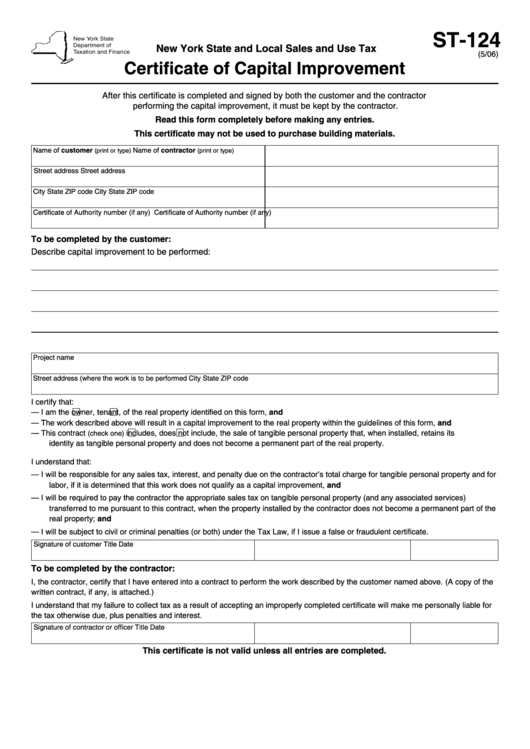

ST-124

New York State and Local Sales and Use Tax

(5/06)

Certificate of Capital Improvement

After this certificate is completed and signed by both the customer and the contractor

performing the capital improvement, it must be kept by the contractor.

Read this form completely before making any entries.

This certificate may not be used to purchase building materials.

Name of customer

Name of contractor

(print or type)

(print or type)

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Certificate of Authority number (if any)

Certificate of Authority number (if any)

To be completed by the customer:

Describe capital improvement to be performed:

Project name

Street address (where the work is to be performed

City

State

ZIP code

I certify that:

tenant, of the real property identified on this form, and

— I am the

owner,

— The work described above will result in a capital improvement to the real property within the guidelines of this form, and

— This contract

includes,

does not include, the sale of tangible personal property that, when installed, retains its

(check one)

identity as tangible personal property and does not become a permanent part of the real property.

I understand that:

— I will be responsible for any sales tax, interest, and penalty due on the contractor’s total charge for tangible personal property and for

labor, if it is determined that this work does not qualify as a capital improvement, and

— I will be required to pay the contractor the appropriate sales tax on tangible personal property (and any associated services)

transferred to me pursuant to this contract, when the property installed by the contractor does not become a permanent part of the

real property; and

— I will be subject to civil or criminal penalties (or both) under the Tax Law, if I issue a false or fraudulent certificate.

Signature of customer

Title

Date

To be completed by the contractor:

I, the contractor, certify that I have entered into a contract to perform the work described by the customer named above. (A copy of the

written contract, if any, is attached.)

I understand that my failure to collect tax as a result of accepting an improperly completed certificate will make me personally liable for

the tax otherwise due, plus penalties and interest.

Signature of contractor or officer

Title

Date

This certificate is not valid unless all entries are completed.

1

1 2

2