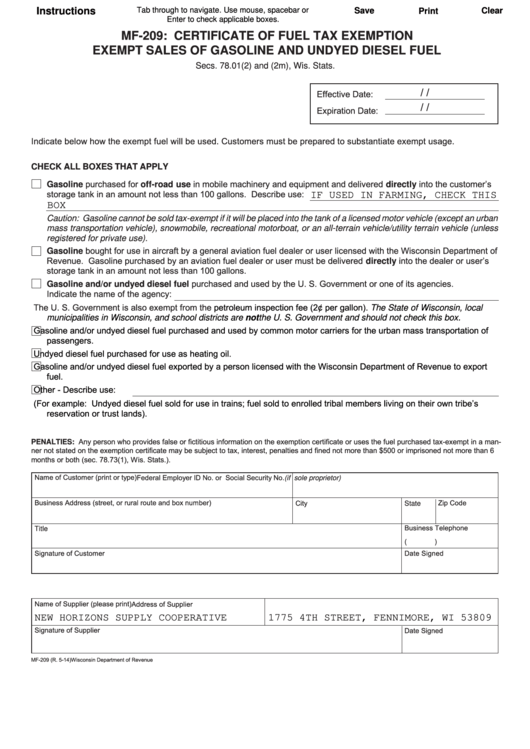

Instructions

Tab through to navigate. Use mouse, spacebar or

Save

Clear

Print

Enter to check applicable boxes.

MF-209: CERTIFICATE OF FUEL TAX EXEMPTION

EXEMPT SALES OF GASOLINE AND UNDYED DIESEL FUEL

Secs. 78.01(2) and (2m), Wis. Stats.

/

/

Effective Date:

/

/

Expiration Date:

Indicate below how the exempt fuel will be used. Customers must be prepared to substantiate exempt usage.

CHECK ALL BOXES THAT APPLY

Gasoline purchased for off-road use in mobile machinery and equipment and delivered directly into the customer’s

storage tank in an amount not less than 100 gallons. Describe use:

IF USED IN FARMING, CHECK THIS

BOX

Caution: Gasoline cannot be sold tax-exempt if it will be placed into the tank of a licensed motor vehicle (except an urban

mass transportation vehicle), snowmobile, recreational motorboat, or an all-terrain vehicle/utility terrain vehicle (unless

registered for private use).

Gasoline bought for use in aircraft by a general aviation fuel dealer or user licensed with the Wisconsin Department of

Revenue. Gasoline purchased by an aviation fuel dealer or user must be delivered directly into the dealer or user’s

storage tank in an amount not less than 100 gallons.

Gasoline and/or undyed diesel fuel purchased and used by the U. S. Government or one of its agencies.

Indicate the name of the agency:

The U. S. Government is also exempt from the

petroleum inspection fee (2¢ per gallon). The State of Wisconsin, local

municipalities in Wisconsin, and school districts are not the U. S. Government and should not check this box.

Gasoline and/or undyed diesel fuel purchased and used by common motor carriers for the urban mass transportation of

passengers.

Undyed diesel fuel purchased for use as heating oil.

Gasoline and/or undyed diesel fuel exported by a person licensed with the Wisconsin Department of Revenue to export

fuel.

Other - Describe use:

(For example: Undyed diesel fuel sold for use in trains; fuel sold to enrolled tribal members living on their own tribe’s

reservation or trust lands).

PENALTIES: Any person who provides false or fictitious information on the exemption certificate or uses the fuel purchased tax-exempt in a man-

ner not stated on the exemption certificate may be subject to tax, interest, penalties and fined not more than $500 or imprisoned not more than 6

months or both (sec. 78.73(1), Wis. Stats.).

Name of Customer (print or type)

Federal Employer ID No. or Social Security No.(if sole proprietor)

Zip Code

Business Address (street, or rural route and box number)

City

State

Business Telephone

Title

(

)

Signature of Customer

Date Signed

Name of Supplier (please print)

Address of Supplier

NEW HORIZONS SUPPLY COOPERATIVE

1775 4TH STREET, FENNIMORE, WI 53809

Signature of Supplier

Date Signed

MF-209 (R. 5-14)

Wisconsin Department of Revenue

1

1 2

2