Sample Form 592-B

ADVERTISEMENT

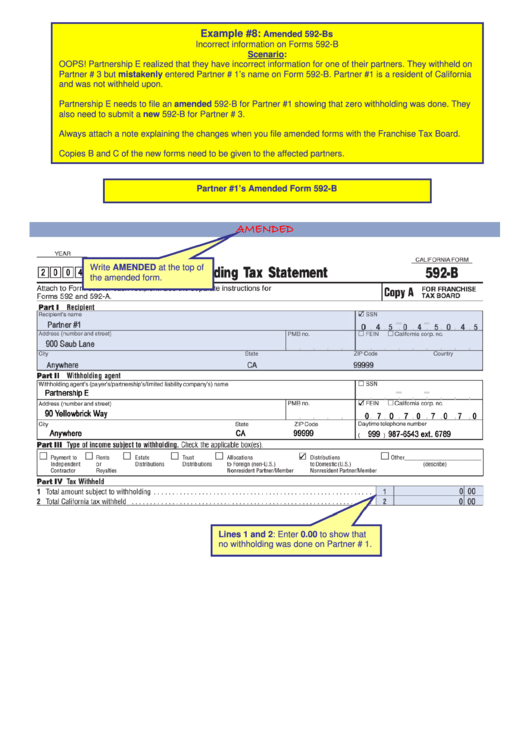

Example #8:

Amended 592-Bs

Incorrect information on Forms 592-B

Scenario:

OOPS! Partnership E realized that they have incorrect information for one of their partners. They withheld on

Partner # 3 but mistakenly entered Partner # 1’s name on Form 592-B. Partner #1 is a resident of California

and was not withheld upon.

Partnership E needs to file an amended 592-B for Partner #1 showing that zero withholding was done. They

also need to submit a new 592-B for Partner # 3.

Always attach a note explaining the changes when you file amended forms with the Franchise Tax Board.

Copies B and C of the new forms need to be given to the affected partners.

Partner #1’s Amended Form 592-B

AMENDED

Write AMENDED at the top of

the amended form.

Lines 1 and 2: Enter 0.00 to show that

no withholding was done on Partner # 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2