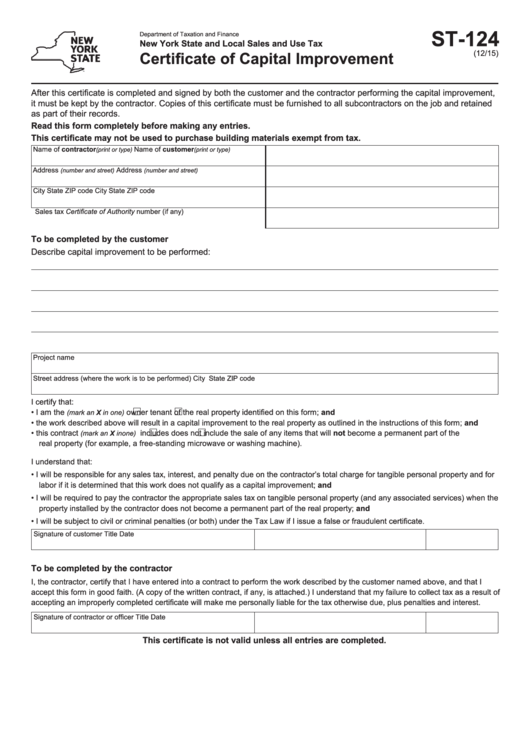

ST-124

Department of Taxation and Finance

New York State and Local Sales and Use Tax

(12/15)

Certificate of Capital Improvement

After this certificate is completed and signed by both the customer and the contractor performing the capital improvement,

it must be kept by the contractor. Copies of this certificate must be furnished to all subcontractors on the job and retained

as part of their records.

Read this form completely before making any entries.

This certificate may not be used to purchase building materials exempt from tax.

Name of contractor

Name of customer

(print or type)

(print or type)

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Sales tax Certificate of Authority number (if any)

To be completed by the customer

Describe capital improvement to be performed:

Project name

Street address (where the work is to be performed)

City

State

ZIP code

I certify that:

• I am the

owner

tenant of the real property identified on this form; and

(mark an X in one)

• the work described above will result in a capital improvement to the real property as outlined in the instructions of this form; and

• this contract

includes

does not include the sale of any items that will not become a permanent part of the

(mark an X in one)

real property (for example, a free-standing microwave or washing machine).

I understand that:

• I will be responsible for any sales tax, interest, and penalty due on the contractor’s total charge for tangible personal property and for

labor if it is determined that this work does not qualify as a capital improvement; and

• I will be required to pay the contractor the appropriate sales tax on tangible personal property (and any associated services) when the

property installed by the contractor does not become a permanent part of the real property; and

• I will be subject to civil or criminal penalties (or both) under the Tax Law if I issue a false or fraudulent certificate.

Signature of customer

Title

Date

To be completed by the contractor

I, the contractor, certify that I have entered into a contract to perform the work described by the customer named above, and that I

accept this form in good faith. (A copy of the written contract, if any, is attached.) I understand that my failure to collect tax as a result of

accepting an improperly completed certificate will make me personally liable for the tax otherwise due, plus penalties and interest.

Signature of contractor or officer

Title

Date

This certificate is not valid unless all entries are completed.

1

1 2

2