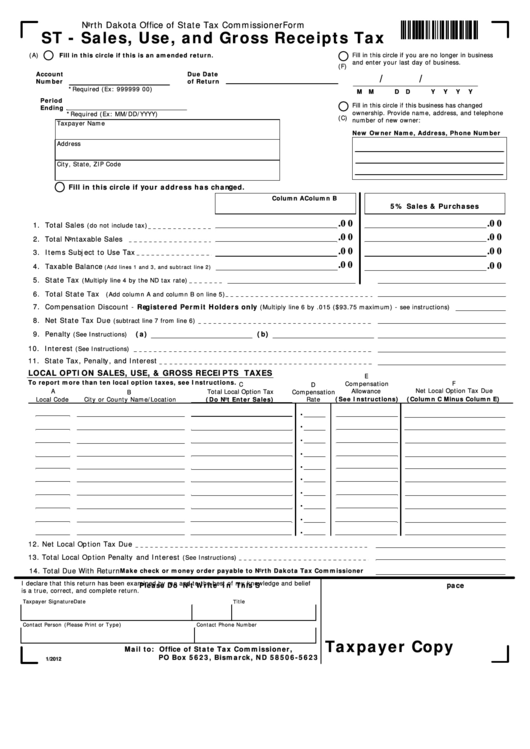

Form

North Dakota Office of State Tax Commissioner

ST - Sales, Use, and Gross Receipts Tax

Fill in this circle if you are no longer in business

(A)

Fill in this circle if this is an amended return.

and enter your last day of business.

(F)

Account

Due Date

/

/

Number

of Return

*Required (Ex: 999999 00)

M M

D D

Y

Y

Y

Y

Period

Fill in this circle if this business has changed

Ending

ownership. Provide name, address, and telephone

*Required (Ex: MM/DD/YYYY)

(C)

number of new owner:

Taxpayer Name

New Owner Name, Address, Phone Number

Address

City, State, ZIP Code

Fill in this circle if your address has changed.

Column A

Column B

5% Sales & Purchases

.0 0

.0 0

1. Total Sales

(do not include tax)

.0 0

.0 0

2. Total Nontaxable Sales

3. Items Subject to Use Tax

.0 0

.0 0

.0 0

4. Taxable Balance

.0 0

(Add lines 1 and 3, and subtract line 2)

5. State Tax

(Multiply line 4 by the ND tax rate)

6. Total State Tax

(Add column A and column B on line 5)

7. Compensation Discount - Registered Permit Holders only

(Multiply line 6 by .015 ($93.75 maximum) - see instructions)

8. Net State Tax Due

(subtract line 7 from line 6)

9. Penalty

(a)

(b)

(See Instructions)

10. Interest

(See Instructions)

11. State Tax, Penalty, and Interest

LOCAL OPTION SALES, USE, & GROSS RECEIPTS TAXES

E

To report more than ten local option taxes, see Instructions.

Compensation

F

C

D

Net Local Option Tax Due

A

Allowance

Total Local Option Tax

B

Compensation

Local Code

(Do Not Enter Sales)

Rate

(See Instructions)

(Column C Minus Column E)

City or County Name/Location

.

.

.

.

.

.

.

.

.

.

12. Net Local Option Tax Due

13. Total Local Option Penalty and Interest

(See Instructions)

14. Total Due With Return

Make check or money order payable to North Dakota Tax Commissioner

I declare that this return has been examined by me and to the best of my knowledge and belief

Please Do Not Write In This Space

is a true, correct, and complete return.

Taxpayer Signature

Date

Title

Contact Person (Please Print or Type)

Contact Phone Number

Taxpayer Copy

Mail to: Office of State Tax Commissioner,

PO Box 5623, Bismarck, ND 58506-5623

1/2012

1

1 2

2 3

3