RESET FORM

PRINT FORM

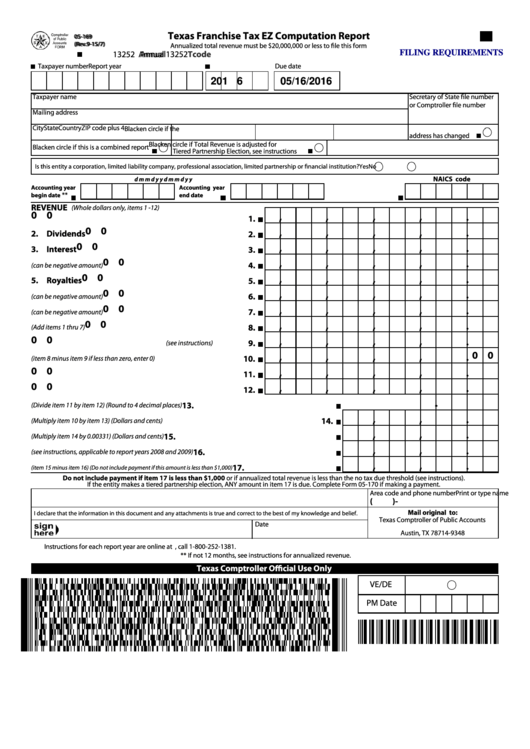

Texas Franchise Tax EZ Computation Report

05-169

05-169

(Rev.9-15/7)

(Rev.9-15/7)

Annualized total revenue must be $20,000,000 or less to le this form

Tcode

13252

13252 Annual

Annual

FILING REQUIREMENTS

Taxpayer number

Report year

Due date

2 0 1 6

05/16/2016

Taxpayer name

Secretary of State le number

or Comptroller le number

Mailing address

City

State

Country

ZIP code plus 4

Blacken circle if the

address has changed

Blacken circle if Total Revenue is adjusted for

Blacken circle if this is a combined report

Tiered Partnership Election, see instructions

Is this entity a corporation, limited liability company, professional association, limited partnership or nancial institution?

Yes

No

NAICS code

m

m

d

d

y

y

m

m

d

d

y

y

Accounting year

Accounting year

**

begin date

end date

REVENUE

(Whole dollars only, items 1 -12)

0 0

1. Gross receipts or sales

1.

0 0

2. Dividends

2.

0 0

3. Interest

3.

0 0

4. Rents

4.

(can be negative amount)

0 0

5. Royalties

5.

0 0

6. Gains/losses

6.

(can be negative amount)

0 0

7. Other income

7.

(can be negative amount)

0 0

8. Total gross revenue

8.

(Add items 1 thru 7)

0 0

9. Exclusions from gross revenue

9.

(see instructions)

0 0

10. TOTAL REVENUE

10.

(item 8 minus item 9 if less than zero, enter 0)

0 0

11. Gross receipts in Texas

11.

0 0

12. Gross receipts everywhere

12.

13. Apportionment factor

13.

(Divide item 11 by item 12) (Round to 4 decimal places)

14. Apportioned revenue

14.

(Multiply item 10 by item 13) (Dollars and cents)

15. Tax due before discount

15.

(Multiply item 14 by 0.00331) (Dollars and cents)

16. Discount

16.

(see instructions, applicable to report years 2008 and 2009)

17. TOTAL TAX DUE

17.

(item 15 minus item 16) (Do not include payment if this amount is less than $1,000)

Do not include payment if item 17 is less than $1,000 or if annualized total revenue is less than the no tax due threshold (see instructions).

If the entity makes a tiered partnership election, ANY amount in item 17 is due. Complete Form 05-170 if making a payment.

Print or type name

Area code and phone number

(

)

-

Mail original to:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Texas Comptroller of Public Accounts

Date

P.O. Box 149348

Austin, TX 78714-9348

Instructions for each report year are online at If you have any questions, call 1-800-252-1381.

** If not 12 months, see instructions for annualized revenue.

Texas Comptroller O cial Use Only

VE/DE

PM Date

1

1