Instruction 8023

ADVERTISEMENT

Department of the Treasury

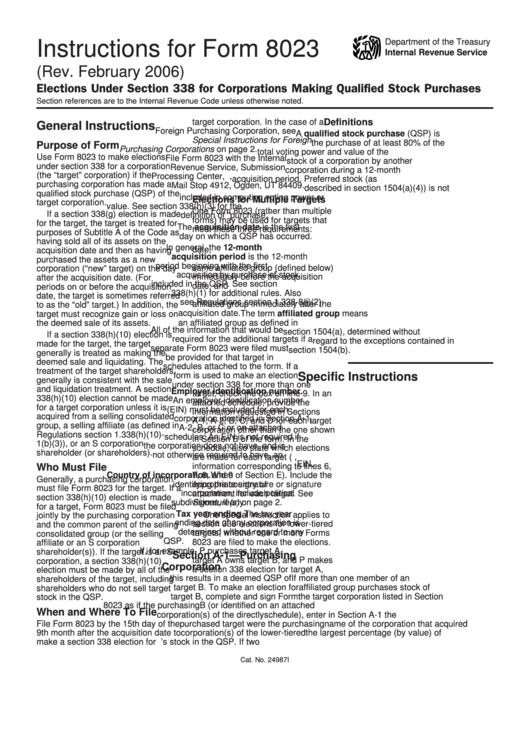

Instructions for Form 8023

Internal Revenue Service

(Rev. February 2006)

Elections Under Section 338 for Corporations Making Qualified Stock Purchases

Section references are to the Internal Revenue Code unless otherwise noted.

target corporation. In the case of a

Definitions

General Instructions

Foreign Purchasing Corporation, see

A qualified stock purchase (QSP) is

Special Instructions for Foreign

the purchase of at least 80% of the

Purpose of Form

Purchasing Corporations on page 2.

total voting power and value of the

Use Form 8023 to make elections

File Form 8023 with the Internal

stock of a corporation by another

under section 338 for a corporation

Revenue Service, Submission

corporation during a 12-month

(the “target” corporation) if the

Processing Center, P.O. Box 9941,

acquisition period. Preferred stock (as

purchasing corporation has made a

Mail Stop 4912, Ogden, UT 84409.

described in section 1504(a)(4)) is not

qualified stock purchase (QSP) of the

included in computing voting power or

Elections for Multiple Targets

target corporation.

value. See section 338(h)(3) for the

One Form 8023 (rather than multiple

If a section 338(g) election is made

definition of “purchase.”

forms) may be used for targets that

for the target, the target is treated for

The acquisition date is the first

meet these three requirements:

purposes of Subtitle A of the Code as

day on which a QSP has occurred.

1. Each has the same acquisition

having sold all of its assets on the

In general, the 12-month

date,

acquisition date and then as having

acquisition period is the 12-month

2. Each was a member of the

purchased the assets as a new

period beginning with the first

same affiliated group (defined below)

corporation (“new” target) on the day

acquisition by purchase of stock

immediately before the acquisition

after the acquisition date. (For

included in the QSP. See section

date, and

periods on or before the acquisition

338(h)(1) for additional rules. Also

3. Each is a member of the same

date, the target is sometimes referred

see Regulations section 1.338-8(j)(2).

affiliated group immediately after the

to as the “old” target.) In addition, the

acquisition date.

The term affiliated group means

target must recognize gain or loss on

the deemed sale of its assets.

an affiliated group as defined in

All of the information that would be

section 1504(a), determined without

If a section 338(h)(10) election is

required for the additional targets if a

regard to the exceptions contained in

made for the target, the target

separate Form 8023 were filed must

section 1504(b).

generally is treated as making the

be provided for that target in

deemed sale and liquidating. The

schedules attached to the form. If a

treatment of the target shareholders

form is used to make an election

Specific Instructions

generally is consistent with the sale

under section 338 for more than one

and liquidation treatment. A section

Employer identification number.

target, check the box on line 9. In an

338(h)(10) election cannot be made

An employer identification number

attached schedule, provide the

for a target corporation unless it is

(EIN) must be included for each

information requested in Sections

acquired from a selling consolidated

corporation identified in Section A-1,

A-1, A-2, B, C, and D for each target

group, a selling affiliate (as defined in

A-2, B, or C or on attached

corporation other than the one shown

Regulations section 1.338(h)(10)-

schedules. An EIN is not required if

in Section B of the form. In the

1(b)(3)), or an S corporation

the corporation does not have, and is

schedule, also state which elections

shareholder (or shareholders).

not otherwise required to have, an

are made for each target (i.e.,

EIN.

information corresponding to lines 6,

Who Must File

7, 8, and 9 of Section E). Include the

Country of incorporation. When

Generally, a purchasing corporation

appropriate signature or signature

identifying the country of

must file Form 8023 for the target. If a

incorporation, include political

attachment for each target. See

section 338(h)(10) election is made

Signature(s) on page 2.

subdivisions, if any.

for a target, Form 8023 must be filed

Tax year ending. The tax year

One special instruction applies to

jointly by the purchasing corporation

ending date of any corporation is

section 338 elections for lower-tiered

and the common parent of the selling

determined without regard to any

targets, whether one or more Forms

consolidated group (or the selling

QSP.

8023 are filed to make the elections.

affiliate or an S corporation

If, for example, P purchases target A,

shareholder(s)). If the target is an S

Section A-1—Purchasing

target A owns target B, and P makes

corporation, a section 338(h)(10)

Corporation

a section 338 election for target A,

election must be made by all of the

this results in a deemed QSP of

If more than one member of an

shareholders of the target, including

target B. To make an election for

affiliated group purchases stock of

shareholders who do not sell target

target B, complete and sign Form

the target corporation listed in Section

stock in the QSP.

8023 as if the purchasing

B (or identified on an attached

When and Where To File

corporation(s) of the directly

schedule), enter in Section A-1 the

File Form 8023 by the 15th day of the

purchased target were the purchasing

name of the corporation that acquired

9th month after the acquisition date to

corporation(s) of the lower-tiered

the largest percentage (by value) of

make a section 338 election for the

target.

the target’s stock in the QSP. If two

Cat. No. 24987I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3