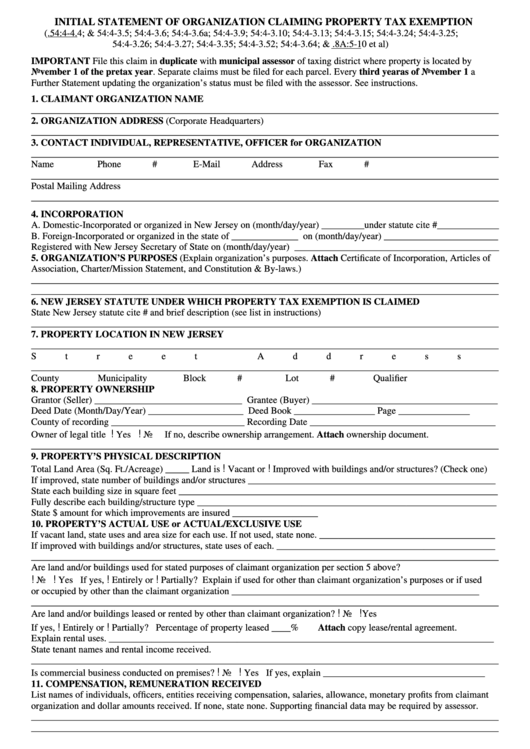

INITIAL STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION

(N.J.S.A.54:4-4.4; & 54:4-3.5; 54:4-3.6; 54:4-3.6a; 54:4-3.9; 54:4-3.10; 54:4-3.13; 54:4-3.15; 54:4-3.24; 54:4-3.25;

54:4-3.26; 54:4-3.27; 54:4-3.35; 54:4-3.52; 54:4-3.64; & N.J.S.A.8A:5-10 et al)

IMPORTANT File this claim in duplicate with municipal assessor of taxing district where property is located by

November 1 of the pretax year. Separate claims must be filed for each parcel. Every third year as of November 1 a

Further Statement updating the organization’s status must be filed with the assessor. See instructions.

1. CLAIMANT ORGANIZATION NAME

__________________________________________________________________________________________________

2. ORGANIZATION ADDRESS (Corporate Headquarters)

__________________________________________________________________________________________________

3. CONTACT INDIVIDUAL, REPRESENTATIVE, OFFICER for ORGANIZATION

__________________________________________________________________________________________________

Name

Phone #

E-Mail Address

Fax #

__________________________________________________________________________________________________

Postal Mailing Address

__________________________________________________________________________________________________

4. INCORPORATION

A. Domestic-Incorporated or organized in New Jersey on (month/day/year) _________under statute cite #_____________

B. Foreign-Incorporated or organized in the state of ______________ on (month/day/year) ________________________

Registered with New Jersey Secretary of State on (month/day/year) ___________________________________________

5. ORGANIZATION’S PURPOSES (Explain organization’s purposes. Attach Certificate of Incorporation, Articles of

Association, Charter/Mission Statement, and Constitution & By-laws.)

__________________________________________________________________________________________________

__________________________________________________________________________________________________

6. NEW JERSEY STATUTE UNDER WHICH PROPERTY TAX EXEMPTION IS CLAIMED

State New Jersey statute cite # and brief description (see list in instructions)

__________________________________________________________________________________________________

7. PROPERTY LOCATION IN NEW JERSEY

__________________________________________________________________________________________________

Street Address

City

Zip Code

__________________________________________________________________________________________________

County

Municipality

Block #

Lot #

Qualifier

8. PROPERTY OWNERSHIP

Grantor (Seller) _______________________________ Grantee (Buyer) _______________________________________

Deed Date (Month/Day/Year) ____________________ Deed Book _________________

Page _______________

County of recording ____________________________ Recording Date _______________________________________

!

!

Owner of legal title

Yes

No

If no, describe ownership arrangement. Attach ownership document.

__________________________________________________________________________________________________

9. PROPERTY’S PHYSICAL DESCRIPTION

!

!

Total Land Area (Sq. Ft./Acreage) _____ Land is

Vacant or

Improved with buildings and/or structures? (Check one)

If improved, state number of buildings and/or structures ____________________________________________________

State each building size in square feet ___________________________________________________________________

Fully describe each building/structure type _______________________________________________________________

State $ amount for which improvements are insured __________________

10. PROPERTY’S ACTUAL USE or ACTUAL/EXCLUSIVE USE

If vacant land, state uses and area size for each use. If not used, state none. _____________________________________

If improved with buildings and/or structures, state uses of each. ______________________________________________

__________________________________________________________________________________________________

Are land and/or buildings used for stated purposes of claimant organization per section 5 above?

!

!

!

!

No

Yes If yes,

Entirely or

Partially? Explain if used for other than claimant organization’s purposes or if used

or occupied by other than the claimant organization ____________________________________________________

__________________________________________________________________________________________________

!

!

Are land and/or buildings leased or rented by other than claimant organization?

No

Yes

!

!

If yes,

Entirely or

Partially? Percentage of property leased ____%

Attach copy lease/rental agreement.

Explain rental uses. _________________________________________________________________________________

State tenant names and rental income received.

__________________________________________________________________________________________________

!

!

Is commercial business conducted on premises?

No

Yes If yes, explain __________________________________

11. COMPENSATION, REMUNERATION RECEIVED

List names of individuals, officers, entities receiving compensation, salaries, allowance, monetary profits from claimant

organization and dollar amounts received. If none, state none. Supporting financial data may be required by assessor.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

12. SIGNATURE, DATE & TITLE OF OFFICER CLAIMING EXEMPTION FOR ORGANIZATION

I certify the above declarations are true to the best of my knowledge and belief and understand they will be considered as

if made under oath and subject to penalties for perjury if falsified.

Signature________________________________ Official Title or Position ______________________Date__________

__________________________________________________________________________________________________

!

!

Official Use

Denied

Approved

Exempt Property Code_____________________________

Assessor______________________________________________________________________Date_________________

Form I.S. Rev. December 2001. This form is prescribed by the Director, Division of Taxation, as required by law, and

may not be altered without the approval of the Director.

1

1 2

2