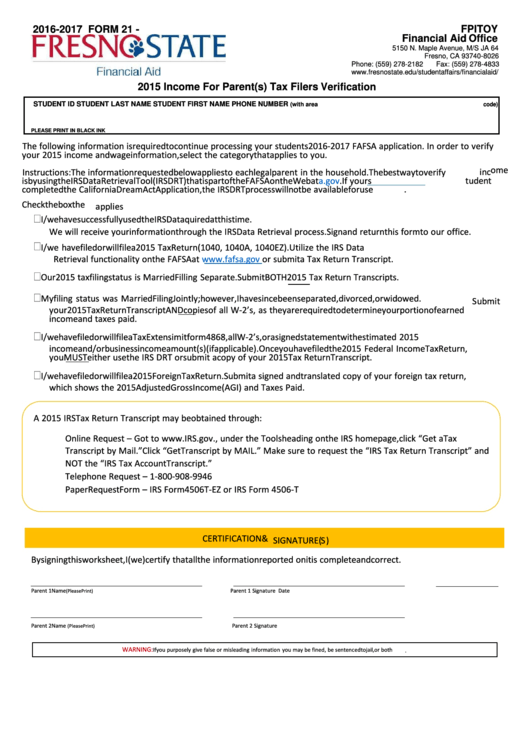

Form 21 - Fpitoy 2015 Income For Parent(S) Tax Filers Verification - 2016-2017

ADVERTISEMENT

2016-2017

FORM 21 - FPITOY

Financial Aid Office

5150 N. Maple Avenue, M/S JA 64

Fresno, CA 93740-8026

Phone: (559) 278-2182

Fax: (559) 278-4833

2015 Income For Parent(s) Tax Filers Verification

STUDENT ID

STUDENT LAST NAME

STUDENT FIRST NAME

PHONE NUMBER

(with area code)

PLEASE PRINT IN BLACK INK

The following information is required to continue processing your students 2016-2017 FAFSA application. In order to verify

your 2015 income and wage information, select the category that applies to you.

Instructions: The information requested below applies to each legal parent in the household. The best way to verify income

is by using the IRS Data Retrieval Tool (IRS DRT) that is part of the FAFSA on the Web at If your student

completed the California Dream Act Application, the IRS DRT process will not be available for use.

Check the box the applies

I/we have successfully used the IRS Data Retrieval Tool on the FAFSA. No further documents are required at this time.

We will receive your information through the IRS Data Retrieval process. Sign and return this form to our office.

I/we have filed or will file a 2015 U.S. Federal Income Tax Return (1040, 1040A, 1040EZ). Utilize the IRS Data

Retrieval functionality on the FAFSA at

or submit a Tax Return Transcript.

Our 2015 tax filing status is Married Filling Separate. Submit BOTH 2015 Tax Return Transcripts.

My filing status was Married Filing Jointly; however, I have since been separated, divorced, or widowed. Submit

your 2015 Tax Return Transcript AND copies of all W-2’s, as they are required to determine your portion of earned

income and taxes paid.

I/we have filed or will file a Tax Extension. Submit form 4868, all W-2’s, or a signed statement with estimated 2015

income and/or business income amount(s) (if applicable). Once you have filed the 2015 Federal Income Tax Return,

you MUST either use the IRS DRT or submit a copy of your 2015 Tax Return Transcript.

I/we have filed or will file a 2015 Foreign Tax Return. Submit a signed and translated copy of your foreign tax return,

which shows the 2015 Adjusted Gross Income (AGI) and Taxes Paid.

A 2015 IRS Tax Return Transcript may be obtained through:

Online Request – Got to , under the Tools heading on the IRS homepage, click “Get a Tax

Transcript by Mail.” Click “Get Transcript by MAIL.” Make sure to request the “IRS Tax Return Transcript” and

NOT the “IRS Tax Account Transcript.”

Telephone Request – 1-800-908-9946

Paper Request Form – IRS Form 4506T-EZ or IRS Form 4506-T

CERTIFICATION & SIGNATURE(S)

By signing this worksheet, I (we) certify that all the information reported on it is complete and correct.

Parent 1 Name

Parent 1 Signature

Date

(Please Print)

Parent 2 Name

Parent 2 Signature

(Please Print)

WARNING:

If you purposely give false or misleading information you may be fined, be sentenced to jail, or both.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1