Credit Score Pie Chart Template

ADVERTISEMENT

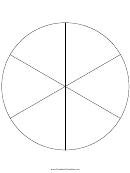

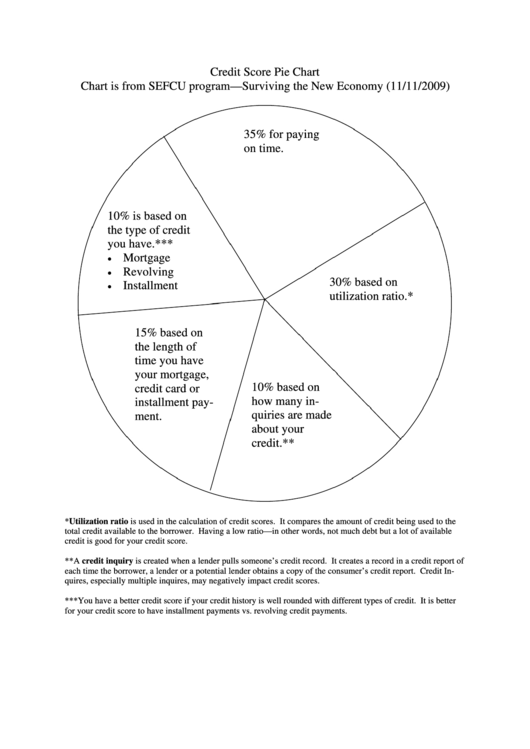

Credit Score Pie Chart

Chart is from SEFCU program—Surviving the New Economy (11/11/2009)

35% for paying

on time.

10% is based on

the type of credit

you have.***

Mortgage

Revolving

30% based on

Installment

utilization ratio.*

15% based on

the length of

time you have

your mortgage,

10% based on

credit card or

how many in-

installment pay-

quiries are made

ment.

about your

credit.**

*Utilization ratio is used in the calculation of credit scores. It compares the amount of credit being used to the

total credit available to the borrower. Having a low ratio—in other words, not much debt but a lot of available

credit is good for your credit score.

**A credit inquiry is created when a lender pulls someone’s credit record. It creates a record in a credit report of

each time the borrower, a lender or a potential lender obtains a copy of the consumer’s credit report. Credit In-

quires, especially multiple inquires, may negatively impact credit scores.

***You have a better credit score if your credit history is well rounded with different types of credit. It is better

for your credit score to have installment payments vs. revolving credit payments.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1