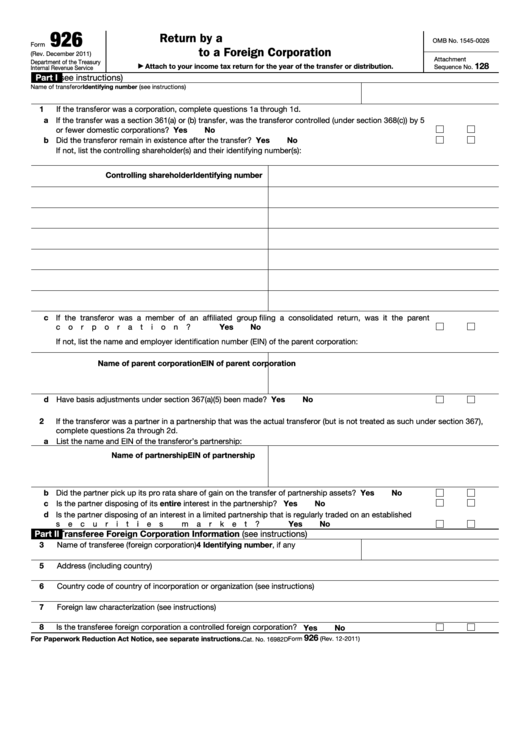

926

Return by a U.S. Transferor of Property

OMB No. 1545-0026

Form

to a Foreign Corporation

(Rev. December 2011)

Attachment

Department of the Treasury

128

Attach to your income tax return for the year of the transfer or distribution.

Sequence No.

▶

Internal Revenue Service

Part I

U.S. Transferor Information (see instructions)

Name of transferor

Identifying number (see instructions)

1

If the transferor was a corporation, complete questions 1a through 1d.

a If the transfer was a section 361(a) or (b) transfer, was the transferor controlled (under section 368(c)) by 5

or fewer domestic corporations? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b Did the transferor remain in existence after the transfer?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If not, list the controlling shareholder(s) and their identifying number(s):

Controlling shareholder

Identifying number

c If the transferor was a member of an affiliated group filing a consolidated return, was it the parent

Yes

No

corporation? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If not, list the name and employer identification number (EIN) of the parent corporation:

Name of parent corporation

EIN of parent corporation

d Have basis adjustments under section 367(a)(5) been made? .

Yes

No

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

If the transferor was a partner in a partnership that was the actual transferor (but is not treated as such under section 367),

complete questions 2a through 2d.

a List the name and EIN of the transferor’s partnership:

Name of partnership

EIN of partnership

b Did the partner pick up its pro rata share of gain on the transfer of partnership assets?

Yes

No

.

.

.

.

.

.

.

c Is the partner disposing of its entire interest in the partnership? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

d Is the partner disposing of an interest in a limited partnership that is regularly traded on an established

securities market? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Part II

Transferee Foreign Corporation Information (see instructions)

3

Name of transferee (foreign corporation)

4 Identifying number, if any

5

Address (including country)

6

Country code of country of incorporation or organization (see instructions)

7

Foreign law characterization (see instructions)

8

Is the transferee foreign corporation a controlled foreign corporation? .

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

926

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 12-2011)

Cat. No. 16982D

1

1 2

2 3

3