process if the foreign partnership is sued. The agent should agree to accept service of process

on behalf of the foreign partnership prior to designation. If a corporation is designated as agent, that

corporation must have previously filed with the Secretary of State, a certificate pursuant to California

Corporations Code section 1505. Note, a foreign partnership cannot act as its own agent and no

domestic or foreign corporation may file pursuant to Section 1505 unless the corporation is currently

authorized to engage in business in California and is in good standing on the records of the Secretary of

State.

If an individual is designated as agent, complete Items 4 and 5. If a corporation is designated as agent,

complete Item 4 and proceed to Item 6 (do not complete Item 5).

Item 6.

If the foreign partnership previously filed a Statement by Foreign Partnership, enter the file number issued

by the Secretary of State. If no prior statements have been filed, leave Item 6 blank and proceed to Item 8.

Item 7.

If the foreign partnership previously filed a Statement by Foreign Partnership under a name other than the

name entered in Item 1, enter the former name of the foreign partnership exactly as it is of record with the

Secretary of State. If the name has not changed, or no prior statements have been filed, leave Item 7

blank and proceed to Item 8.

Item 8.

Type or print the name and title of the person completing this form.

1

1 2

2 3

3