Instructions For Form 8863-K - Kentucky Education Tuition Tax Credit

ADVERTISEMENT

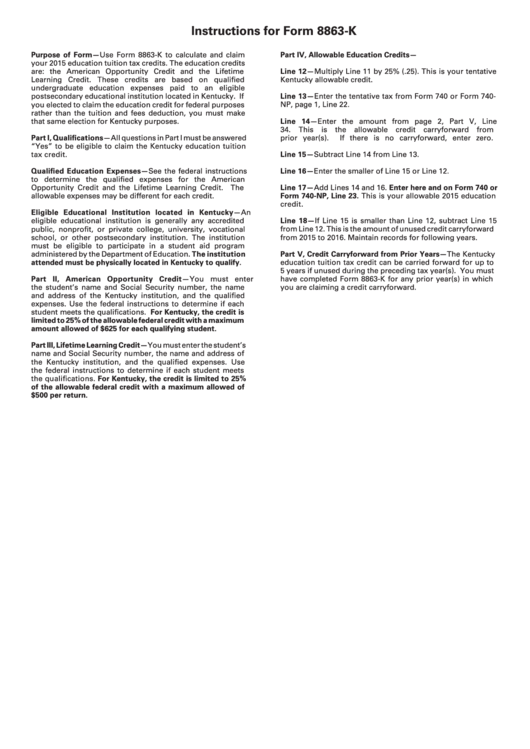

Instructions for Form 8863-K

Purpose of Form—Use Form 8863-K to calculate and claim

Part IV, Allowable Education Credits—

your 2015 education tuition tax credits. The education credits

are: the American Opportunity Credit and the Lifetime

Line 12—Multiply Line 11 by 25% (.25). This is your tentative

Learning Credit. These credits are based on qualified

Kentucky allowable credit.

undergraduate education expenses paid to an eligible

postsecondary educational institution located in Kentucky. If

Line 13—Enter the tentative tax from Form 740 or Form 740-

you elected to claim the education credit for federal purposes

NP, page 1, Line 22.

rather than the tuition and fees deduction, you must make

that same election for Kentucky purposes.

Line 14—Enter the amount from page 2, Part V, Line

34.

This

is

the

allowable

credit

carryforward

from

Part I, Qualifications—All questions in Part I must be answered

prior year(s).

If there is no carryforward, enter zero.

“Yes” to be eligible to claim the Kentucky education tuition

tax credit.

Line 15—Subtract Line 14 from Line 13.

Qualified Education Expenses—See the federal instructions

Line 16—Enter the smaller of Line 15 or Line 12.

to determine the qualified expenses for the American

Opportunity Credit and the Lifetime Learning Credit. The

Line 17—Add Lines 14 and 16. Enter here and on Form 740 or

allowable expenses may be different for each credit.

Form 740-NP, Line 23. This is your allowable 2015 education

credit.

Eligible Educational Institution located in Kentucky—An

eligible educational institution is generally any accredited

Line 18—If Line 15 is smaller than Line 12, subtract Line 15

public, nonprofit, or private college, university, vocational

from Line 12. This is the amount of unused credit carryforward

school, or other postsecondary institution. The institution

from 2015 to 2016. Maintain records for following years.

must be eligible to participate in a student aid program

administered by the Department of Education. The institution

Part V, Credit Carryforward from Prior Years—The Kentucky

attended must be physically located in Kentucky to qualify.

education tuition tax credit can be carried forward for up to

5 years if unused during the preceding tax year(s). You must

Part II, American Opportunity Credit—You must enter

have completed Form 8863-K for any prior year(s) in which

the student’s name and Social Security number, the name

you are claiming a credit carryforward.

and address of the Kentucky institution, and the qualified

expenses. Use the federal instructions to determine if each

student meets the qualifications. For Kentucky, the credit is

limited to 25% of the allowable federal credit with a maximum

amount allowed of $625 for each qualifying student.

Part III, Lifetime Learning Credit—You must enter the student’s

name and Social Security number, the name and address of

the Kentucky institution, and the qualified expenses. Use

the federal instructions to determine if each student meets

the qualifications. For Kentucky, the credit is limited to 25%

of the allowable federal credit with a maximum allowed of

$500 per return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1