Reset Form

Print Form

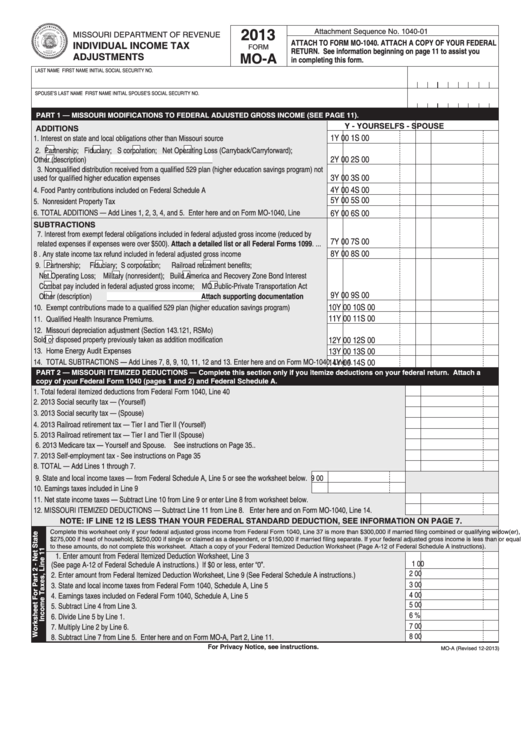

2013

Attachment Sequence No. 1040-01

MISSOURI DEPARTMENT OF REVENUE

ATTACH TO FORM MO-1040. ATTACH A COPY OF YOUR FEDERAL

INDIVIDUAL INCOME TAX

FORM

RETURN. See information beginning on page 11 to assist you

MO-A

ADJUSTMENTS

in completing this form.

LAST NAME

FIRST NAME

INITIAL

SOCIAL SECURITY NO.

SPOUSE’S LAST NAME

FIRST NAME

INITIAL

SPOUSE’S SOCIAL SECURITY NO.

PART 1 — MISSOURI MODIFICATIONS TO FEDERAL ADJUSTED GROSS INCOME (SEE PAGE 11).

Y - YOURSELF

S - SPOUSE

ADDITIONS

1Y

00 1S

00

1. Interest on state and local obligations other than Missouri source .....................................................

2.

Partnership;

Fiduciary;

S corporation;

Net Operating Loss (Carryback/Carryforward);

2Y

00 2S

00

Other (description) .........................................................................................................................

3. Nonqualified distribution received from a qualified 529 plan (higher education savings program) not

3Y

00 3S

00

used for qualified higher education expenses ..........................................................................................

4Y

00 4S

00

4. Food Pantry contributions included on Federal Schedule A ...............................................................

5Y

00 5S

00

5. Nonresident Property Tax ...................................................................................................................

6. TOTAL ADDITIONS — Add Lines 1, 2, 3, 4, and 5. Enter here and on Form MO‑1040, Line 2........

6Y

00 6S

00

SUBTRACTIONS

7. Interest from exempt federal obligations included in federal adjusted gross income (reduced by

7Y

00 7S

00

related expenses if expenses were over $500). Attach a detailed list or all Federal Forms 1099. ...

8Y

00 8S

00

8 . Any state income tax refund included in federal adjusted gross income .............................................

9.

Partnership;

Fiduciary;

S corporation;

Railroad retirement benefits;

Net Operating Loss;

Military (nonresident);

Build America and Recovery Zone Bond Interest

Combat pay included in federal adjusted gross income;

MO Public‑Private Transportation Act

9Y

00 9S

00

Attach supporting documentation ......

Other (description)

10Y

00 10S

00

10. Exempt contributions made to a qualified 529 plan (higher education savings program) ...................

11Y

00 11S

00

11. Qualified Health Insurance Premiums. ................................................................................................

12. Missouri depreciation adjustment (Section 143.121, RSMo)

Sold or disposed property previously taken as addition modification .............................................

12Y

00 12S

00

13. Home Energy Audit Expenses .............................................................................................................

13Y

00 13S

00

14. TOTAL SUBTRACTIONS — Add Lines 7, 8, 9, 10, 11, 12 and 13. Enter here and on Form MO‑1040, Line 4. ....

14Y

00 14S

00

PART 2 — MISSOURI ITEMIZED DEDUCTIONS — Complete this section only if you itemize deductions on your federal return. Attach a

copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A.

1. Total federal itemized deductions from Federal Form 1040, Line 40 ............................................................................................

1

00

2. 2013 Social security tax — (Yourself) ..........................................................................................................................................

2

00

3. 2013 Social security tax — (Spouse) ...........................................................................................................................................

3

00

4. 2013 Railroad retirement tax — Tier I and Tier II (Yourself) ........................................................................................................

4

00

5. 2013 Railroad retirement tax — Tier I and Tier II (Spouse) .........................................................................................................

5

00

6. 2013 Medicare tax — Yourself and Spouse. See instructions on Page 35....................................................................................

6

00

7. 2013 Self‑employment tax ‑ See instructions on Page 35 ............................................................................................................

7

00

8. TOTAL — Add Lines 1 through 7. .................................................................................................................................................

8

00

9. State and local income taxes — from Federal Schedule A, Line 5 or see the worksheet below.

9

00

10. Earnings taxes included in Line 9 ............................................................................................

10

00

11. Net state income taxes — Subtract Line 10 from Line 9 or enter Line 8 from worksheet below. .................................................. 11

00

12. MISSOURI ITEMIZED DEDUCTIONS — Subtract Line 11 from Line 8. Enter here and on Form MO‑1040, Line 14. .............. 12

00

NOTE: IF LINE 12 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INFORMATION ON PAGE 7.

Complete this worksheet only if your federal adjusted gross income from Federal Form 1040, Line 37 is more than $300,000 if married filing combined or qualifying widow(er),

$275,000 if head of household, $250,000 if single or claimed as a dependent, or $150,000 if married filing separate. If your federal adjusted gross income is less than or equal

to these amounts, do not complete this worksheet. Attach a copy of your Federal Itemized Deduction Worksheet (Page A-12 of Federal Schedule A instructions).

1. Enter amount from Federal Itemized Deduction Worksheet, Line 3

1

00

(See page A‑12 of Federal Schedule A instructions.) If $0 or less, enter “0”. ....................................................................

2

00

2. Enter amount from Federal Itemized Deduction Worksheet, Line 9 (See Federal Schedule A instructions.) .....................

3

00

3. State and local income taxes from Federal Form 1040, Schedule A, Line 5 ......................................................................

4

00

4. Earnings taxes included on Federal Form 1040, Schedule A, Line 5 .................................................................................

5

00

5. Subtract Line 4 from Line 3. ................................................................................................................................................

6

%

6. Divide Line 5 by Line 1. .......................................................................................................................................................

7

00

7. Multiply Line 2 by Line 6. .....................................................................................................................................................

8

00

8. Subtract Line 7 from Line 5. Enter here and on Form MO‑A, Part 2, Line 11. ...................................................................

For Privacy Notice, see instructions.

MO-A (Revised 12-2013)

1

1 2

2