Form 592 Instructions - 2017

ADVERTISEMENT

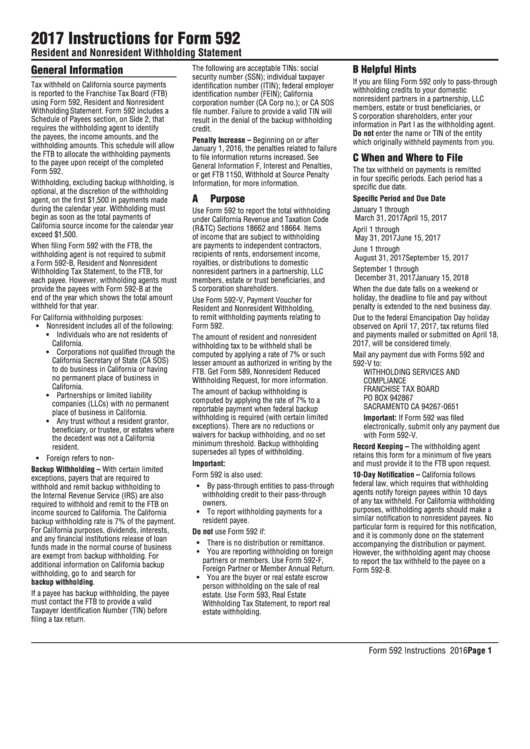

2017 Instructions for Form 592

Resident and Nonresident Withholding Statement

General Information

B

Helpful Hints

The following are acceptable TINs: social

security number (SSN); individual taxpayer

If you are filing Form 592 only to pass‑through

Tax withheld on California source payments

identification number (ITIN); federal employer

withholding credits to your domestic

is reported to the Franchise Tax Board (FTB)

identification number (FEIN); California

nonresident partners in a partnership, LLC

using Form 592, Resident and Nonresident

corporation number (CA Corp no.); or CA SOS

members, estate or trust beneficiaries, or

Withholding Statement. Form 592 includes a

file number. Failure to provide a valid TIN will

S corporation shareholders, enter your

Schedule of Payees section, on Side 2, that

result in the denial of the backup withholding

information in Part I as the withholding agent.

requires the withholding agent to identify

credit.

Do not enter the name or TIN of the entity

the payees, the income amounts, and the

Penalty Increase – Beginning on or after

which originally withheld payments from you.

withholding amounts. This schedule will allow

January 1, 2016, the penalties related to failure

the FTB to allocate the withholding payments

C

When and Where to File

to file information returns increased. See

to the payee upon receipt of the completed

General Information F, Interest and Penalties,

The tax withheld on payments is remitted

Form 592.

or get FTB 1150, Withhold at Source Penalty

in four specific periods. Each period has a

Withholding, excluding backup withholding, is

Information, for more information.

specific due date.

optional, at the discretion of the withholding

A

Purpose

Specific Period and Due Date

agent, on the first $1,500 in payments made

during the calendar year. Withholding must

January 1 through

Use Form 592 to report the total withholding

begin as soon as the total payments of

March 31, 2017 . . . . . . . . . . . April 15, 2017

under California Revenue and Taxation Code

California source income for the calendar year

(R&TC) Sections 18662 and 18664. Items

April 1 through

exceed $1,500.

of income that are subject to withholding

May 31, 2017 . . . . . . . . . . . . . June 15, 2017

are payments to independent contractors,

When filing Form 592 with the FTB, the

June 1 through

withholding agent is not required to submit

recipients of rents, endorsement income,

August 31, 2017 . . . . . September 15, 2017

a Form 592‑B, Resident and Nonresident

royalties, or distributions to domestic

September 1 through

nonresident partners in a partnership, LLC

Withholding Tax Statement, to the FTB, for

December 31, 2017 . . . . . .January 15, 2018

members, estate or trust beneficiaries, and

each payee. However, withholding agents must

provide the payees with Form 592‑B at the

S corporation shareholders.

When the due date falls on a weekend or

end of the year which shows the total amount

holiday, the deadline to file and pay without

Use Form 592‑V, Payment Voucher for

withheld for that year.

penalty is extended to the next business day.

Resident and Nonresident Withholding,

For California withholding purposes:

to remit withholding payments relating to

Due to the federal Emancipation Day holiday

• Nonresident includes all of the following:

Form 592.

observed on April 17, 2017, tax returns filed

• Individuals who are not residents of

and payments mailed or submitted on April 18,

The amount of resident and nonresident

California.

2017, will be considered timely.

withholding tax to be withheld shall be

• Corporations not qualified through the

computed by applying a rate of 7% or such

Mail any payment due with Forms 592 and

California Secretary of State (CA SOS)

lesser amount as authorized in writing by the

592‑V to:

to do business in California or having

FTB. Get Form 589, Nonresident Reduced

WITHHOLDING SERVICES AND

no permanent place of business in

Withholding Request, for more information.

COMPLIANCE

California.

FRANCHISE TAX BOARD

The amount of backup withholding is

• Partnerships or limited liability

PO BOX 942867

computed by applying the rate of 7% to a

companies (LLCs) with no permanent

SACRAMENTO CA 94267‑0651

reportable payment when federal backup

place of business in California.

withholding is required (with certain limited

Important: If Form 592 was filed

• Any trust without a resident grantor,

exceptions). There are no reductions or

electronically, submit only any payment due

beneficiary, or trustee, or estates where

waivers for backup withholding, and no set

with Form 592‑V.

the decedent was not a California

minimum threshold. Backup withholding

Record Keeping – The withholding agent

resident.

supersedes all types of withholding.

retains this form for a minimum of five years

• Foreign refers to non‑U.S.

Important:

and must provide it to the FTB upon request.

Backup Withholding – With certain limited

Form 592 is also used:

10-Day Notification – California follows

exceptions, payers that are required to

federal law, which requires that withholding

• By pass‑through entities to pass‑through

withhold and remit backup withholding to

agents notify foreign payees within 10 days

withholding credit to their pass‑through

the Internal Revenue Service (IRS) are also

of any tax withheld. For California withholding

owners.

required to withhold and remit to the FTB on

purposes, withholding agents should make a

• To report withholding payments for a

income sourced to California. The California

similar notification to nonresident payees. No

resident payee.

backup withholding rate is 7% of the payment.

particular form is required for this notification,

For California purposes, dividends, interests,

Do not use Form 592 if:

and it is commonly done on the statement

and any financial institutions release of loan

• There is no distribution or remittance.

accompanying the distribution or payment.

funds made in the normal course of business

• You are reporting withholding on foreign

However, the withholding agent may choose

are exempt from backup withholding. For

partners or members. Use Form 592‑F,

to report the tax withheld to the payee on a

additional information on California backup

Foreign Partner or Member Annual Return.

Form 592‑B.

withholding, go to ftb.ca.gov and search for

• You are the buyer or real estate escrow

backup withholding.

person withholding on the sale of real

If a payee has backup withholding, the payee

estate. Use Form 593, Real Estate

must contact the FTB to provide a valid

Withholding Tax Statement, to report real

Taxpayer Identification Number (TIN) before

estate withholding.

filing a tax return.

Form 592 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3