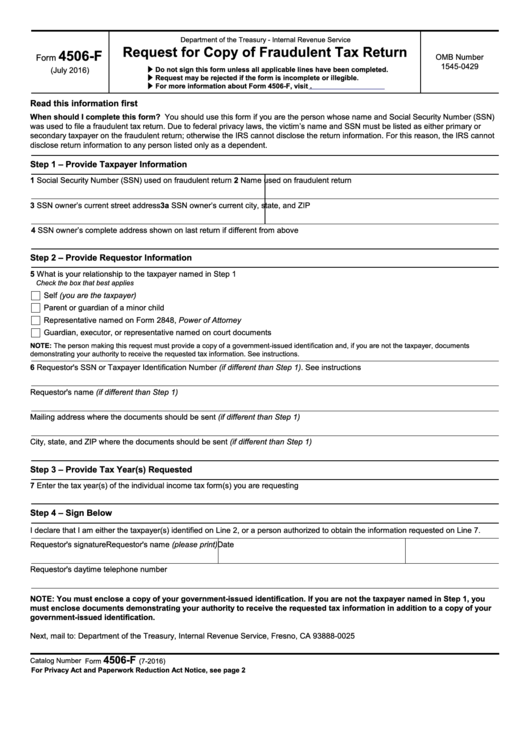

Department of the Treasury - Internal Revenue Service

Request for Copy of Fraudulent Tax Return

4506-F

Form

OMB Number

1545-0429

▶ Do not sign this form unless all applicable lines have been completed.

(July 2016)

▶ Request may be rejected if the form is incomplete or illegible.

▶ For more information about Form 4506-F, visit

Read this information first

When should I complete this form? You should use this form if you are the person whose name and Social Security Number (SSN)

was used to file a fraudulent tax return. Due to federal privacy laws, the victim’s name and SSN must be listed as either primary or

secondary taxpayer on the fraudulent return; otherwise the IRS cannot disclose the return information. For this reason, the IRS cannot

disclose return information to any person listed only as a dependent.

Step 1 – Provide Taxpayer Information

1 Social Security Number (SSN) used on fraudulent return

2 Name used on fraudulent return

3 SSN owner’s current street address

3a SSN owner’s current city, state, and ZIP

4 SSN owner’s complete address shown on last return if different from above

Step 2 – Provide Requestor Information

5 What is your relationship to the taxpayer named in Step 1

Check the box that best applies

Self (you are the taxpayer)

Parent or guardian of a minor child

Representative named on Form 2848, Power of Attorney

Guardian, executor, or representative named on court documents

NOTE: The person making this request must provide a copy of a government-issued identification and, if you are not the taxpayer, documents

demonstrating your authority to receive the requested tax information. See instructions.

6 Requestor's SSN or Taxpayer Identification Number (if different than Step 1). See instructions

Requestor's name (if different than Step 1)

Mailing address where the documents should be sent (if different than Step 1)

City, state, and ZIP where the documents should be sent (if different than Step 1)

Step 3 – Provide Tax Year(s) Requested

7 Enter the tax year(s) of the individual income tax form(s) you are requesting

Step 4 – Sign Below

I declare that I am either the taxpayer(s) identified on Line 2, or a person authorized to obtain the information requested on Line 7.

Requestor's signature

Requestor's name (please print)

Date

Requestor's daytime telephone number

NOTE: You must enclose a copy of your government-issued identification. If you are not the taxpayer named in Step 1, you

must enclose documents demonstrating your authority to receive the requested tax information in addition to a copy of your

government-issued identification.

Next, mail to: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0025

4506-F

Catalog Number 68948H

Form

(7-2016)

For Privacy Act and Paperwork Reduction Act Notice, see page 2

1

1 2

2