Form Ssa-1099 Distributions

ADVERTISEMENT

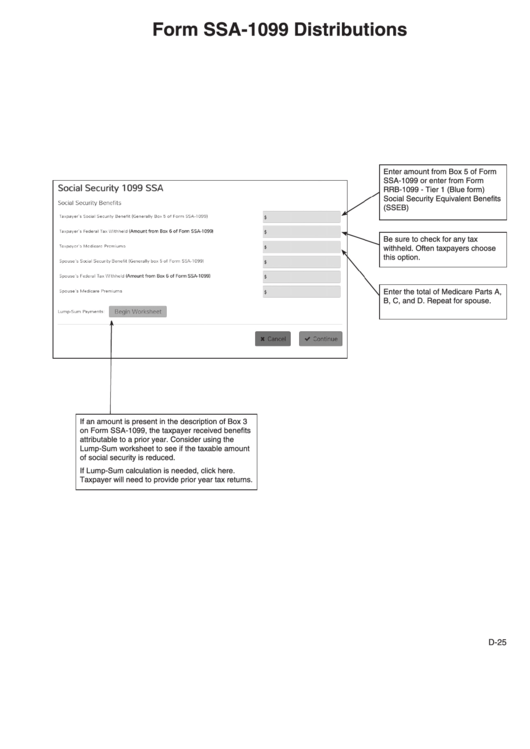

Form SSA-1099 Distributions

Enter amount from Box 5 of Form

SSA-1099 or enter from Form

RRB-1099 - Tier 1 (Blue form)

Social Security Equivalent Benefits

(SSEB)

Be sure to check for any tax

withheld. Often taxpayers choose

this option.

Enter the total of Medicare Parts A,

B, C, and D. Repeat for spouse.

If an amount is present in the description of Box 3

on Form SSA-1099, the taxpayer received benefits

attributable to a prior year. Consider using the

Lump-Sum worksheet to see if the taxable amount

of social security is reduced.

If Lump-Sum calculation is needed, click here.

Taxpayer will need to provide prior year tax returns.

D-25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2